Mt. Gox Clients Wont Get Paid Again In 2024: How Is The Industry Reacting?

Bankrupt crypto exchange Mt. Gox has once again postponed the repayment deadline for its creditors. Now, some victims of its collapse will not be able to receive funds until next year.

The new report shows that most creditors have already received primary and early payments, but some still need to complete the necessary procedures or encountered various problems. Therefore, the repayment deadline has been postponed from Oct. 31, 2024, to Oct. 31, 2025.

“As it is desirable to make the Repayments to such rehabilitation creditors to the extent reasonably practicable, the Rehabilitation Trustee, with the permission of the court, has changed the deadline for the Repayments from October 31, 2024 (Japan Standard Time) to October 31, 2025 (Japan Standard Time).”

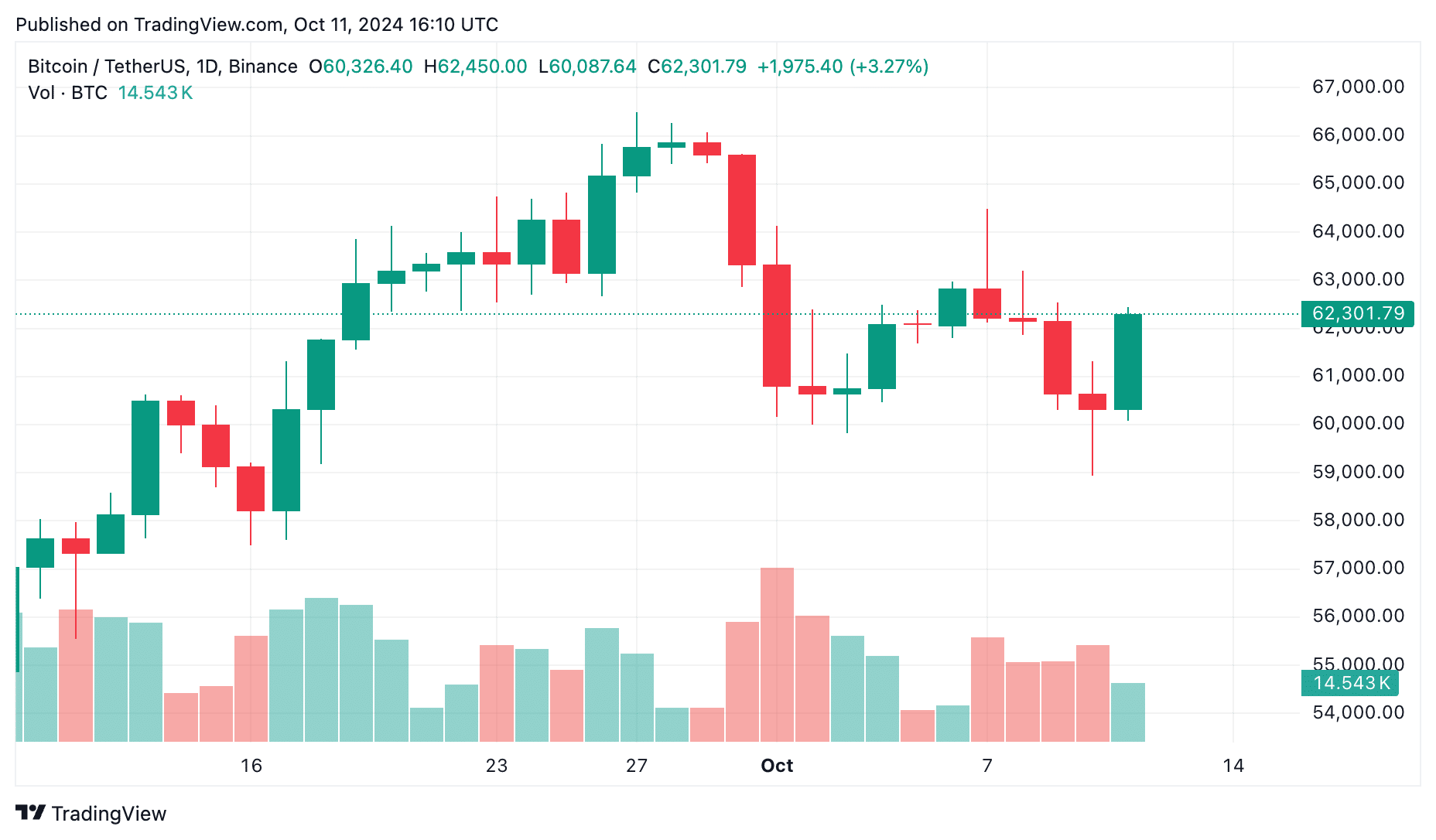

Market remains calm after news from Mt. Gox

Bitcoin (BTC) is trading around $61,000, with the bare increase of less than 1% in the last 24 hours — the news from Mt. Gox has not caused much of a reaction in the market.

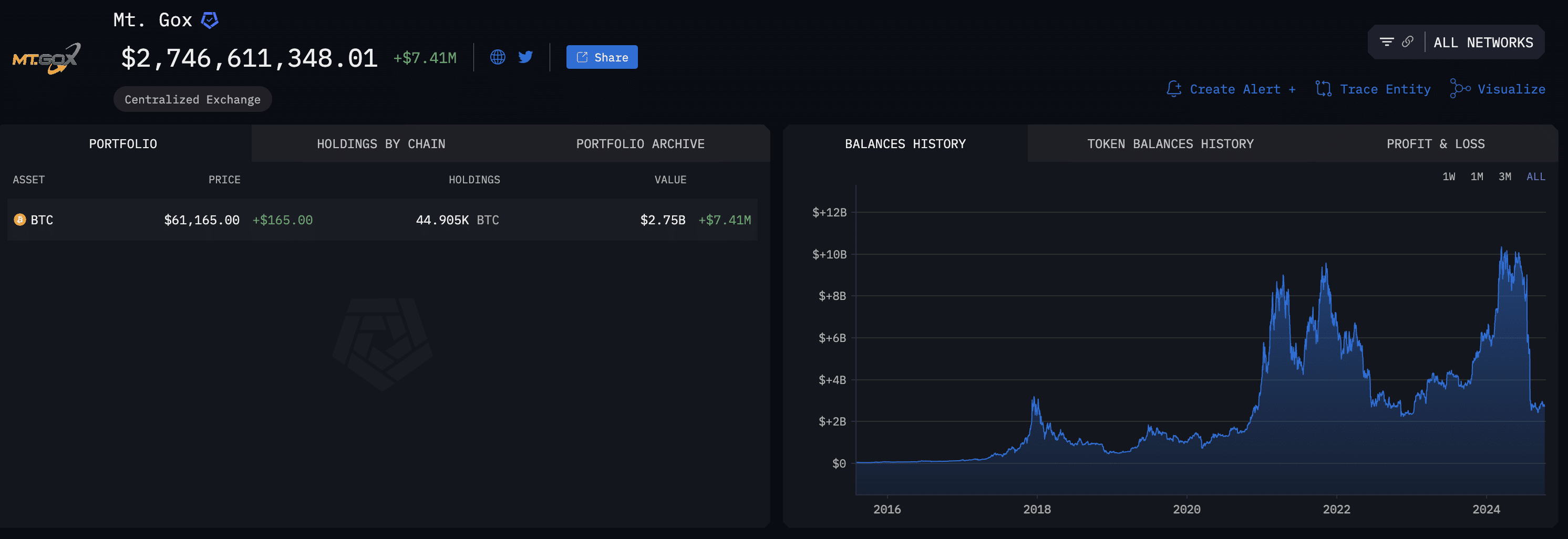

According to Arkham, Mt. Gox’s crypto wallet currently holds 44,905 Bitcoin, equivalent to more than $2.7 billion.

Meanwhile, the exchange has moved its Bitcoin holdings in the past; for example, on May 28, it transferred the cryptocurrency worth $8.7 billion in preparation for the first payments to creditors. By the end of July, Mt. Gox had moved another 37,477 BTC, worth $2.5 billion, and reported that 60% of payments to creditors had been completed.

New growth driver for October or disappointment?

Many crypto community members have long been concerned that the exchange’s payments could sink BTC and cause a wave of massive sell-offs in the crypto market.

However, news about the postponement of Mt. Gox payments is not uncommon. Crypto exchange creditors regularly postpone deadlines, and the latest news about the postponement of deadlines did not cause a strong reaction in the community.

“Till now, Uptober is looking like Rektober.”

Wise Advice

Eljaboom, founder and CEO of Ajoobz, believes that the news about Mt. Gox has become another driver for the growth of the crypto market. In his opinion, a combination of factors, including support for U.S. presidential candidate Donald Trump and global rate cuts, drive growth and a bullish trend.

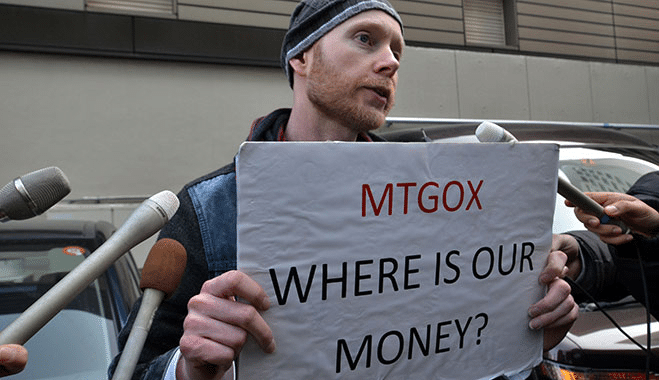

Why haven’t Mt. Gox clients been able to get their money for 10 years?

The crypto market is experiencing many fluctuations and changes, and one of the most iconic pages in its history is the case of the Mt. Gox exchange. Launched in 2010, this platform at one point became the largest in the world in terms of bitcoin trading volume.

However, in 2014, it went bankrupt, losing 850,000 customer BTC, which amounted to more than $450 million. Since then, various attempts to return funds to investors have continued, and the latest news about payment delays has again attracted the attention of both investors and experts.

Mt. Gox’s bankruptcy raised many complex legal issues. Creditors and investors became involved in lengthy litigation that dragged on for years. Complex procedures for determining rights to cryptocurrency assets only sometimes comply with traditional legislation, which creates additional difficulties.

Asset recovery and distribution are associated with the need to account for and identify owners, which takes time and the right approach. Crypto assets can be scattered across different addresses and wallets, complicating the return of funds. Moreover, a severe technical base is required to ensure the security and transparency of transactions on the exchange, and developers must also create and test it. However, some investors may find relief in delays in payments.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more