Mantle Networks MNT Token Sees 12% Surge Amid Whale Buying

MNT, the native token of Mantle Network, the Layer-2 technology stack for scaling Ethereum, has experienced a price surge of 12% in the last 24 hours, now trading at $0.8578.

This surge in MNT’s value comes amidst a broader decline in the cryptocurrency market. Currently, Mantle boasts a market capitalization of around $2.8 billion, placing it 31st in global cryptocurrency rankings by market cap, according to price data from crypto.news.

Over the past 24 hours, MNT’s trading volume has also risen by 12.7%, reaching $240 million. Within the same period, MNT’s price fluctuated between a low of $0.77 and a high of $0.86.

Formerly known as BitDAO, Mantle is an ecosystem investment DAO with close ties to Bybit. The Mantle token, MNT, is used for governance, gas fees on the Mantle Network, and staking on various platforms. The Mantle Network utilizes an Optimistic Rollup (ORU) to scale Ethereum and aims for EVM compatibility.

Operating on the Ethereum network, Mantle offers a seamless, secure, and scalable platform for decentralized application (dApp) developers to launch their projects. This has made Mantle an attractive protocol for supporting GameFi applications, prompting the creation of an in-house Web3 gaming team.

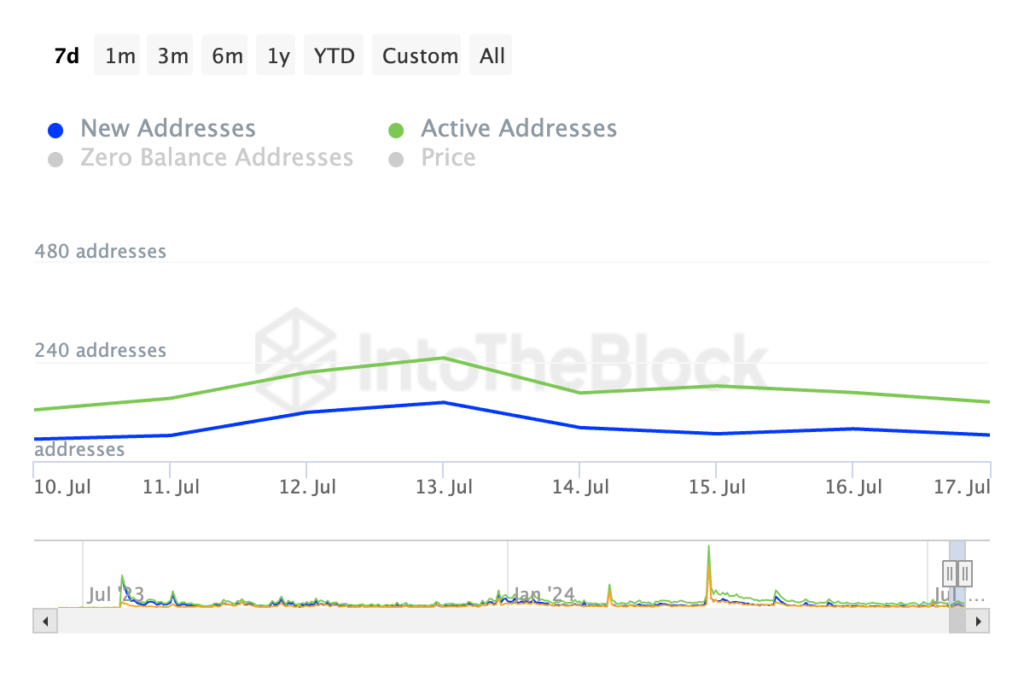

The recent price surge in MNT coincides with an increase in daily active and new addresses involved in MNT transactions.

On-chain data from IntoTheBlock indicates a 19% rise in the number of active addresses completing at least one MNT transaction over the past week. Additionally, the number of new addresses created to trade MNT has increased by 15% during the same period.

An uptick in daily active addresses and new addresses typically signifies growing network activity and heightened interest in the asset, suggesting increased demand and potential for future value appreciation.

The spike in MNT’s price has also garnered attention from large holders or whales. These are addresses holding over 0.1% of an asset’s circulating supply. When the net flow of these large holders increases, it indicates that whale addresses are accumulating the asset, which is generally a bullish signal.

According to IntoTheBlock, MNT’s large holders’ net flow has surged by 134% over the past seven days, highlighting substantial accumulation by these investors.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more