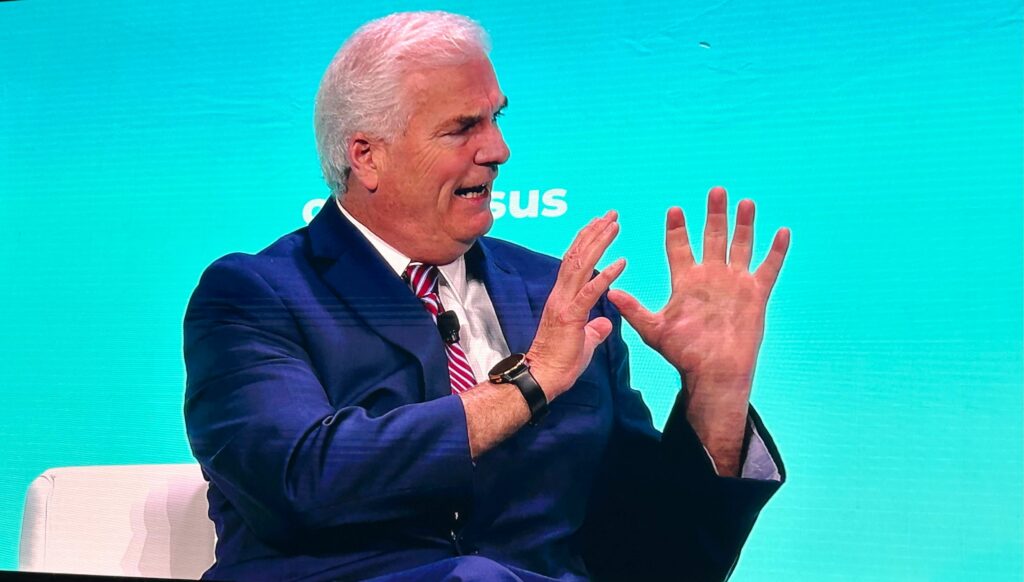

Tom Emmer At Consensus 2024: Crypto Is Nonpartisan And Here To Stay

Speaking at Consensus 2024, Republican majority whip Tom Emmer shared his perspective on cryptocurrency regulatory efforts in Washington D.C.

Following several bankruptcies and FTX’s crash in 2022, crypto has remained a hot topic among U.S. policymakers as industry stakeholders like Coinbase lobbied for clear rules.

Regulators like the Securities and Exchange Commission (SEC) and Senators like Elizabeth Warren from Massachusetts adopted an anti-crypto approach, initiating industry crackdowns and calling for tighter rules on digital asset operations.

On the surface, crypto seemed locked in an uphill battle, but advocacy and rapid blockchain adoption have impacted discussions in Washington within both Democrat and Republican parties.

According to Congressman and House majority whip Tom Emmer, votes for the Financial Innovation and Technology for the 21st Century Act (FIT 21) and opposition to the SEC’s controversial Staff Accounting Bulletin 121 (SAB 121) showed a bipartisan stance to safeguard U.S. innovation and check the SEC’s unconstitutional advanced against crypto.

“He has gone way beyond the authority that he has. He literally violates the mission of the SEC every day,” Emmer said, referring to SEC Chair Gary Gensler.

The GOP majority whip also hinted that Warren’s influence in the White House may be declining, paving the way for more neutral merit-centric digital asset discussions. In Emmer’s view, the White House’s statement on FIT 21 indicated a willingness to negotiate and find common ground on legislation as elections approach.

Emmer opined that this election year may motivate concluding rules but stressed that nothing is certain. The Congressman said FIT 21 remains subject to markups in the Senate and likely returns to the House for further hearings.

An anti-CBDC bill is also on the agenda, as policymakers slammed the Federal Reserve for conducting a central bank digital currency pilot and initiative development without Congressional approval.

Emmer believes work on crypto bills will advance after the elections and that digital asset voters could sway votes. The comments mirrored sentiments shared by CoinShares chief strategy officer Meltem Demirors during the Consensus OG Survivors panel. Demirors stated that American policymakers can’t ignore some 40 million constituents invested in digital assets.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more