Marathon Digital Sells 51% Of Bitcoin Produced In Q2 As Net Loss Soars To $200m

Bitcoin mining company Marathon Digital has disclosed in its Q2 financial report that it sold over 50% of the BTC it mined during the quarter to fund operating costs.

Marathon Digital Holdings, a publicly traded American crypto mining firm, saw its shares drop more than 7% on Thursday, Aug. 1, following the release of its earnings report, which showed revenue falling significantly short of analysts’ expectations.

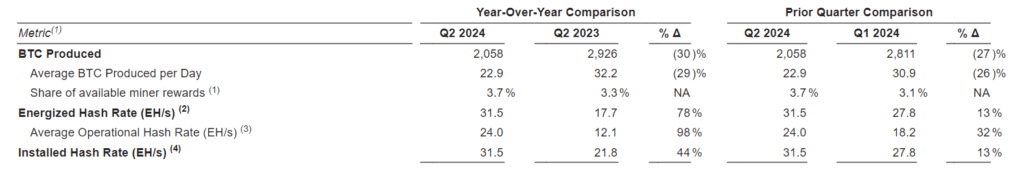

According to the report, the company produced a total of 2,058 Bitcoin (BTC) during Q2, representing a 30% decrease compared to Q2 2023. Marathon noted that it had to sell 51% of BTC mined during the reporting period to cover “operating costs” as its net loss soared to nearly $200 million.

Despite a nearly 80% increase in quarterly revenues to $145.1 million, Marathon’s performance did not meet analysts’ forecasts of approximately $158 million. This shortfall marks the second consecutive quarter that the company has missed revenue projections, following a 15% revenue underperformance in Q1 compared to estimates by Zacks Investment Research.

Addressing the difficulties, Marathon chief executive Fred Thiel said the company’s production was impacted by “unexpected equipment failures” as well as transmission line maintenance, increased global hash rate, and the April halving event.

However, Thiel reassured investors that Marathon’s transformer issues at the Ellendale site “were mitigated and remediated post quarter end,” adding that the company continues to target “50 exahash of energized hash rate by the end of 2024 with additional growth in 2025.”

In late July, Marathon disclosed a $100 million Bitcoin acquisition under its “HODL strategy,” bringing its total holdings to over 20,000 BTC. The company also announced that it will now retain all Bitcoin mined and engage in “periodically making strategic open market purchases” as part of its revised strategy.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more