Will EIGEN Price Soar To $5 As 7 Siblings Buys The Dip?

EigenLayer’s token dropped for four consecutive days even as “7 Siblings” bought the dip, hoping for its eventual rebound.

EigenLayer (EIGEN) token tumbled to $2.3, its lowest level since Nov. 3, and down by 33% from its highest point this week and 52% below its all-time high.

Data from Nansen shows that “7 siblings” bought 1.07 million EIGEN tokens valued at $2.59 million, which is a sign that they expect it to eventually bounce back.

This acquisition is notable because they are some of the biggest crypto investors, with over $106 million in their wallets. Their biggest holdings are staked Ethereum (ETH) tokens, Compound (COMP), and USD Coin.

EIGEN token also retreated even after Infura announced that it was launching a decentralized public infrastructure network on EigenLayer. This will be a big event since Infura is one of the biggest infrastructure network in the crypto industry, processing over 700 billion RPC requests a year. This launch comes after RedStone launched its testnet on Eigen’s AVS network.

EigenLayer has become a leading player in Decentralized Finance, where it provides restaking solutions. It has over $12.89 billion in assets, making it the third-biggest network in DeFi after Lido and AAVE.

EigenLayer launched its airdrop in September and has achieved a market capitalization of $435 million. Its fully diluted valuation has dropped from over $6 billion to $3.9 billion. A key challenge is that 14.9% of its market cap will be unlocked in December, diluting existing holders.

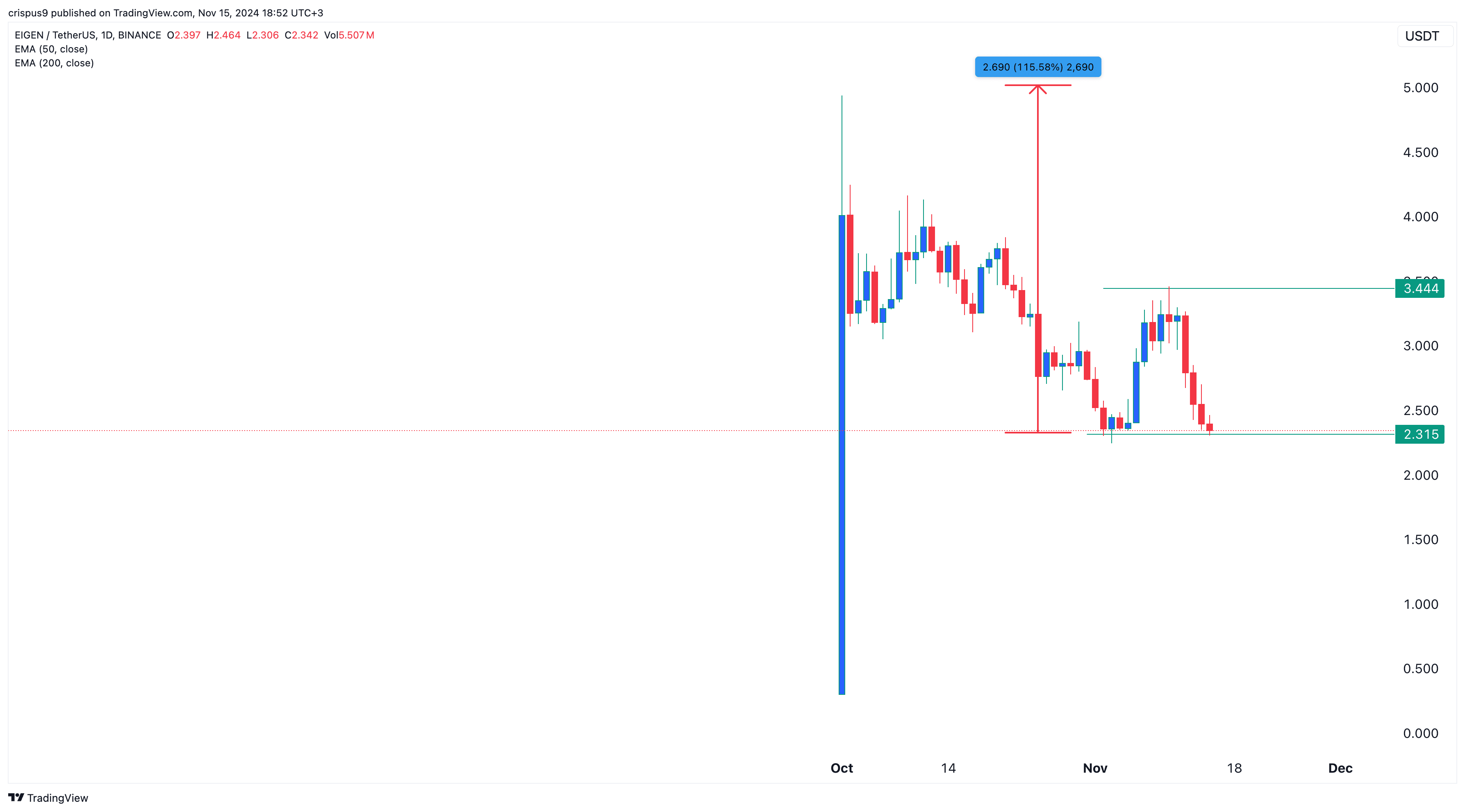

The daily chart shows that the EigenLayer price has been in a steep downward trend, falling in the past four consecutive days. The current phase of the downtrend started when EigenLayer token formed a shooting star on Nov. 10. This is one of the most popular bearish reversal signs in technical analysis.

EIGEN was trading at $2.315 on Friday, a notable level as it was its lowest level on November 3. It has also dropped below the 15-period moving average.

On the positive side, it has formed a double-bottom pattern, which is a popular bullish reversal sign. If it works out, it means that the coin will rebound and possibly retest the resistance level at $5, which is 115% above the current level.

A drop below the support at $2.31 will invalidate the bullish view and continue its downward trend, potentially to $1.5.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more