Stock markets retreated Monday after a sustained rise to successive records last week, against a backdrop of fast-rising coronavirus cases and US political turmoil.

And cryptocurrency bitcoin plunged, posting its biggest loss since the start of the pandemic.

Though investors were unmoved by the violent invasion of the US Capitol by President Donald Trump's supporters last week, they were shaken by the aftermath amid Democratic efforts to remove him from office.

All three major US indices pulled back, and tech shares also felt the fallout after social media platforms pulled the plug on Trump.

"Investors are hitting the pause button with the relentless buying of US stocks as big-tech's actions following the mayhem at the Capitol drags sentiment down," said Edward Moya at the online brokerage Oanda.

Art Hogan, chief market strategist at National Securities, said investors can only ignore bad news for so long.

The bad news included data showing spiking Covid-19 cases led in December to the first job losses since April.

The market "was able to look through the insurrection, the attack on the Capitol (and) lousy job numbers last week," he told AFP.

"But you get to a point where you have to stop pricing in the future and look at the here and now."

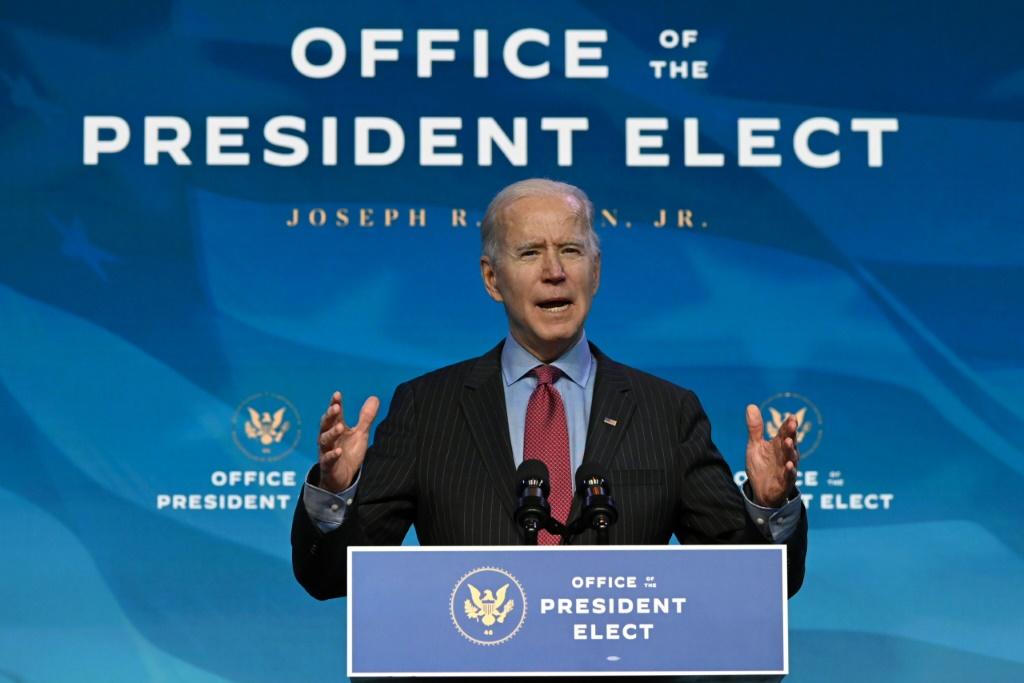

Analysts cite concerns the repercussions could be felt for months if efforts to again impeach Trump undermine President-elect Joe Biden's efforts to push through his economic stimulus plan, which he said he will unveil this week.

Bitcoin continued to be hugely volatile, losing 15 percent in a single day for its steepest drop since March, to $33,964.38.

The cryptocurrency last week smashed record after record, at one point surging past $40,000.

Britain's financial watchdog on Monday urged caution, especially among smaller investors.

The Financial Conduct Authority "is aware that some firms are offering investments in cryptoassets, or lending or investments linked to cryptoassets, that promise high returns", it said in a statement.

"Investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors' money.

"If consumers invest in these types of product, they should be prepared to lose all their money," the FCA added.

New York - Dow: DOWN 0.3 percent at 31,008.69 points

New York - S&P 500: DOWN 0.7 percent at 3,799.61 (close)

New York - Nasdaq: DOWN 1.2 percent at 13,036.43 (close)

EURO STOXX 50: DOWN 0.7 percent at 3,620.62

London - FTSE 100: DOWN 1.1 percent at 6,798.48 (close)

Frankfurt - DAX 30: DOWN 0.8 percent at 13,936.66 (close)

Paris - CAC 40: DOWN 0.8 percent at 5,662.43 (close)

Hong Kong - Hang Seng: UP 0.1 percent at 27,908.22 (close)

Shanghai - Composite: DOWN 1.1 percent at 3,531.50 (close)

Tokyo - Nikkei 225: Closed for a public holiday

Euro/dollar: DOWN at $1.2153 from $1.2219 at 2210 GMT

Dollar/yen: UP at 104.20 yen from 103.95 yen

Pound/dollar: DOWN at $1.3511 from $1.3560

Euro/pound: DOWN at 89.89 pence from 90.09 pence

West Texas Intermediate: DOWN 0.1 percent at $52.18 per barrel

Brent North Sea crude: DOWN 0.7 percent at $55.61 per barrel

Copyright AFP. All rights reserved.