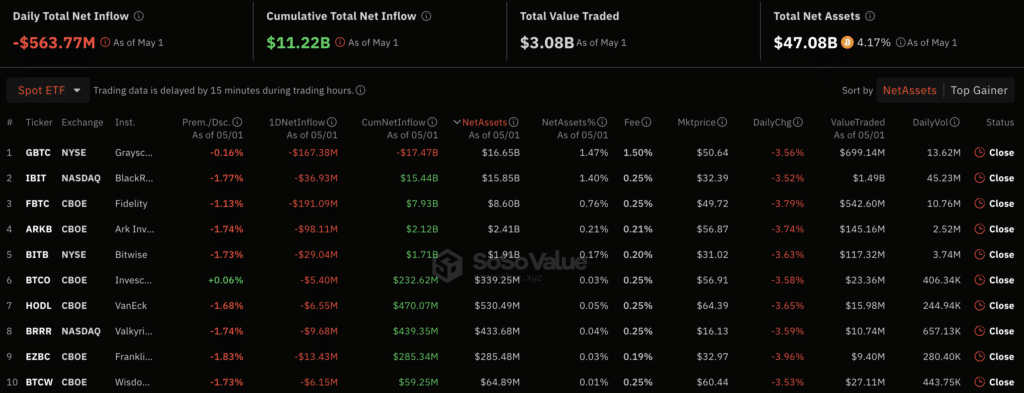

Spot Bitcoin ETFs Reach Record $563m Outflows

On May 1, the U.S. spot Bitcoin ETF sector recorded a record capital outflow of $563.77 million.

According to SoSo Value, the sector’s fund outflow continued for the sixth straight day. Capital outflows on May 1 reached their highest point since the spot Bitcoin ETFs were approved by the U.S. SEC.

Capital outflow was recorded for 10 products, with the hardest hit coming against the Fidelity Wise Origin Bitcoin Fund (FBTC) at $191.09 million.

May 1 is also the first day when an outflow of capital was recorded on the iShares Bitcoin Trust (IBIT) position from BlackRock. Before this, the fund recorded a net inflow of funds for 70 consecutive days.

The head of The ETF Store, Nate Geraci, compared IBIT’s performance with another BlackRock exchange-traded fund, the iShares Gold ETF. Geraci emphasized that the second product lost more than $1 billion in one year.

Geraci’s stance was supported by Bloomberg Intelligence analyst James Seyffart. According to Seyffart, all ETFs operate stably, and such fluctuations are the norm for such products.

“Should add — these ETFs are operating smoothly across the board. Inflows and outflows are part of the norm in the life of an ETF.”

James Seyffart, Bloomberg Intelligence analyst

The net outflow of capital on May 1 exceeded the losses of funds for the entire April which only saw $345.88 million in outflows.

The massive outflow happened against a drawdown in the Bitcoin (BTC) price below $57,000 following a four-month prison sentence for Binance founder Changpeng Zhao.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more