Dollar Maintains Dominance As Global Markets Wrestle With Risk Aversion

Dollar is capitalizing on its strong position and extends its rally om Asian session today, as risk aversion grips global markets. US stocks, which initially showed gains overnight, ultimately closed significantly lower as Treasury yields climbed in response to robust economic data. The sentiment continued in Asia, with major markets opening lower, and followed by extended decline. lower open.

Amid these developments, China’s economic data presented a mixed picture, providing little to uplift overall market sentiment. Strong Q1 GDP from China was overshadowed by a batch of weak March data. Further dampening sentiment, S&P Global downgraded the credit rating of Chinese developer Longfor from BBB- to BBB+ yesterday, assigning a negative outlook. These developments in China have cast a shadow over global market sentiment.

In the currency markets, Dollar stands out as the strongest performer of the day, with Japanese Yen and Canadian Dollar also showing resilience. Conversely, Australian Dollar is facing the most significant pressure, followed by New Zealand Dollar and Swiss Franc. Euro and Sterling are holding middle ground as market participants shift their focus to upcoming economic releases, including UK employment data and wage growth, German ZEW economic sentiment, and Canadian CPI.

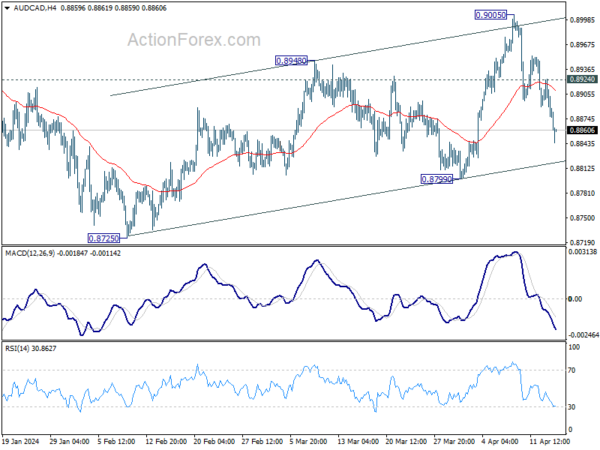

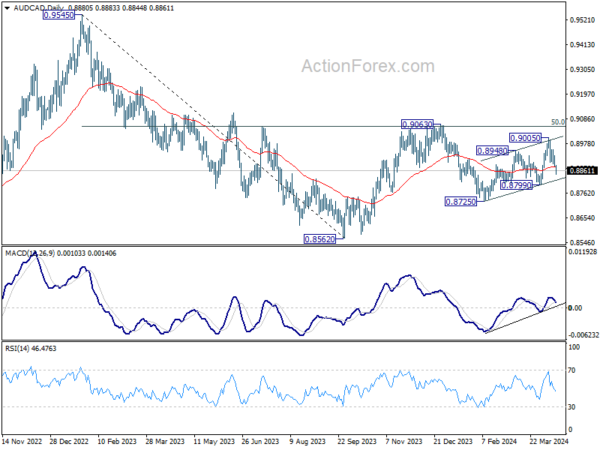

Technically, AUD/CAD’s extended decline affirms that case that corrective recovery from 0.8725 has completed with three waves up to 0.9005. Deeper decline would be seen to 0.8799 support next. Firm break there will argue that whole fall from 0.9063 is ready to resume through 0.8725 support. Let’s see if Canadian CPI today would prompt the downside breakout.

In Asia, at the time of writing, Nikkei is down -2.22%. Hong Kong HSI is down -1.93%. China Shanghai SSE is down -1.42%. Singapore Strait Times is down -1.29%. Japan 10-year JGB yield is up 0.0089 at 0.875. Overnight, DOW fell -0.65%. S&P 500 fell -1.20%. NASDAQ fell -1.79%. 10-year yield rose 0.129 to 4.628.

Fed’s Daly stresses patience on rate cuts, no urgency required

San Francisco Fed President Mary Daly emphasized a cautious approach to interest rate reductions. Given the current economic and labor market strength, coupled with persistently high inflation rates, she highlighted the lack of urgency to lower interest rate policy.

“The worst thing to do is act urgently when urgency is not required,” Daly remarked at an event.

Daly also expressed her reservations about the consequences of misjudging the necessary intensity of policy adjustments. She requires more evidence of inflation consistently moving towards 2% target before considering easing monetary policy.

China’s GDP grows 5.3% yoy in Q1, but March data weak

China’s GDP grew 5.3% yoy in Q1, above expectation of 5.0% yoy. Comparing to Q4, GDP grew 1.6% yoy. By sector, primary industry was up 3.3% yoy, secondary industry rose 6.0% yoy, tertiary industry rose 5.0% yoy.

In March, retail sales rose 3.1% yoy, below expectation of 5.1% yoy. Industrial production rose 4.5% yoy, below expectation of 6.0% yoy. Fixed asset investment rose 4.5% ytd yoy, above expectation of 4.3%.

USD/CNH is steady after the release with focus on 7.2815 resistance. firm break there will resume whole rebound from 7.0870 and target 100% projection of 7.0870 to 7.2318 from 7.1715 at 7.3163. For now, outlook will stay bullish as long as 7.2354 support holds, in case of retreat.

Looking ahead

UK employment and German ZEW economic sentiment are the main focus in European session. Later in the day, Canada CPI will take center stage. US will release housing starts and building permits, and industrial production.

AUD/USD Daily Report

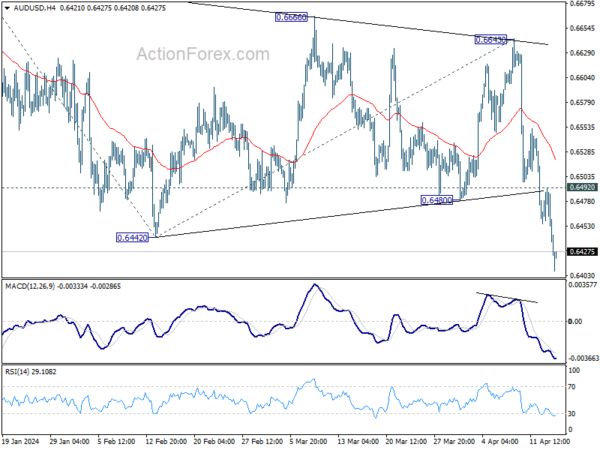

Daily Pivots: (S1) 0.6422; (P) 0.6458; (R1) 0.6477; More…

AUD/USD’s break of 0.6442 support confirms resumption of whole fall from 0.6870. Intraday bias remains on the downside for 61.8% projection of 0.6870 to 0.6442 from 0.6643 at 0.6378. Decisive break there will pave the way to 0.6269 low, and possibly further to 100% projection at 0.6215. On the upside, above 0.6429 minor resistance will turn intraday bias and bring consolidations, before staging another fall.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which is still in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | GDP Y/Y Q1 | 5.30% | 5.00% | 5.20% | |

| 02:00 | CNY | Retail Sales Y/Y Mar | 3.10% | 5.10% | 5.50% | |

| 02:00 | CNY | Industrial Production Y/Y Mar | 4.50% | 6.00% | 7.00% | |

| 02:00 | CNY | Fixed Asset Investment YTD Y/Y Mar | 4.50% | 4.30% | 4.20% | |

| 06:00 | GBP | Claimant Count Change Mar | 17.2K | 16.8K | ||

| 06:00 | GBP | ILO Unemployment Rate (3M) Feb | 4.00% | 3.90% | ||

| 06:00 | GBP | Average Earnings Including Bonus 3M/Y Feb | 5.50% | 5.60% | ||

| 06:00 | GBP | Average Earnings Excluding Bonus 3M/Y Feb | 6.10% | |||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Feb | 27.3B | 28.1B | ||

| 09:00 | EUR | Germany ZEW Economic Sentiment Apr | 35.1 | 31.7 | ||

| 09:00 | EUR | Germany ZEW Current Situation Apr | -80.5 | |||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Apr | 37.2 | 33.5 | ||

| 12:30 | CAD | CPI M/M Mar | 0.70% | 0.30% | ||

| 12:30 | CAD | CPI Y/Y Mar | 2.80% | |||

| 12:30 | CAD | CPI Median Y/Y Mar | 3.00% | 3.10% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Mar | 3.20% | 3.20% | ||

| 12:30 | CAD | CPI Common Y/Y Mar | 3.10% | 3.10% | ||

| 12:30 | USD | Building Permits Mar | 1.51M | 1.52M | ||

| 12:30 | USD | Housing Starts Mar | 1.48M | 1.52M | ||

| 13:15 | USD | Industrial Production M/M Mar | 0.40% | 0.10% | ||

| 13:15 | USD | Capacity Utilization Mar | 78.50% | 78.30% |

Gyrostat Capital Management: Why Risk Management Is Not About Predicting Risk

Why Risk Management is Not About Predicting Risk Financial markets reward confidence, but they punish certai... Read more

Gyrostat January Outlook: Calm At Multiyear Extremes

This monthly Gyrostat Risk-Managed Market Outlook does not attempt to forecast market direction. Its p... Read more

Gyrostat December Outlook: The Market Does The Work

Harnessing Natural Volatility for Consistent Returns Markets have always moved more th... Read more

Gyrostat Capital Management: Why Advisers Must Scenario-Plan Both The Bubble And The Bust

The Blind Spot: Why Advisers Must Scenario-Plan Both The Bubble and The Bust In financial m... Read more

Gyrostat Capital Management: The Hidden Architecture Of Consequences

When Structures Themselves Become A Risk In portfolio construction, risk is rarely where we look for it.... Read more

Gyrostat November Outlook: The Rising Cost Of Doing Nothing

Through the second half of 2025, markets have delivered a curious mix of surface tranquillity and instabi... Read more