Islamic Development Bank Aims For $2.5bn Mega Sukuk

Islamic Development Bank aims for $2.5bn Mega Sukuk

today 20th February 2018

Bandar Hajjar, president of the Islamic Development Bank (IDB) has said the Saudi Arabia headquartered institution is planning soon to issue its largest sized Sukuk for $2.5 billion.

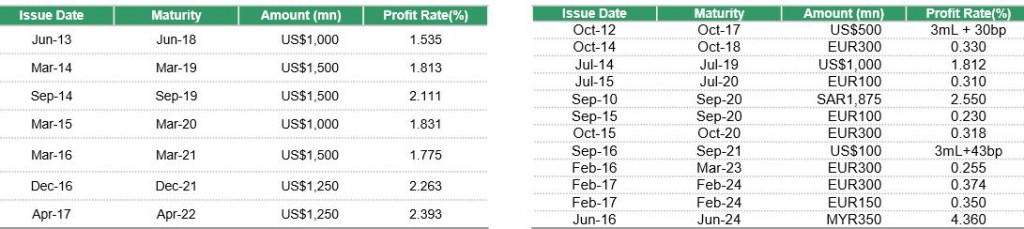

The 57 member AAA rated development bank is a regular issuer of Sukuk having last issued in September 2017 with a $1.25 billion issuance which was priced at 2.261%. As part of its stated capital market objectives, the multilateral bank is looking to develop a liquid yield curve as well as undertaking issuance in different currencies, such as its private issuance in 2016 of a €300 million Sukuk. The bank has a $1.5 billion of Sukuk maturing this year.

In the Financial Times interview Mr Hajjar also spoke about IDB’s partnership with China-led Asian Infrastructure Investment Bank. The FT quoted him as saying “We will partner with the AIIB. We will co-finance many projects [with AIIB] in the future in Africa. Africa needs . . . about $150bn a year to finance infrastructure and there are about 650m people in Africa without access to electricity.”

The growing infrastructure financing needs of Africa has also been a focus of the Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of the IDB.

To date, Africa has witnessed a growing share of mostly sovereign Sukuk issuances. While states such as Sudan and Gambia have issued Sukuk in the past, it was in 2014 that Senegal debuted the region’s largest Sukuk issuance (USD 208 million), with ICD acting as one of the lead arrangers. Following Senegal, South Africa became the third non-Muslim country after Hong Kong and the U.K to sell government debt that adheres to Shari‘ah law by issuing a USD 500 million 5.75-year Sukuk in September 2014. Looking to emulate Senegal and South Africa’s successful move into the Sukuk market, Cote d’Ivoire have since made inaugural debuts in 2015 of USD 260 million. ICD was involved as lead arranger in all of the sovereign issuances in Africa (except for South Africa’s Sukuk).

Riyadh Metro Spurs Residential Property Boom: Knight Frank

RIYADH: The opening of the Riyadh Metro has transformed the Saudi capital’s housing market, with villa prices near s... Read more

Saudi POS Transactions Hold Above $3bn In Mid-October

RIYADH: Saudi Arabia’s point-of-sale transactions remained above the $3 billion mark for the third consecutive week, u... Read more

IMF Expects MENA Inflation To Ease In 2025 And 2026

RIYADH: Lower energy costs will help inflation ease to 12.2 percent this year and 10.3 percent in 2026 across the Middle... Read more

Global ESG Sukuk Market Hits Record $6.5bn In Q3, Set For Strong 2026, Says Fitch

RIYADH: The global market for environmental, social and governance sukuk reached a record $6.5 billion in the third quar... Read more

Saudi Ride-hailing Trips Surge 78% In Q3, Topping 39m

RIYADH: Saudi Arabia’s ride-hailing sector witnessed a major surge during the third quarter of 2025, reaching 39.04 mi... Read more

PIFs EA Deal: Whats Happening Behind The Scenes In Esports?

RIYADH: Just weeks after the conclusion of the second edition of the Esports World Cup, the Saudis were ready for the ne... Read more