Room For Growth In Indonesian Domestic Corporate Sukuk Issuance

Article Overview

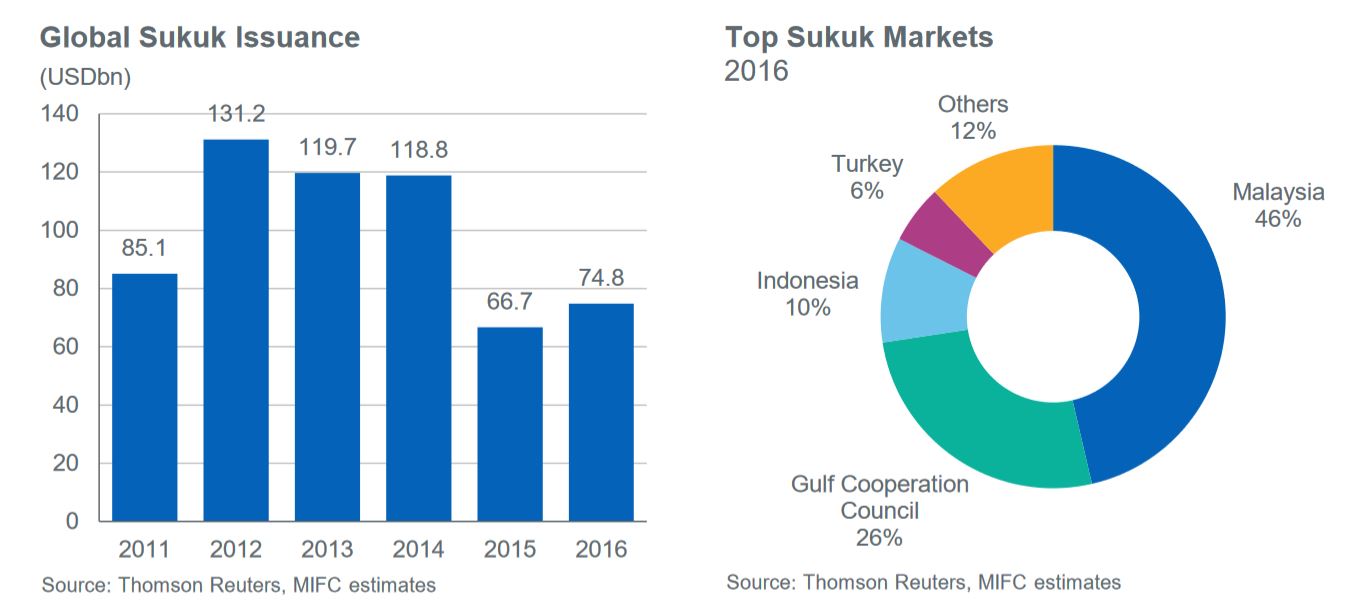

Indonesia has ample room for growth, as the second-largest sukuk market in the world in 2016, Fitch Ratings says in a new report on Indonesian domestic corporate sukuk issuance. Indonesia’s domestic corporate sukuk market continues to lag far behind that of Malaysia, the largest sukuk market in the world.

In the report, Fitch provides an overview of Indonesian domestic sukuk issuance by corporates, including the size of issuance, typical structures and the most-active issuers by sectors. The report also outlines the additional risks of investment in sukuk compared with conventional bonds, and explains briefly Fitch’s approach in rating sukuk issued by Indonesian corporates.

Room for Growth in Nascent Market

Only Ijara and Mudaraba Used Recovering Market, Growing Corporate Issuers: Global sukuk issuance rebounded in 2016 to nearly USD75 billion after a significant decline in 2015, based on the data from the Malaysia International Islamic Financial Centre (MIFC).

In that time, the composition of sukuk issuers also shifted significantly − corporate issuers (corporates and financial

institutions) made up the majority of issuances in 2016 with volume of USD47.3 billion, compared with the past when issuances were driven by sovereigns. Financial institutions were the largest issuers, representing nearly 81% of total corporate issuances globally.

Small Sukuk Market in Indonesia: Sukuk issuance by Indonesia corporates has been relatively small in terms of issuers (fewer than 18) and outstanding issuance (less than IDR14 trillion or USD1.05 billion) since 2014.

In contrast, the local conventional bond market, which has outstanding issuances of nearly IDR320 trillion since 2016, is 22 times larger. Fitch Ratings believes there is ample room for growth in the Indonesian sukuk market because it remains under – penetrated relative to countries like Malaysia, and it has a large untapped investor base – Indonesia has the world’s largest Muslim population.

The corporate sukuk market in Indonesia is still in the early stages of development. The first corporate sukuk issuance was in 2002, compared with 1990 in Malaysia. The market will grow as investors and issuers become more familiar with the risks related to the debt instrument.

Riyadh Metro Spurs Residential Property Boom: Knight Frank

RIYADH: The opening of the Riyadh Metro has transformed the Saudi capital’s housing market, with villa prices near s... Read more

Saudi POS Transactions Hold Above $3bn In Mid-October

RIYADH: Saudi Arabia’s point-of-sale transactions remained above the $3 billion mark for the third consecutive week, u... Read more

IMF Expects MENA Inflation To Ease In 2025 And 2026

RIYADH: Lower energy costs will help inflation ease to 12.2 percent this year and 10.3 percent in 2026 across the Middle... Read more

Global ESG Sukuk Market Hits Record $6.5bn In Q3, Set For Strong 2026, Says Fitch

RIYADH: The global market for environmental, social and governance sukuk reached a record $6.5 billion in the third quar... Read more

Saudi Ride-hailing Trips Surge 78% In Q3, Topping 39m

RIYADH: Saudi Arabia’s ride-hailing sector witnessed a major surge during the third quarter of 2025, reaching 39.04 mi... Read more

PIFs EA Deal: Whats Happening Behind The Scenes In Esports?

RIYADH: Just weeks after the conclusion of the second edition of the Esports World Cup, the Saudis were ready for the ne... Read more