The Winners And Losers From Bitcoins Halving

It will be a box office halving for exchanges and ETFs — but a miserable moment for miners and rival cryptocurrencies.

The Bitcoin halving is fast approaching, but while early investors will be popping open champagne following the cryptocurrency’s recent rally, the 50% cut to block rewards isn’t great news for everyone.

So, who are the winners and losers following this rare event, and how might this affect the markets going forward?

The winners

“OGs” who have had exposure to Bitcoin for years top the list of beneficiaries. The halving means just 450 new BTC a day are going to enter circulation, but this won’t matter much to those who started stacking sats a long time ago.

Someone who has held on to their Bitcoin since the first halving in November 2012 will have seen their investment surge by a jaw-dropping 502,693%. The world’s biggest cryptocurrency has appreciated by 9,578% since the second halving eight years ago and by 607% following the last halving during the coronavirus pandemic in May 2020.

Exchanges

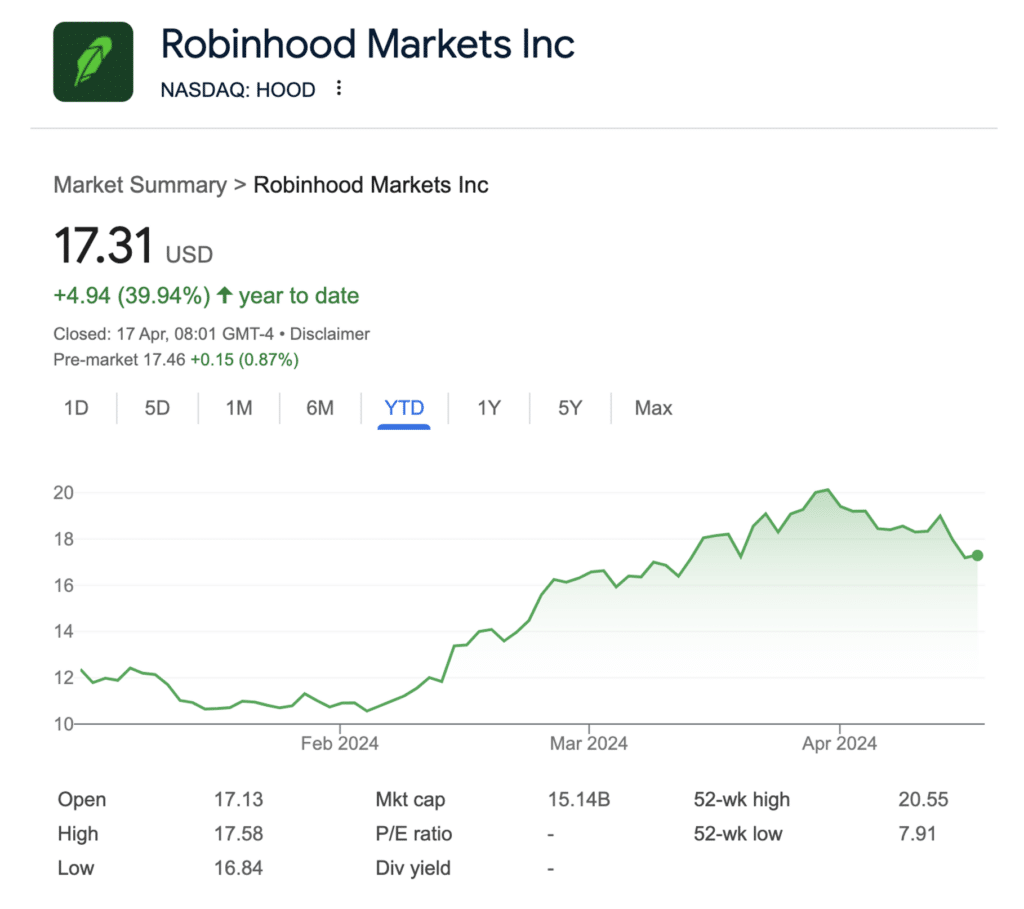

Platforms like Robinhood and Coinbase will also be rubbing their hands with glee as the halving kicks in, and curious consumers open accounts to see what the fuss is all about. Increased volumes among established traders will also bring in bumper fees.

Both companies are now listed on the stock market and have seen their share prices surge since the start of the year.

And while we’re nowhere near the market mania seen during the last bull run, when adverts for crypto exchanges dominated the Super Bowl, firms are starting to notch up their marketing spend once again. Grayscale has released a new commercial in recent days, with Coinbase taking out TV spots during high-profile basketball games. In a nod to Bitcoin Pizza Day, it’s simply explained this cryptocurrency’s staying power with a fitting food analogy.

ETFs

Exchange-traded funds based on Bitcoin’s spot price were approved in the U.S. in January — and have helped propel BTC to a new all-time high even before the halving’s taken place.

BlackRock’s iShares Bitcoin Trust has quickly established itself as a leader in this congested market. With $17.1 billion in assets under management, it could be a key beneficiary if the halving sparks a renewed rush of inflows from retail and institutional investors.

Michael Saylor

Someone else who comes out of the halving smelling of roses is Michael Saylor.

The founder of MicroStrategy turned heads when he started aggressively buying Bitcoin to hold on its balance sheet in August 2020.

Fast forward to now, and MicroStrategy has now amassed a war chest of 214,000 BTC, with each costing just $33,706 on average. That officially means that just one company owns 1% of all the BTC that will ever exist, and is currently sitting on paper profits of about $6.5 billion.

It wasn’t always easy. When BTC plunged to lows of $16,000 during a punishing bear market in 2022, Saylor’s big bet was hugely in the red — and funded by eye-watering levels of debt.

Saylor has now taken a step back as CEO and is now MicroStrategy’s executive chairman, giving him more time to advocate for Bitcoin. He does a lot of that on X.

Journalists

Any list of winners from Bitcoin’s halving would be incomplete without crypto reporters. Hey, it keeps us busy! We’ll be covering every twist and turn on crypto.news.

The losers

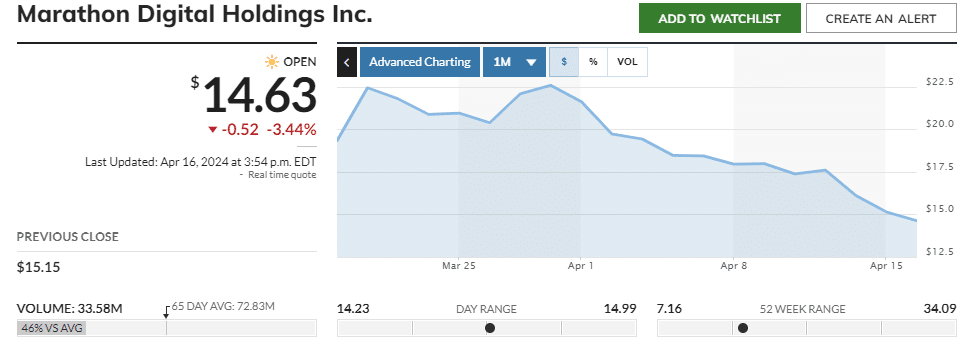

You’ll be unsurprised to know that miners are going to be hit hard by the halving. In the space of one block, the rewards they receive for keeping the network secure will plunge from 6.25 to 3.125 BTC — that’s a drop of about $197,000 in cash terms.

Miners in areas with higher energy costs, and those with older equipment, may find it’s no longer financially viable to continue. Even publicly listed mining giants have seen their stock price battered amid concerns over what the halving will mean for their bottom line. Shares in both Marathon Digital Holdings and Riot Platforms have slumped by 35% over the past month.

Other cryptocurrencies

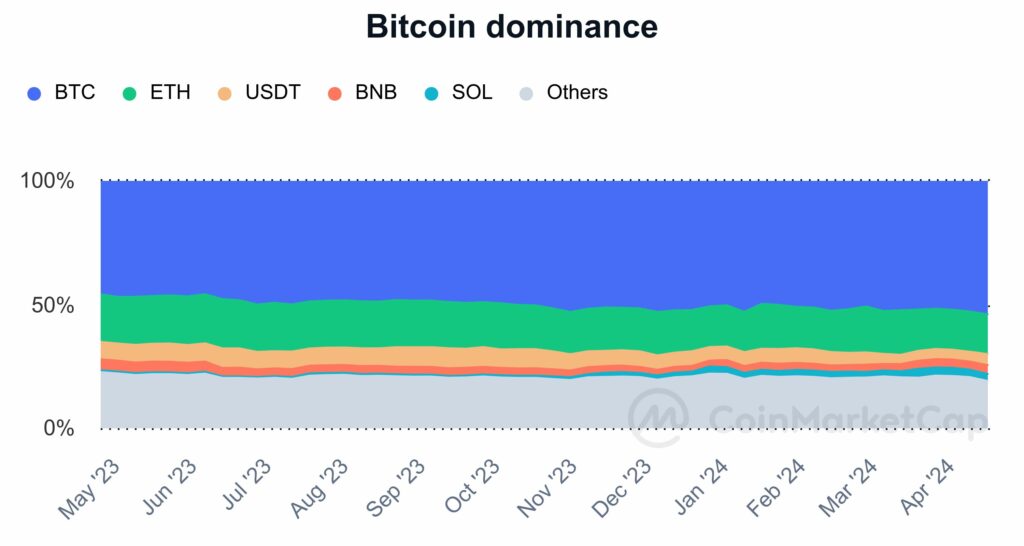

Bitcoin’s dominance now stands at 54.2%, compared with 45.8% a year ago.

The increase in BTC’s market share has been at the expense of Ether and smaller altcoins.

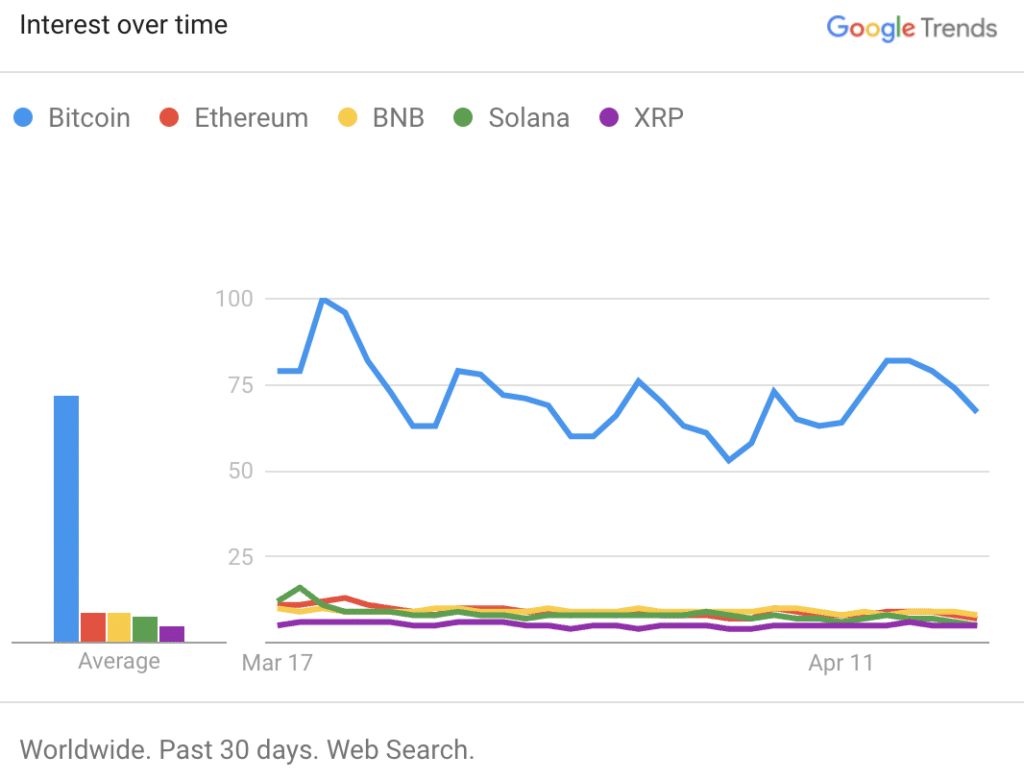

Investors aren’t just voting with their wallets. Google Trends data shows that search interest in Bitcoin is far outpacing rival cryptocurrencies, which are struggling to get a look in right now.

Analysts

There’s no shortage of pundits willing to step forward and make ambitious predictions about where Bitcoin prices will go next.

The likes of JPMorgan have suggested that BTC could be heading for a post-halving slump to $42,000, while Fundstrat Global Advisors founder Tom Lee is adamant that a rally to fresh highs of $150,000 could lie ahead in the next 12 months.

Not everyone can be right — and by the end of the year, some analysts who made pie-in-the-sky predictions will have egg on their faces.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more