Hedge Funds Bet Big On The Weather: Why Top Firms Are Paying $1 Million For Meteorologists

Hedge funds have long been known for their ability to exploit market inefficiencies using cutting-edge data and advanced analytics. But in 2025, an unexpected field of expertise is in high demand: meteorology. Hedge funds are aggressively hiring weather modelers, increasing their hiring of weather experts by 23% compared to the previous year.

Some firms are offering salaries as high as $1 million to attract top talent in atmospheric science and predictive modeling. The reason? Weather plays a crucial role in the global economy, affecting everything from energy prices and agricultural yields to supply chain disruptions and insurance markets. In an era of increasing climate volatility, the ability to predict extreme weather patterns is giving hedge funds a major advantage in financial markets.

Why Hedge Funds Are Investing in Weather Experts

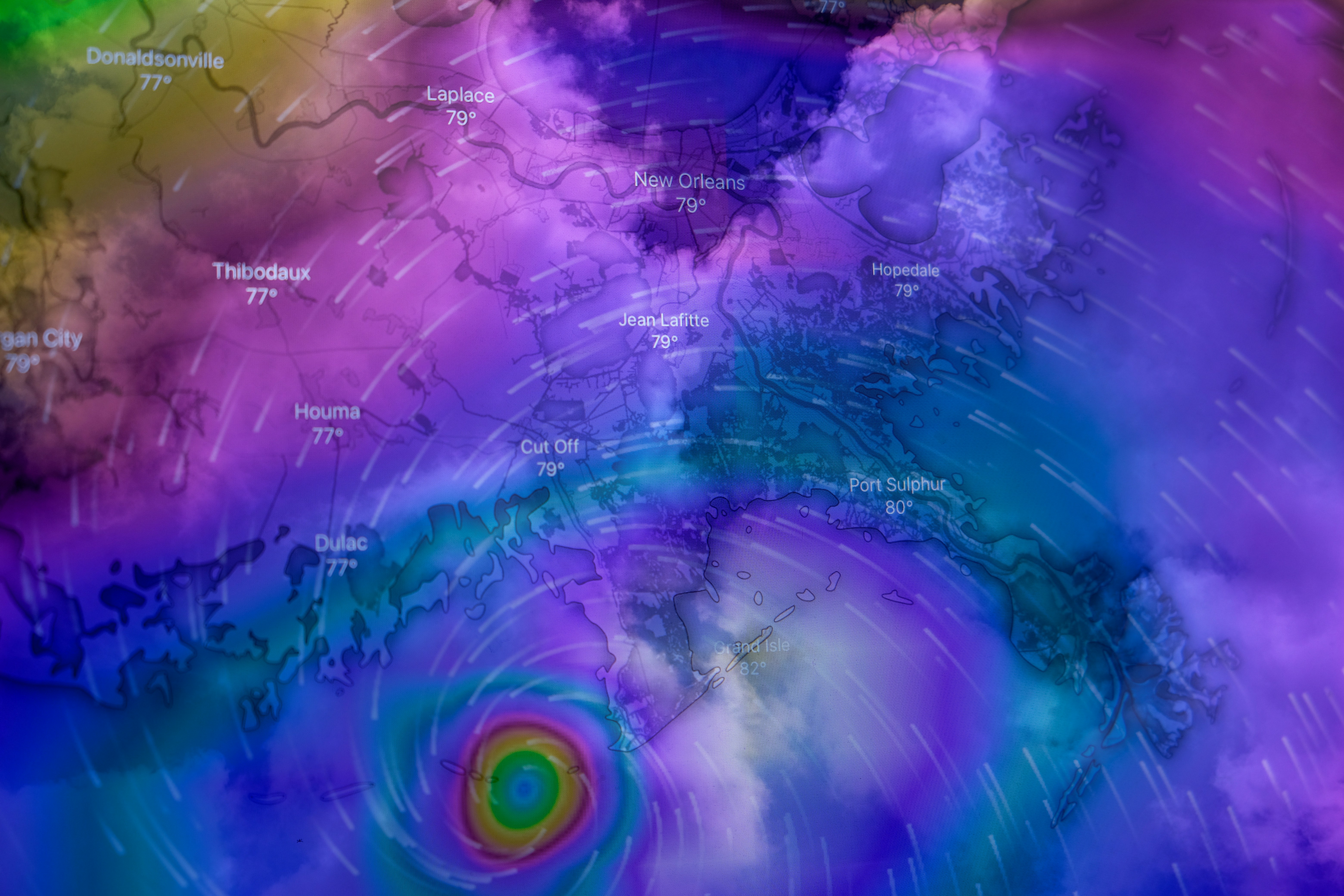

The impact of weather on financial markets cannot be overstated. A sudden heatwave can spike electricity demand, a drought can drive up wheat prices, and an unseasonal hurricane can send insurance stocks into a tailspin. Historically, traders have relied on traditional economic indicators, but hedge funds are now looking beyond financial data and incorporating alternative data sources—like real-time satellite weather models—to gain an edge.

With the stakes higher than ever, hedge funds are betting on meteorologists to give them market-moving insights. By understanding climate trends and extreme weather risks, these firms can make smarter trades in commodities, energy, insurance, and even retail sectors. The more accurate the forecast, the better the investment strategy.

The Industries Driving the Demand

While weather affects nearly every sector, certain industries are particularly dependent on accurate forecasting:

- Commodities Trading: Weather plays a significant role in agriculture, affecting crop yields for wheat, corn, and soybeans. Unexpected droughts, floods, or frosts can lead to massive price swings in global markets. Hedge funds with superior weather modeling can anticipate these shifts before the rest of the market.

- Energy Markets: Natural gas and electricity prices are directly influenced by temperature fluctuations. A colder-than-expected winter can drive up heating demand, while a heatwave can lead to spikes in electricity usage for air conditioning. Traders use meteorologists’ predictions to make bets on future energy prices.

- Insurance and Reinsurance: Weather modelers help insurance companies assess risks related to hurricanes, floods, and wildfires. Hedge funds trading insurance-linked securities (ILS) and catastrophe bonds rely on climate experts to evaluate potential losses.

- Retail and Supply Chains: Unexpected weather events can disrupt global supply chains, impacting everything from consumer demand to transportation logistics. A snowstorm can hurt holiday retail sales, while flooding can delay shipments of key materials.

For hedge funds, understanding how weather impacts these industries is not just an academic exercise—it’s a way to profit from market movements before others react.

The High-Stakes Game of Weather Prediction in Finance

Hedge funds aren’t just hiring meteorologists; they’re integrating sophisticated AI-driven weather models into their trading strategies. By combining historical climate data with real-time satellite readings, these firms can anticipate major weather events before they happen.

This ability to predict market-moving weather events has already led to significant financial wins—and losses. For example:

- A hedge fund that accurately predicted an unseasonal cold snap in Texas in 2021 made millions by shorting natural gas supplies before the prices skyrocketed.

- Another firm suffered heavy losses when it failed to anticipate the devastating impact of Hurricane Ian in 2022, which sent insurance stocks plunging.

These cases illustrate how weather forecasting is no longer just a tool for farmers and news stations—it’s a crucial component of financial trading.

The Cost of Expertise: Why Meteorologists Are Earning $1 Million

Why are hedge funds willing to pay meteorologists up to $1 million? The answer lies in the unique skill set required to bridge the gap between atmospheric science and financial markets.

Top-tier weather modelers possess:

- Expertise in atmospheric science and climatology

- Experience with predictive modeling and AI-driven analytics

- Knowledge of how weather impacts different asset classes, from commodities to bonds

This combination of skills is rare, and with the demand growing, hedge funds are competing aggressively to secure the best talent. Many of these experts come from government agencies like the National Weather Service or private firms specializing in climate analytics. Now, they’re being lured into finance with lucrative salaries and the promise of working on high-stakes market strategies.

For hedge funds, these million-dollar salaries are a small price to pay if accurate weather predictions lead to multimillion-dollar trading profits.

The Future of Weather Modeling in Hedge Funds

The rise of weather-focused financial strategies is likely just the beginning. As climate change increases the frequency of extreme weather events, the need for precise forecasting will only become more critical.

Key developments shaping the future include:

- Advancements in AI-powered weather prediction: Machine learning is improving the accuracy of long-term weather forecasts, giving hedge funds better predictive insights.

- Increased use of satellite data: Real-time climate monitoring via satellites is becoming a crucial tool for traders.

- Potential regulatory oversight: As hedge funds gain an edge from weather data, regulators may step in to ensure fair market access to these insights.

Additionally, hedge funds may expand their use of climate forecasting beyond short-term trades. As global climate patterns shift, long-term investment strategies—such as positioning for future agricultural trends or adapting real estate portfolios to rising sea levels—will become increasingly important.

Conclusion

Hedge funds have always sought out unconventional sources of data to gain a market advantage. Now, they’re turning to meteorology as a key tool in their trading arsenal. By hiring top weather modelers at salaries reaching $1 million, these firms are betting big on the ability to predict climate-driven market shifts.

With extreme weather events becoming more frequent, the role of weather intelligence in finance is set to grow. Hedge funds are no longer just tracking interest rates and corporate earnings—they’re tracking storms, droughts, and temperature anomalies to stay ahead of the market.

As the competition for climate expertise intensifies, one thing is clear: in the high-stakes world of hedge funds, the next big trade might just depend on the weather.

Author: Ricardo Goulart

Global Fund Groups Set To Hit $200tn

Global fund groups set to hit $200tn in assets by 2030, says PwCThe global fund management industry is expected to reach... Read more

Underperform And Report To Office: AHL's Struggles Trigger Policy Shift At Man Group

Man Group, one of the world’s largest hedge funds, has ordered staff at its flagship systematic trading unit AHL to re... Read more

Asia's Quiet Hedge Fund Star: Arrowpoint Rides Tariff Waves To Strong Gains

While some hedge funds chase headlines and media attention, others prefer to let performance speak for itself. Arrowpoin... Read more

China's Contrarian Hedge Fund Star Bags 1,485% Return

In a year when many global investors remained wary of China’s turbulent markets, one homegrown hedge fund has delivere... Read more

Beyond The Black Box: How Hedge Funds Are Systematically Embedding AI Into Core Operations

Artificial intelligence (AI) has long been discussed in hedge fund circles as a powerful but opaque tool—useful in the... Read more

Hedge Funds Rebuild Long Positions In Oil

Brent Crude Rally Gains Momentum After Diplomatic Thaw Hedge funds have significantly increased their bullish bets on B... Read more