Should You Buy Ethereum? Bitwise CIO Shares 3 Reasons To Be Bullish

Matthew Hougan, Chief Investment Officer (CIO) at Bitwise Asset Management has shared his outlook for crypto – specifically why Ethereum may be good addition to an investor’s portfolio.

Hougan said in an X post there are three reasons one may want to add ETH to their portfolio, and one other reason investors could choose to stick with a Bitcoin-only portfolio.

Hougan cautions that his comments do not constitute investment advice. However, he thinks the upcoming launch of spot Ethereum ETFs in the US means most people may find this a good time to add the world’s second largest cryptocurrency to their wallets.

Why consider ETH for a portfolio?

According to Hougan, it’s down to diversification, Bitcoin and Ethereum’s use cases targeting different and historical analysis. There, three reasons.

Commenting on the diversification aspect, he compares the investment landscape during the dot.com boom to the current crypto market. He wrote:

“It is very hard to predict the future with precision. Ask any investor from the dot-com boom who bought AOL or Pets.com. They got the overall bet right—the internet is going to be big!—but the specifics wrong.”

Today, crypto is an emerging technology with all the potential to change the world. But while it’s impossible to predict the future, one way to go about it is “own the market.” A scenario where its 75% BTC and 25% ETH could be “a good default starting place.”

The second reason why the Bitwise exec thinks it might be wise to add ETH to a portfolio is Bitcoin and Ethereum’s use cases.

While Bitcoin is “the best form of money that has ever existed,” Ethereum’s focus is to make money programmable. Stablecoins and DeFi are among the top applications relying on this new system.

Although difficult to say what applications will make the most the new technology, broader exposure to both BTC and ETH may work for a portfolio.

For the third reason, Hougan opines, it’s the historical analysis.

“Adding ETH to a portfolio over a full crypto market cycle has historically boosted both your absolute and risk-adjusted returns compared to adding BTC only,” he said.

An example of a portfolio with ETH

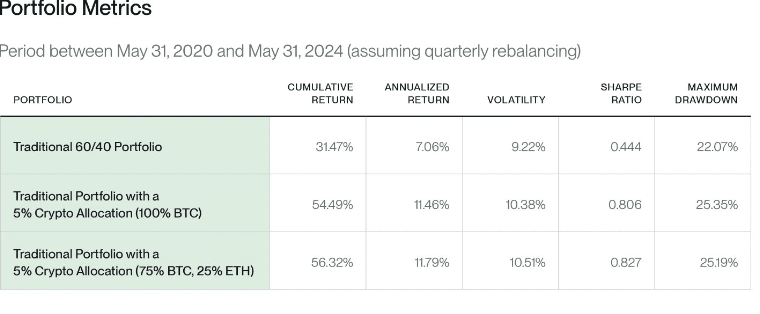

A sample portfolio showing performance between May 31, 2020 and May 31, 2024 shows that a traditional 60/40 portfolio had a cumulative return of 31.47% and annualized return of just 7.06%.

In comparison, adding 5% to such a portfolio with 100% BTC allocation has cumulative returns jumping to 54.49% and annualized return at 11.46%. With ETH added, this increases to 56.32% and 11.79% respectively for cumulative and annualized returns.

Notably, the portfolio with ETH added shows both a higher return and lower maximum drawdown.

But Hougan also says:

“My view, in a word: If you want to make a broad bet on crypto and public blockchains, you should own multiple crypto assets. If you want to make a specific bet on a new form of digital money, buy Bitcoin.”

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more