Vitalik Buterin Proposes Method To Increase Ethereum Capacity

Ethereum co-founder Vitalik Buterin proposed introducing multidimensional gas pricing.

In his latest essay, Buterin proposed eliminating the limitations of the existing commission system using multidimensional gas pricing.

The network uses a peer-to-peer model in which all computing processes, including storage, data transfer, and encryption operations, are measured in a single metric, gas.

With this approach, various resources are considered as interconvertible but are not. Although the system simplifies market transactions and the calculation of commissions, it combines fundamentally different types of resources, Buterin noted.

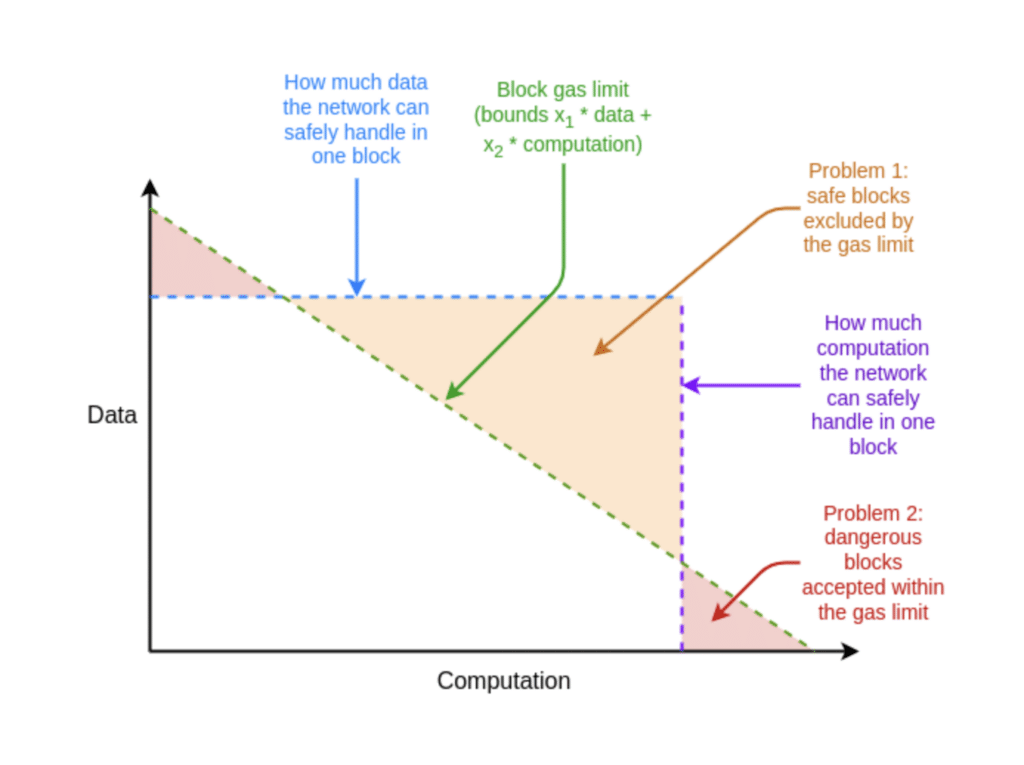

According to Buterin, mixing leads to inefficient computing power use and the potential rejection of safe blocks or, conversely, the inclusion of dangerous blocks in the blockchain.

The Ethereum co-creator proposes that moving to a multidimensional gas model may better reflect the network’s true constraints and capabilities, potentially increasing capacity without making resources more fungible.

Buterin has previously spoken about the concept of multidimensional gas, noting its implementation in the EIP-4844 update. The new type of transactions for large binary data arrays, BLOBs, added during the Dencun update significantly reduced costs for layer 2 solutions, especially those based on rollup technology. The Dencun hard fork was successfully implemented on the mainnet on March 13.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more