Stock markets mostly retreated Friday after the week's strong gains on US election developments and ahead of American jobs data.

The dollar was down 0.5 percent against the euro, while oil prices slumped three percent at the end of a volatile week for financial markets generally.

President Donald Trump has launched a tirade of unsubstantiated claims that he had been cheated out of winning the US election, as vote counting across battleground states showed Democrat Joe Biden closing in on victory.

Despite Friday's losses for equities on profit-taking, stocks have surged over the week owing to a potential Biden win, paving the way for a bigger fiscal stimulus package than if Trump was re-elected, noted Fawad Razaqzada, market analyst with ThinkMarkets.

Meanwhile a "Republican-controlled senate will make it unlikely that Trump's corporate tax cuts will be rolled back", he added.

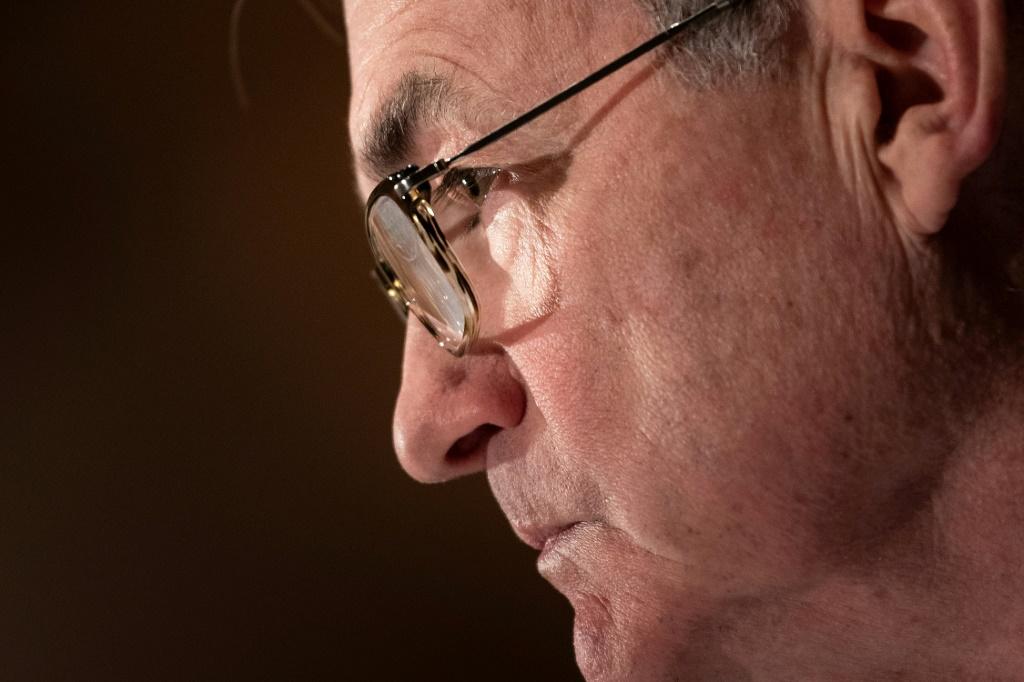

Federal Reserve head Jerome Powell on Thursday said more US stimulus was "absolutely essential" to support the economy.

Heading into the election, Democrats and Republicans failed to reach a deal owing to disputes on the stimulus amount.

The US central bank has provided some cheer after pledging Thursday to do all it could to support the world's top economy.

The Fed has been widely credited with helping equities soar from their March lows thanks to its promise to support financial markets with vast sums of cash and record-low borrowing costs.

The prospect of further monetary easing measures from the Fed and a new stimulus have meanwhile weighed on the dollar.

The greenback is sitting at its lowest levels against the yen since the dark days of March when the virus began battering the world economy -- and has suffered heavy falls this week against the euro and pound.

The softer dollar was helping to push up gold prices, with the haven investment at its highest levels since September.

Bitcoin has meanwhile "blitzed through $15,000 for the first time since the beginning of 2018... as investors rode a momentum trade that has been building up a head of steam ever since PayPal announced it would let users buy, sell and hold a variety of major cryptocurrencies", noted Neil Wilson, chief market analyst at Markets.com.

Looking ahead to Friday's US monthly jobs numbers, he added:

"These are increasingly irrelevant against the backdrop of the pandemic, stimulus and the weekly claims numbers, but the release could still move the market."

London - FTSE 100: DOWN 0.1 percent at 5,899.42 points

Frankfurt - DAX 30: DOWN 1.0 percent at 12,447.37

Paris - CAC 40: DOWN 0.7 percent at 4,947.77

EURO STOXX 50: DOWN 0.7 percent at 3,191.77

Tokyo - Nikkei 225: UP 0.9 percent at 24,367.35 (close)

Hong Kong - Hang Seng: UP 0.1 percent at 25,712.97 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,312.16 (close)

New York - Dow: UP 2.0 percent at 28,390.18 (close)

Euro/dollar: UP at $1.1873 from $1.1832 at 2230 GMT

Dollar/yen: DOWN at 103.27 yen from 103.55 yen

Pound/dollar: DOWN at $1.3127 from $1.3150

Euro/pound: UP at 90.41 pence from 89.92 pence

West Texas Intermediate: DOWN 3.4 percent at $37.47 per barrel

Brent North Sea crude: DOWN 3.0 percent at $39.69 per barrel

Copyright AFP. All rights reserved.