SEC Serves Wells Notice To Uniswap

Defi exchange Uniswap has received a warning of an impending enforcement action enacted by the U.S. SEC.

On April 10, Uniswap disclosed a Wells notice issued by the SEC’s Enforcement Division. The notice is part of a broader crackdown on crypto by the securities watchdog, as chair Gary Gensler insists that most digital assets issued on blockchains fall under existing financial laws.

Gensler has often referred to crypto as the “Wild West” and has sought to reign in the industry through enforcement action.

Uniswap founder and CEO Hayden Adams wrote on X that he was annoyed and disappointed but ready to fight the SEC and protect his company.

In a blog post discussing the SEC’s notice, Uniswap also refuted claims that most cryptocurrencies constitute investment contracts. Like several in the industry, including Coinbase, the DEX argued that the overwhelming volume of traded tokens is stablecoins, utility tokens, and commodities like Bitcoin (BTC) and Ethereum (ETH).

“Despite SEC rhetoric that “most” tokens are securities, the reality is that tokens are a digital file format, like a PDF or spreadsheet, and can store many kinds of value. They are not intrinsically securities, just as every sheet of paper is not a stock certificate. We are confident that the products we offer are not just legal – they are transformative.”

Uniswap’s April 10 blog post

According to DefiLlama, Uniswap is the largest defi exchange and holds over $6.2 billion in total value locked across 16 individual blockchains. CoinGecko data showed that the DEX handles 22.5% of all cryptocurrency trading volume.

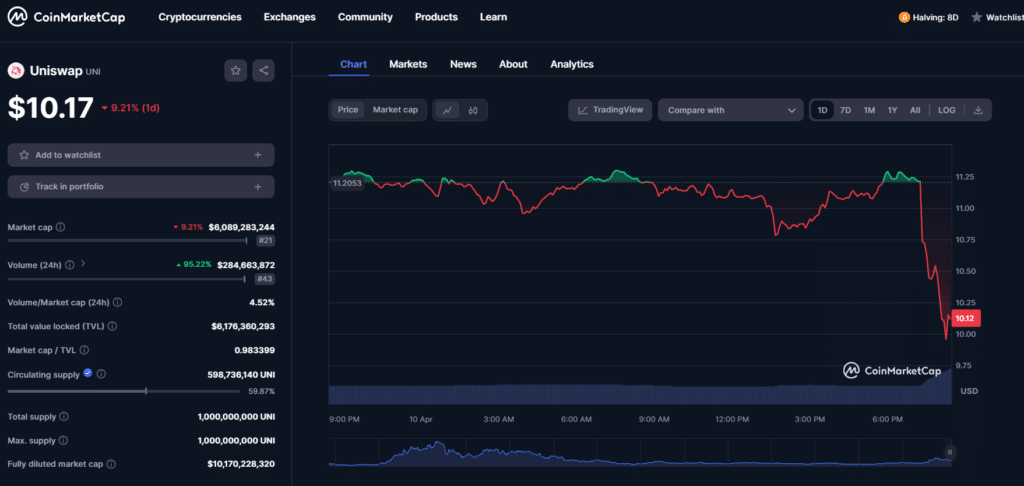

Following the news, the UNI token declined by over 9% and traded for around $10, per CoinMarketCap.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more