Spot Bitcoin ETFs See Inflows Of $64.8m, Ether ETFs Outflows Drop To $874k

Spot Bitcoin ETFs have seen their sixth consecutive day of net inflows, while spot Ether ETFs continue to net outflows, adding to their six-day negative flow streak.

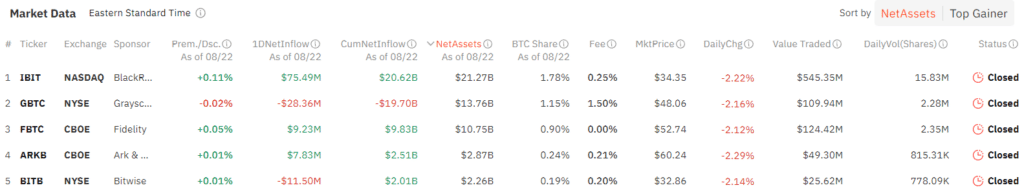

According to data from SoSoValue, the 12 spot Bitcoin exchange-traded funds recorded $64.91 million in net inflows on Aug. 22, representing a jump of 65% compared to the $39.42 million net inflows seen on Aug. 21.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, led the charge with reported inflows of $75.5 million, bringing its total inflows to date to $20.6 billion. Fidelity’s FBTC and ARK 21Shares’s ARKB followed next with inflows of $9.2 million and $7.8 million, respectively.

Meanwhile, WisdomTree’s BTCW and VanEck’s HODL reported more modest inflows of $4.8 and $3.4 million respectively following 9 days of no activity.

These inflows were offset by Grayscale’s GBTC, which logged outflows of $28.4 million, bringing its total outflows from its launch date to $19.69 billion. However, the crypto asset manager’s mini Bitcoin trust ETF drew $4 million in inflows. Bitwise’s BITB also reported $11.5 million in outflows. The remaining four BTC ETFs remained neutral.

Trading volume for BTC ETFs dropped to $899.6 million on Aug. 22, significantly lower than the $1.42 billion seen on Aug. 21. These funds have recorded a cumulative net inflow of $17.62 billion since inception. At the time of writing, Bitcoin (BTC) was up 0.3% over the past day, trading at $61,058, per data from crypto.news.

Meanwhile, the nine-spot Ethereum ETFs collectively saw a major drop in outflows, which stood at $874,610 on Aug. 22, marking the sixth consecutive day of outflows.

Grayscale’s ETHE led the outflows once again, with $19.8 million leaving the fund, bringing its total outflows to the $2.52 billion mark since its launch on July 23. Meanwhile, Fidelity’s FETH, Grayscale’s ETH, and VanEck’s ETHV were the only offerings to record inflows of $14.3 million, $3.7 million, and $1 million, respectively. The remaining five ETH ETFs saw no flows on the day.

These investment vehicles have also seen their daily trading volume drop to $93.8 million on Aug. 22, a major drop over the previous day. The spot Ether ETFs have experienced a cumulative net outflow of $458.95 million to date. At the time of publication, Ethereum (ETH) was also up by 1.4%, exchanging hands at $2,669.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more