K33 Research: Over 900 Institutions Invested $11b In Spot Bitcoin ETFs

As of March 31, 937 institutions had invested over $11 billion in U.S. spot Bitcoin ETFs.

Senior Analyst at K33 Research Vetle Lunde says that $11.05 billion equals 18.7% of the total funds managed by BTC-based products. For comparison, only 95 firms invested in gold ETFs over the same period.

Morgan Stanley is among the 937 firms, investing $269.9 million in GBTC and becoming the second largest holder of an ETF from Grayscale after Susquehanna International Group (~$1 billion).

Institutions invested the most actively in GBTC, with a total of $4.38 billion. Following the Grayscale fund is IBIT from BlackRock, which has seen $3.23 billion in investments. FBTC from Fidelity closes the top three with investments of $2.1 billion.

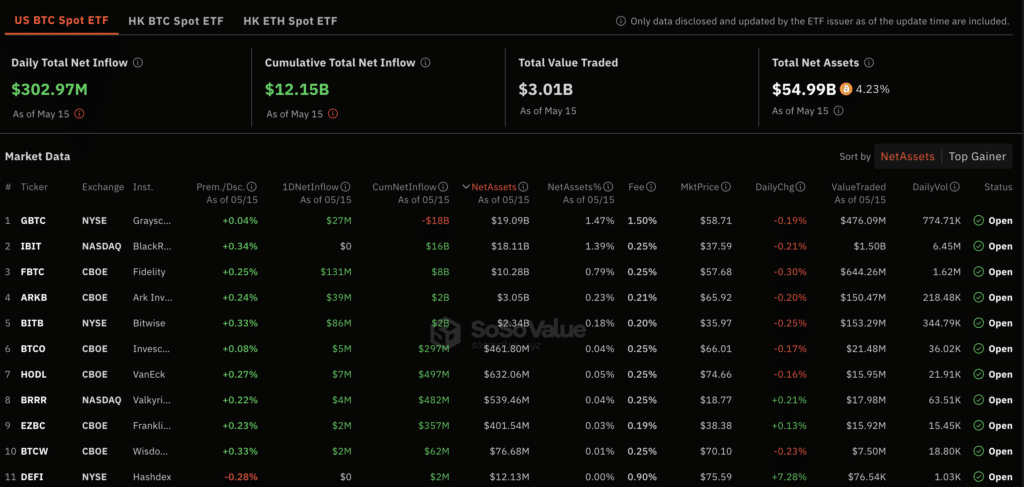

On May 15, the net inflow into spot Bitcoin ETFs increased to $303 million, including $131 million in FBTC and $86.3 million in BITB. Since approval, inflows into spot Bitcoin ETFs have exceeded $12 billion, with the positive trend continuing for the third day in a row, according to SoSoValue.

On May 13, Bitwise Chief Investment Officer Matt Hougan emphasized that investing in Bitcoin ETFs is a new trend among institutions. According to him, about 563 investment companies have reportedly collectively invested about $3.5 billion in ETFs.

Hougan compares interest in spot Bitcoin ETFs to the surge in demand for gold-focused exchange-traded funds launched in 2004. Gold ETF funds were highly successful, raising over $1 billion in the first five trading days.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more