Stablecoin Market Cap Jumps $37b, Hits Record High Since Trumps Victory

The market capitalization of stablecoins has jumped by $37.6 billion since U.S. president Donald Trump’s electoral victory in November.

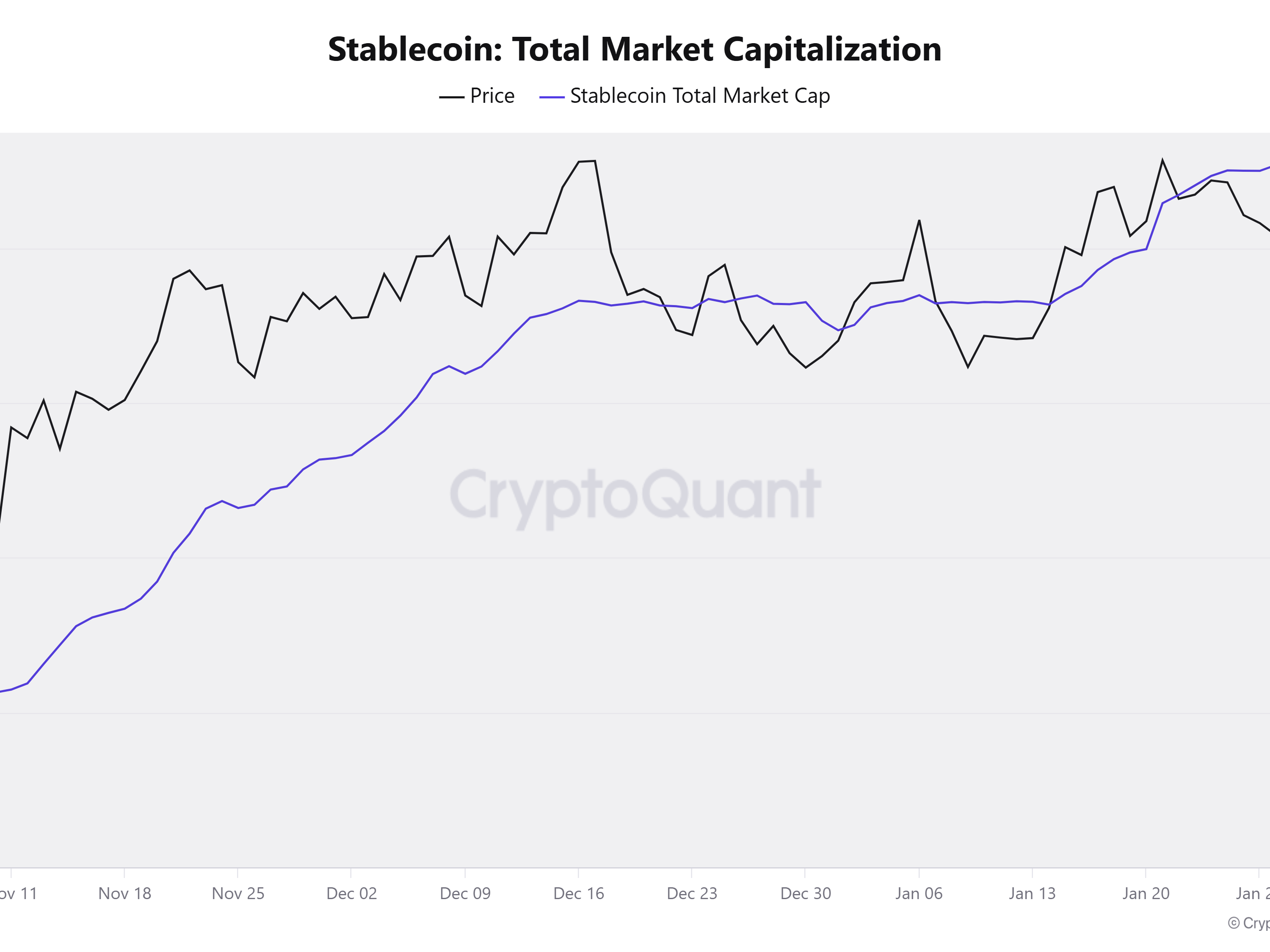

A new report from on-chain analytics provider CryptoQuant has revealed that the total value of USD-denominated stablecoins in circulation has jumped to a new record high since the announcement on Nov. 6.

The report, which tracks the total market cap of Tether (USDT), USD Coin, Binance USD, True USD, Pax Dollar, and DAI, reveals that they have collectively hit $204 billion, representing a 22 percent rise in value in the 86 days since Trump’s victory.

According to the data, Tether deposited on centralized exchanges has been a major driver of stablecoin liquidity, with the figure growing by 41 percent from $30.5 billion on Nov. 4 to $43 billion on Jan. 31.

According to the report, the stablecoin market cap is an important metric for gauging market activity because it acts as an important source of liquidity for trading on exchanges and its growth typically correlates with higher crypto prices, which motivate retail traders to become more active in the market. The data also shows that USDC has grown strongly over the same period, second only to USDT. An excerpt from the report reads:

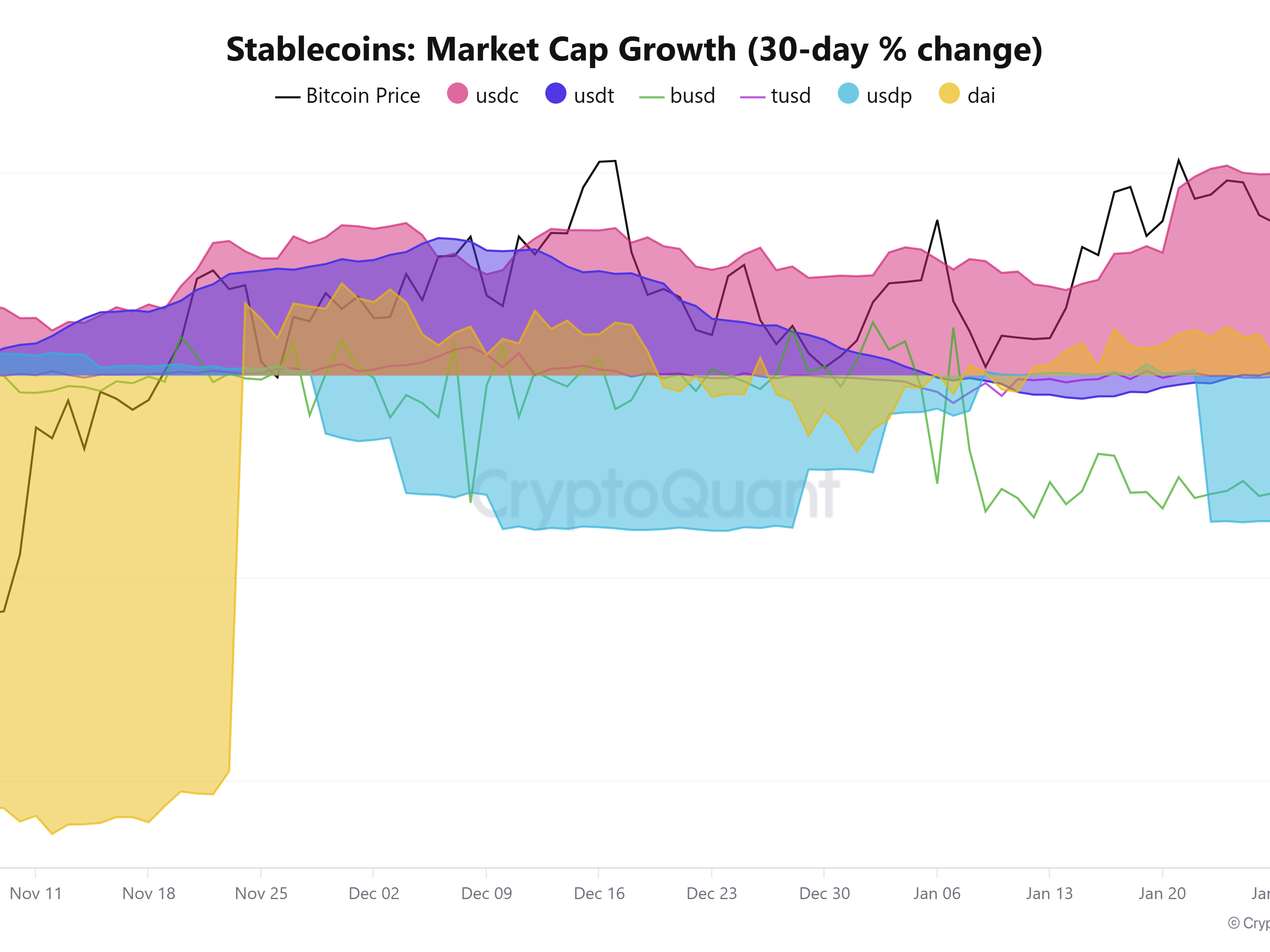

The expansion of liquidity via stablecoins continues to be driven by Tether’s USDT, but Circle’s USDC has regained traction. The market capitalization of USDT is $139 billion today, up by $19 billion (15%) since November 4. Meanwhile, USDC’s market capitalization has started to increase significantly again, rising by $17 billion (48%) over the same period. USDC’s market capitalization is now $52.5 billion

CryptoQuant analysts believe that the booming stablecoin market could be a signal that the next significant upward movement for Bitcoin and crypto prices could be imminent.

The liquidity impulse, which measures the 30-day percentage change in market capitalization is now a roaring 20 percent for USDC, while USDT is once again slightly positive following a brief contraction at the start of 2024.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more