Pavel Durovs Arrest Unleashes The Streisand Effect On Toncoin

On August 24, 2024, French authorities arrested Pavel Durov, the founder of Telegram, and released him on bail a few days later. Though the arrest cited alleged illegal activities conducted through his messaging platform, many have viewed it as an attack on free speech. The perspective has ignited a Streisand Effect, unintentionally increasing the popularity of both Telegram and its associated cryptocurrency, Toncoin.

Understanding the Streisand Effect

The Streisand Effect is a well-documented phenomenon where efforts to suppress or censor information lead to increased public attention to that very information. The term originates from a 2003 incident where Barbra Streisand attempted to block the publication of aerial photos of her home. Her actions led to the images gaining widespread attention and becoming much more popular than they would have been otherwise. And research supports this through various real-world examples and theoretical models.

For instance, a study published in the International Journal of Communication highlights how attempts to censor information often backfire, resulting in greater dissemination and public awareness than would have occurred without the censorship attempt. This is because the act of trying to hide information inherently makes people more curious about it, thereby increasing its visibility.

The same phenomenon unfolded with Telegram and Toncoin following Pavel Durov’s arrest. While Durov does cooperate with authorities to some extent by banning certain content, he has consistently refused to compromise on issues that could jeopardize user privacy or restrict free speech. The approach has made Telegram a focus of scrutiny in various countries, such as Russia, Iran, and recently France, where his recent arrest is seen by many as an effort to pressure him into greater cooperation on these sensitive matters.

Telegram and Toncoin post-arrest analysis

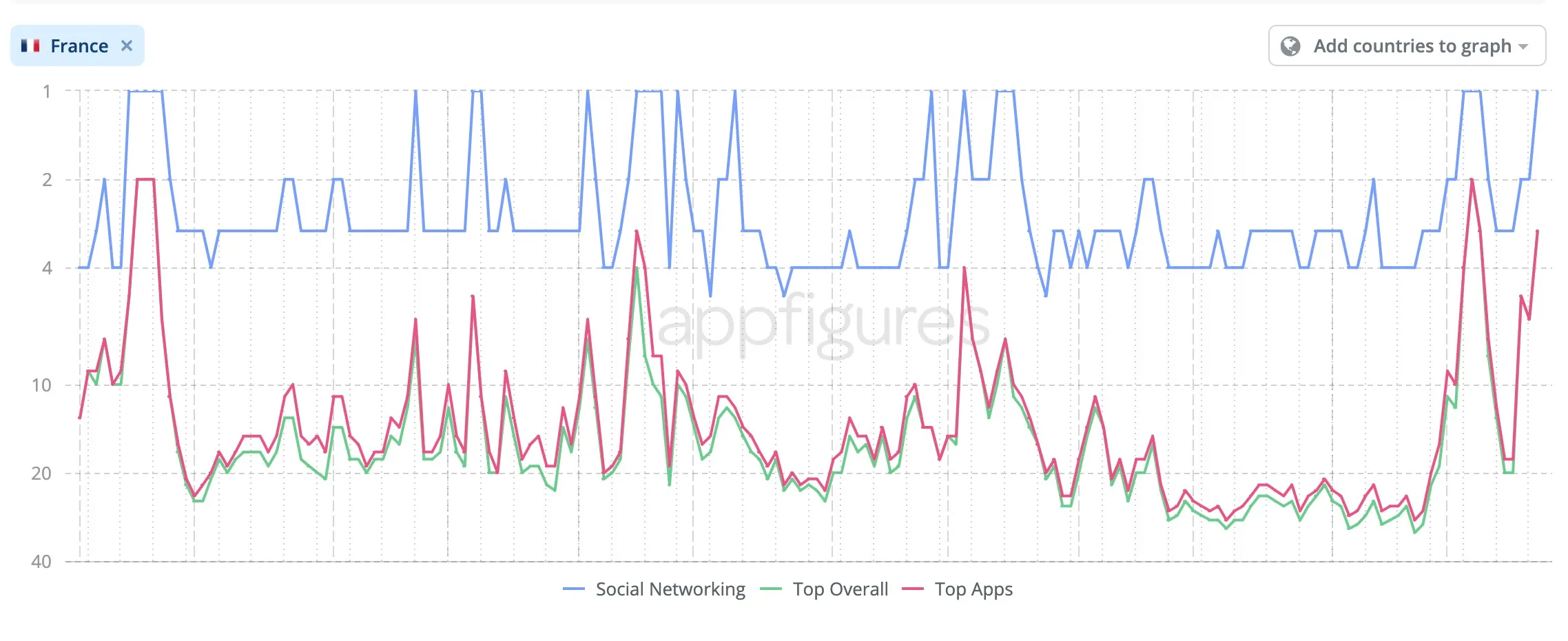

As Durov’s legal troubles made headlines, Telegram’s popularity quickly reflected the increased public interest. By August 26, 2024, just two days after Durov’s detention, Telegram had climbed to the No. 2 spot in the U.S. App Store’s Social Networking charts, with global iOS downloads increasing by 4%. In France, where Durov was detained, the app reached the No. 1 position in the Social Networking category and became the third most popular app overall.

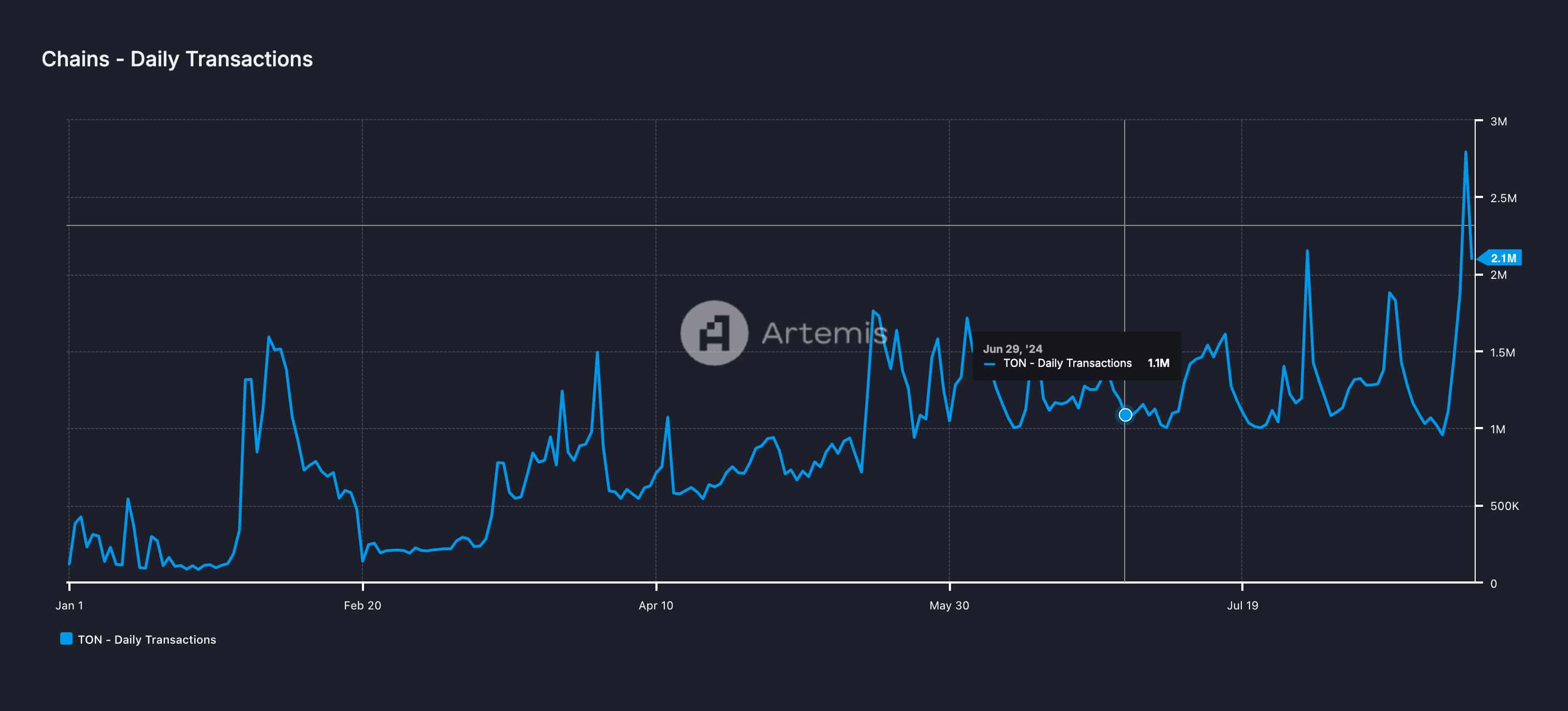

When examining Toncoin, the effects of Pavel Durov’s arrest closely parallel the trends observed with Telegram. By August 26, daily transactions on the Toncoin blockchain rose by 192%, reaching 2.8 million. This number marked the highest level recorded so far this year and was the second highest in the history of the blockchain.

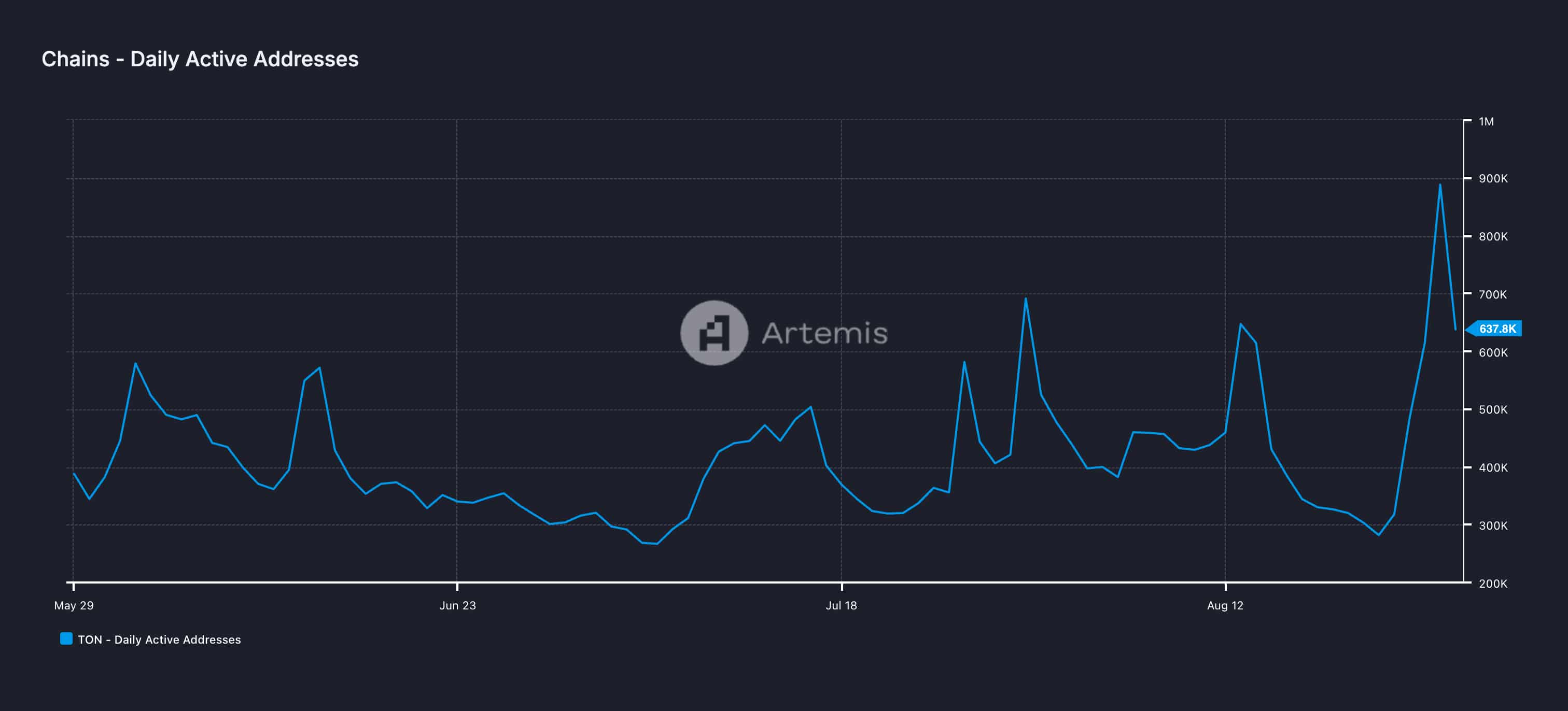

Daily active addresses also saw a substantial increase, climbing by 215% to an all-time high of 888.9K.

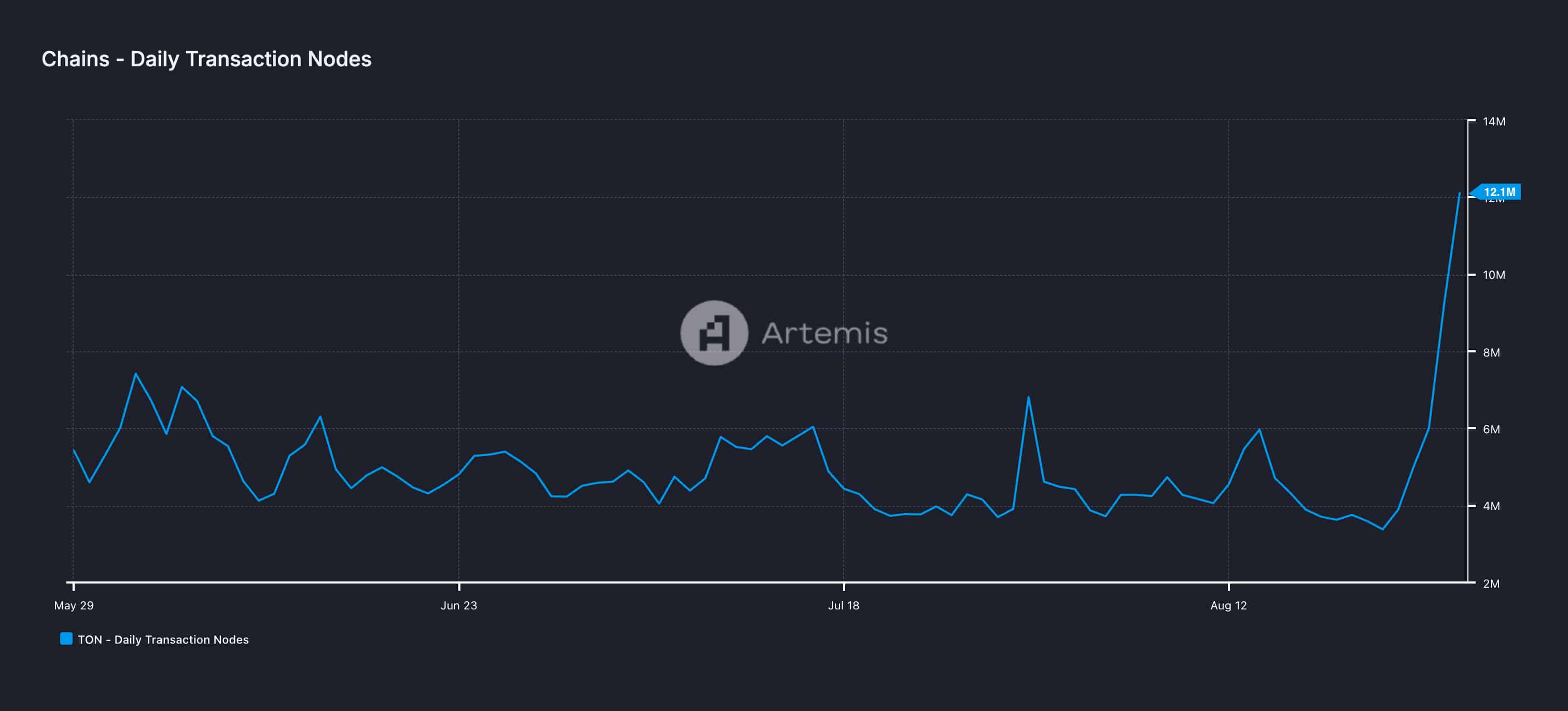

Additionally, daily transaction nodes increased by 174%, reaching 9.3 million, the highest recorded this year and the second highest in the blockchain’s history.

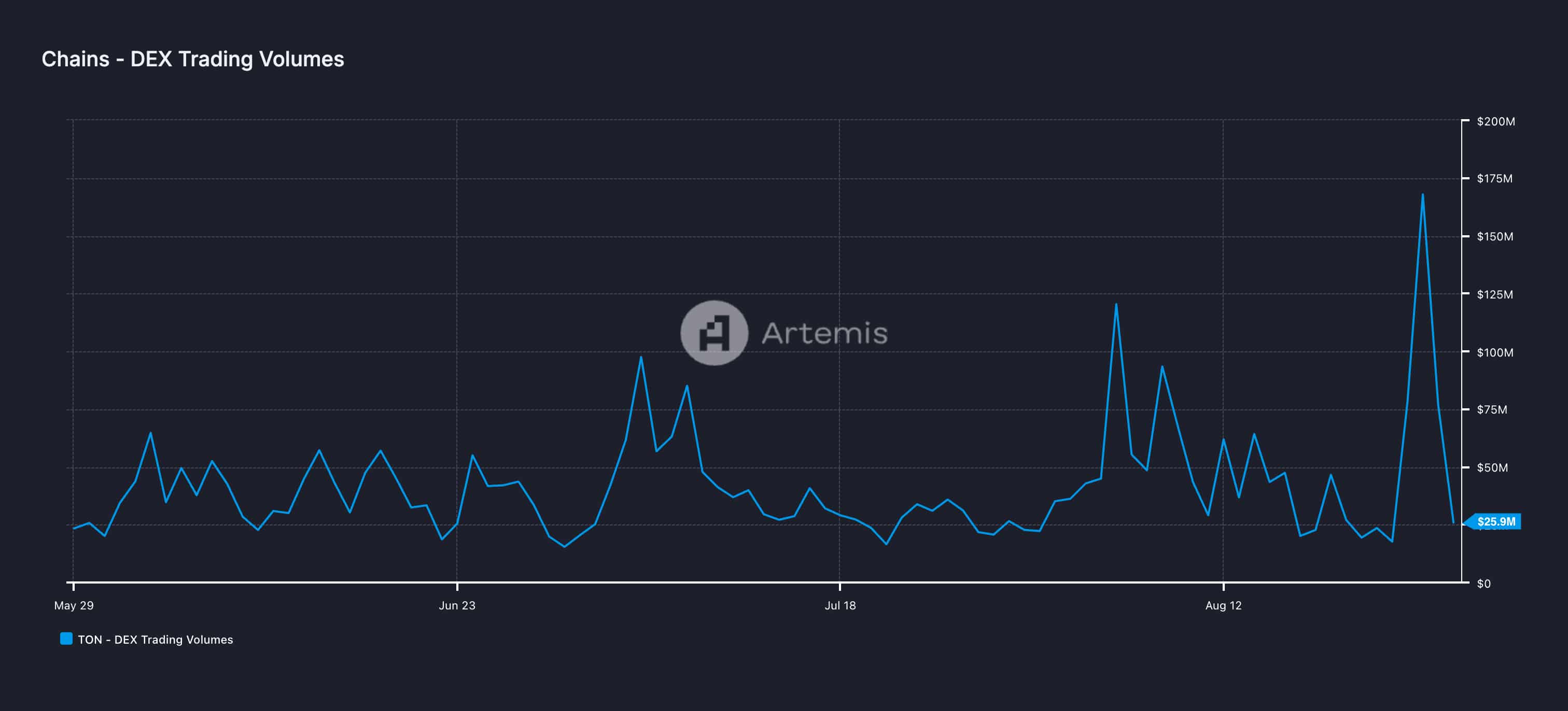

Furthermore, trading volumes on decentralized exchanges for Toncoin saw an even more dramatic increase. Volumes surged by 849%, reaching an all-time high of $167.9 million.

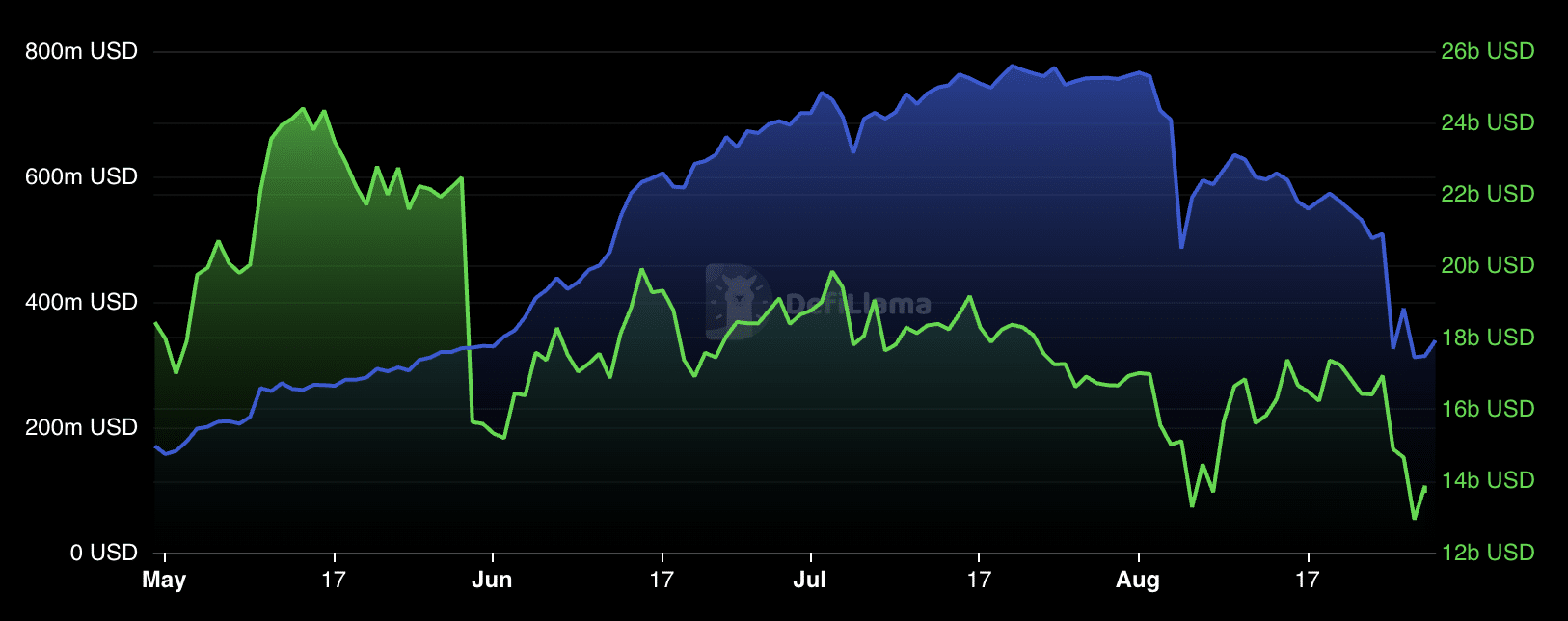

But not everything is so sunshine and rainbows for Toncoin. The Total Value Locked (TVL) in its decentralized applications dropped by 39%, falling to $312 million. One might assume this drop was due to the bearish news impacting Toncoin’s price, but that’s not entirely the case, although somewhat true. While Toncoin’s market cap did decline by 24%, reaching $12.9 billion by August 27, the decrease is much less than the drop in TVL.

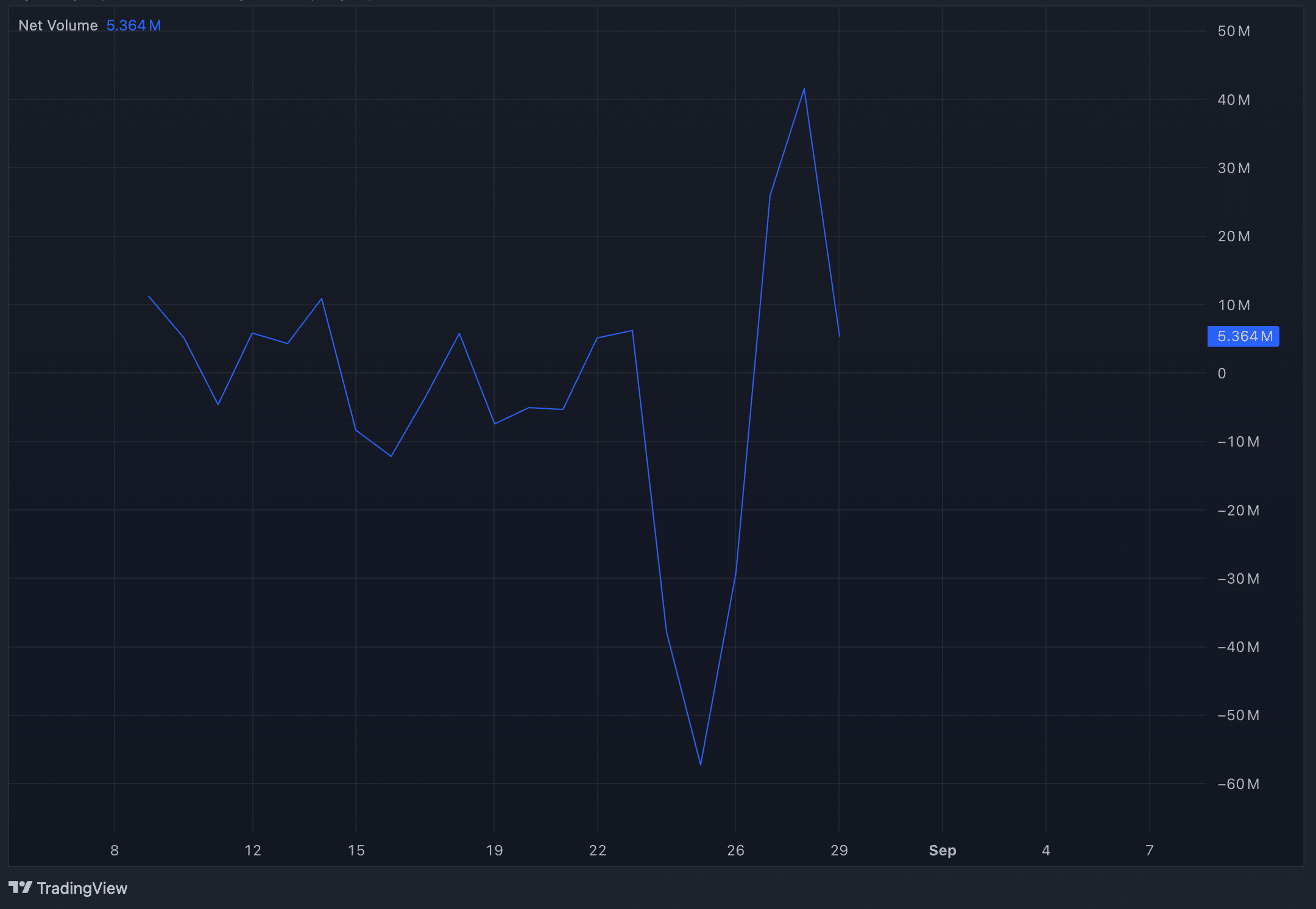

The only plausible explanation is that some users began withdrawing their assets from dApps, possibly selling them off. However, despite this selling pressure, the net volume on Binance, the top exchange by volume for TON, experienced a dip from -$37.83 million to -$57.26 million on the day of Durov’s arrest but then rebounded, rising to $41.57 million by August 28 — a nearly $100 million swing back into positive territory. The same trend was observed on other major exchanges like OKX and Bybit, where TON also shifted from negative to positive net volumes during this period.

Where do Telegram and Toncoin go from here?

It will be interesting to observe how Pavel Durov’s arrest and the ongoing investigation shape the future of Telegram and Toncoin. Whether the surge in user activity and transactions for both Telegram and Toncoin will translate into sustained growth or remain a temporary spike driven by media attention remains to be seen. One thing is certain: any developments affecting Telegram, whether positive or negative, will inevitably impact TON as well. Currently, TON faces a major regulatory hurdle, which makes it a risky investment until the investigation concludes and the legal landscape becomes clearer.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more