Solana Jumps 8% As VanEck Files First SOL ETF Bid

Wealth Manager VanEck has moved to expand its crypto-related suite of offerings with a Solana trust.

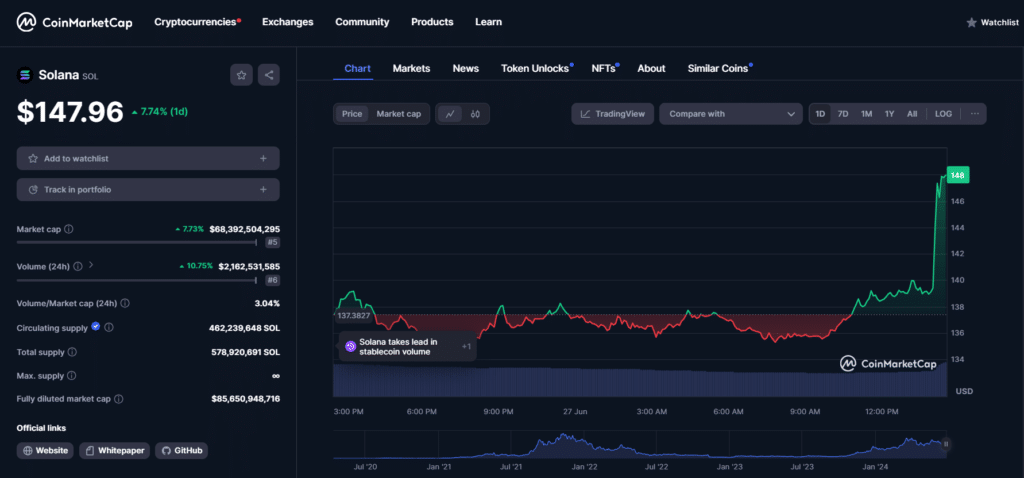

Spot Bitcoin (BTC) ETF Issuer and asset manager VanEck submitted the first-ever bid for a Solana (SOL) exchange-traded fund in the U.S., per a Thursday filing with the Securities and Exchange Commission (SEC). CoinMarketCap data showed that the price of SOL surged over 8% shortly after the news broke.

According to the document, the so-called VanEck Solana Trust will track and reflect the performance of SOL prices as the firm attempts to foray deeper into crypto-backed investment vehicles. Similar to update prospectus submissions for spot Ethereum (ETH) ETFs, VanEck’s filing stressed the absence of staking for its Solana Trust.

“Neither the Trust nor the Sponsor, the SOL Custodian, or any other person associated with the Trust will, directly or indirectly, engage in any action where any portion of the Trust’s SOL is used to earn staking rewards, to earn additional SOL or to generate income or other earnings.” read the June 27 SEC filing.

In a statement regarding the application, Matthew Sigel also challenged assertions from the SEC, although indirect, and Michael Saylor’s view that SOL is an unregistered security. Sigel argued that Solana is a commodity just like Bitcoin and Ethereum.

VanEck likely included this language to comply with perceived SEC direction, which currently leans toward classifying staking activities under federal securities laws. The filing comes ahead of widely anticipated approvals for spot Ether ETFs after the successful launch of several Bitcoin counterparts in January.

Also, VanEck’s application reaffirmed remarks from analysts and industry leaders like Solana co-founder Raj Gokal and Ripple CEO Brad Garlinghouse, who both said a SOL ETF was merely a matter of time.

Furthermore, the news indicates confidence from asset managers amid a political tailwind shift in the U.S. leading up to the winter elections. Candidates on both sides have espoused some crypto-friendly rhetoric, with Donald Trump adopting a more aggressive stand on the matter and Biden’s regime disclosing willingness to discuss digital asset regulatory policies.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more