Ripple (XRP)'s Study Reveals Key Insights Into Payment Reconciliation Challenges

In the rapidly evolving landscape of global payments, Ripple (XRP) has consistently been at the forefront, revolutionizing how transactions are conducted across borders. According to Ripple, their commitment to understanding and improving users' day-to-day experiences remains unwavering.

Through comprehensive research involving non-Ripple customers, Ripple has gained invaluable insights into the reconciliation process—a critical aspect of financial operations that ensures the accuracy and consistency of transaction records.

Uncovering Reconciliation Insights Through Global Research

Ripple's research efforts have delved deep into reconciliation, a fundamental process for ensuring the accuracy and consistency of financial statements. The company surveyed over 350 CFOs, treasury managers, and payment operators globally to gain a comprehensive view of the payment reconciliation landscape. The findings revealed that the pain points extend across the payments industry and are not unique to a single provider.

Unveiling Common Industry Pain Points

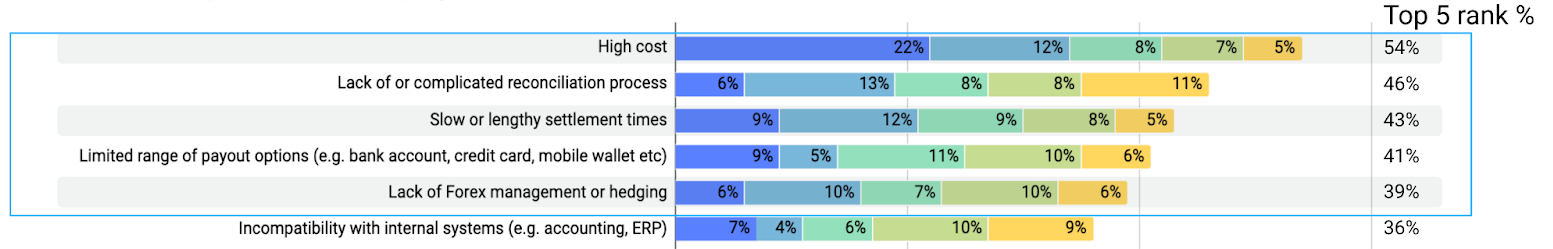

The survey findings uncovered that nearly half of respondents cited complicated reconciliation challenges among their top five pain points, right after high costs. Key pain points identified include:

Data Accuracy and Completeness: Users face difficulties matching transactions manually, encountering discrepancies that demand significant time and effort to resolve.

Reporting Experience: The complexity of navigating reporting features on payment platforms and the manual processes involved in downloading and reconciling statements impede efficiency.

Support Access: Timely resolution of data discrepancies is obstructed by limited customer support availability, highlighting a critical area for enhancement.

Survey comments provided further insight into these challenges:

“They could’ve done more value-adding tasks… And through that, you could say implicitly there’s also a negative impact to the business” (Participant 2)

“It's just the constant manipulation of all the .csv and Excel files… we’re losing anywhere from 2 to 250 hours in a given month” (Participant 3)

The demand for payment providers to offer options for integration with accounting software, enterprise resource planning (ERP), and banking providers for payment reconciliation is the second most wanted feature.

The responses underscore the need for high standards in data quality, reporting automation, and user interfaces that facilitate an intuitive and efficient reconciliation process.

Users Want a Streamlined Payments Experience

Survey respondents indicated a strong desire for customizable reporting features, simplified content, and an interface that helps expedite the reconciliation process. With Ripple Payments, Ripple is seizing the opportunity to further revolutionize the reconciliation experience to best meet the needs of their global survey respondents.

Addressing these reconciliation challenges involves more than just enhancing features—it’s about building trust and empowering users. Ripple aims to provide customers and partners with the peace of mind that comes from knowing their financial data is accurate, complete, and easily manageable, ultimately improving the customer's bottom line.

Looking Forward

Ripple's commitment to users extends beyond simply understanding their challenges; it’s about taking action. As Ripple looks to the future, they are dedicated to leveraging these insights to drive meaningful improvements in their products and services.

By focusing on customization, data quality, and user experience, Ripple aims to redefine the standards of payment reconciliation, making it a seamless, efficient, and user-friendly process.

For more details, visit the original Ripple article.

Image source: ShutterstockCrypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more