Raydiums Share Of Memecoin Volume Surges In Q1 But Pump.funs DEX Poses Risk

Raydium’s dominance in Solana-based memecoin trading has increased to 83% over the past three months, even as overall memecoin market activity declined.

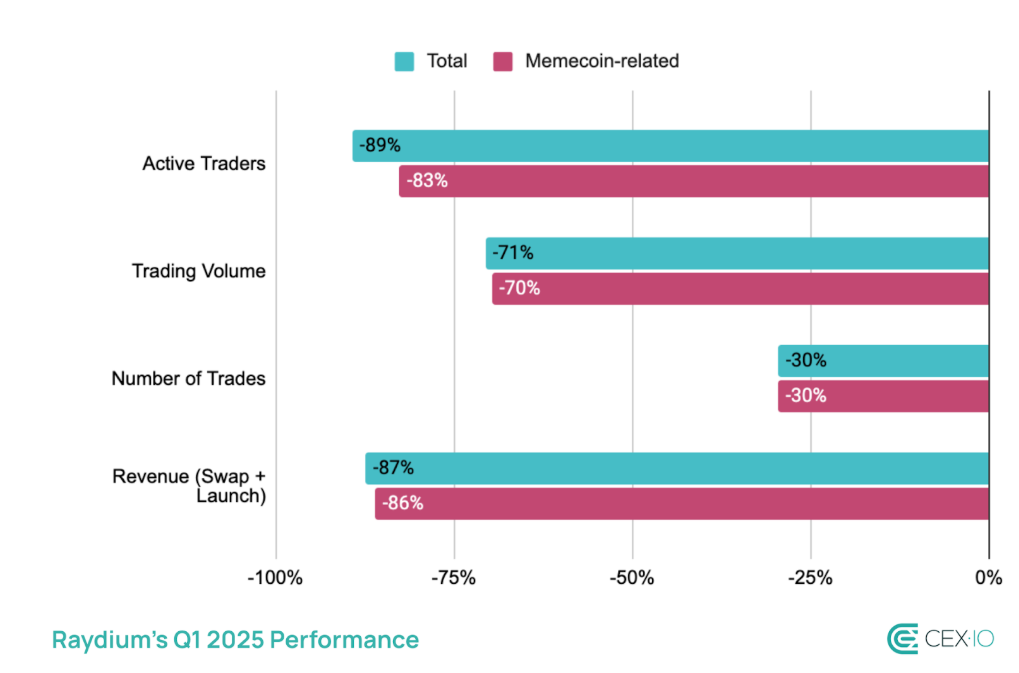

According to Memecoins in Q1 2025 report by CEX.io, Raydium has seen its memecoin trading volume surge to 83% despite the contraction in the overall memecoin market activity and market cap.

Memecoins were riding high on speculative momentum in January following high-profile political launches like the Trump (TRUMP) and Melania (MELANIA) tokens. At their peak, memecoins accounted for 11% of total crypto trading volume on Jan. 20, the CEX.io report noted. However, by April 1, the memecoin market cap had plummeted by 58% from its January high, with their share of trading volume falling to just 4%.

Despite the decline in the overall memecoin market activity, Raydium’s share of memecoin trading volume has increased from 77% to 83% in the first quarter of 2025. This is the direct result of the exchange’s unofficial partnership with Pump.fun, which is responsible for the daily creation of over 50% of SPL tokens. Once these memecoins hit a $69K market cap, they were automatically listed on Raydium.

However, with Pump.fun recently launching its own DEX for memecoins, it’s uncertain how this will affect Raydium’s standing in the memecoin trading ecosystem. Despite Raydium’s launch of its own memecoin launch platform, LaunchLab, much of its past revenue came from memecoins migrating from Pump.fun. Experts have pointed out that the success of launchpads like Pump.fun is largely driven by their community and lore, which will be difficult for Raydium to replicate.

To summarize, while Raydium’s share of memecoin trading volume increased in Q1, much of that growth was fueled by Pump.fun token migration. Now that Pump.fun has introduced its own DEX, Raydium may face a significant hit to its trading volume. The extent of that decline will likely hinge on the success or failure of its own LaunchLab platform.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more