U.S. Moves $240m Silk Road Bitcoin To Coinbase

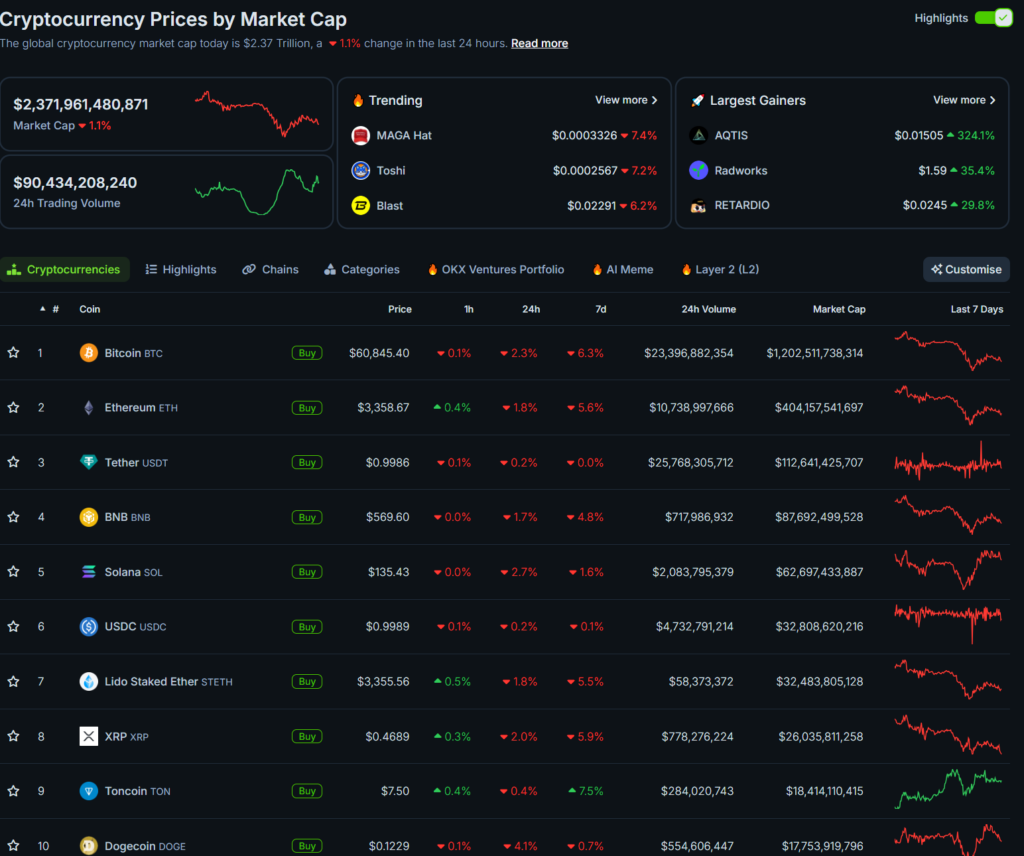

Bitcoin fell 2% after the U.S. government moved 3,940 Bitcoin seized from a Silk Road vendor.

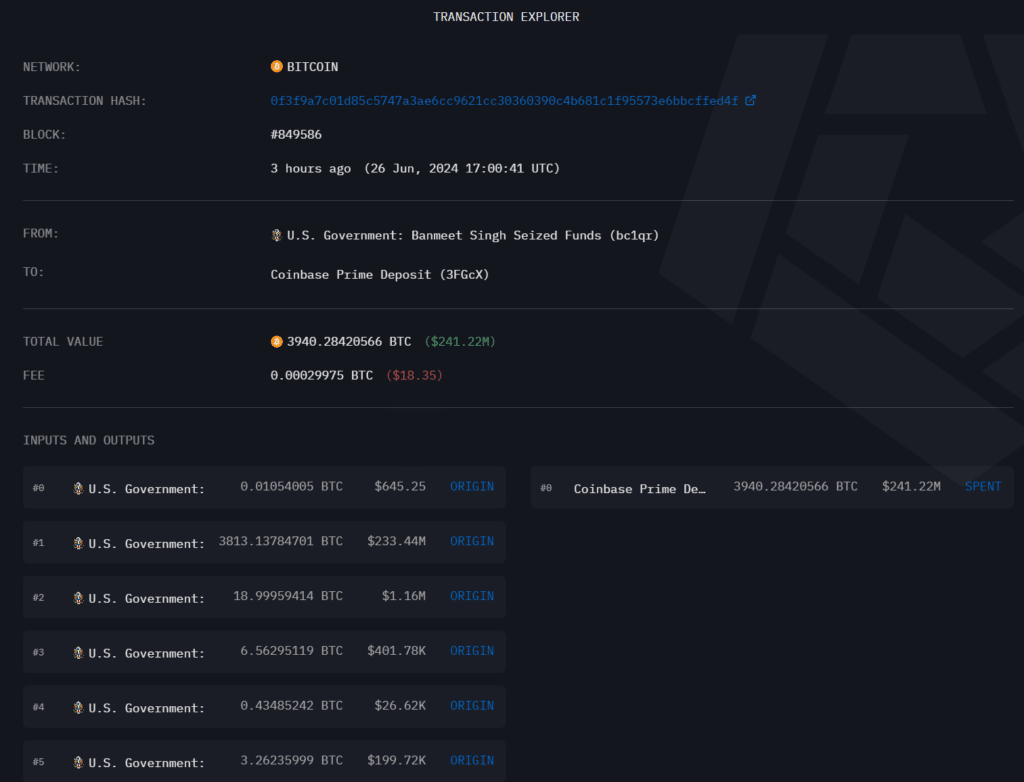

Bitcoin (BTC) came under selling pressure as the U.S. government transferred $240 million worth of crypto to a Coinbase Prime Address. Arkham Intelligence said the 3,940 BTC sent to Coinbase was originally forfeited from Silk Road vendor and narcotics dealer Banmeet Singh in a January trial.

Silk Road was a dark web marketplace created by Ross Ulbricht in 2011. The Federal Bureau of Investigation (FBI) arrested Ulbricht in 2013 and shut down Silk Road. Later, in 2022, U.S. law enforcement confiscated around 50,000 BTC. Authorities have also seized Silk Road BTC on several occasions.

The wallet linked to U.S. authorities moved $2 billion in BTC on April 2, sparking similar speculations about selling at the time. Following the Wednesday transaction, the total cryptocurrency market slid down modestly, along with BTC.

In March 2023, the U.S. government offloaded $216 million in BTC on Coinbase’s institutional platform, Coinbase Prime. The platform is the preferred off-ramp vehicle for government liquidations, but regulators have scrutinized Coinbase for violations and illegal business conduct.

Under chair Gary Gensler, the Securities and Exchange Commission (SEC) charged Coinbase with operating an unregistered securities exchange and unlicensed broker-dealer.

Coinbase denied the allegations and launched its counterarguments in court, accusing the SEC of denying crypto businesses clear rules and registration processes. As Coinbase and the SEC locked legal horns, the platform continued to service demand from the U.S. government tied to selling BTC.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more