Investment Firm Ditches MKR For EIGEN As Top Traders Back New Staking Protocol Project

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

BlockTower Capital has shifted over $2M in Maker tokens to EigenLayer, signaling a growing interest in next-gen DeFi assets.

BlockTower Capital has rotated over $2 million worth of Maker tokens into EigenLayer, marking a growing appetite for next-generation DeFi cryptocurrencies.

The move has also boosted other DeFi projects – a top trader has just predicted that meme coin-focused staking app Crypto All-Stars will see big gains in the near future.

Maker slumps and eigen jumps on BlackTower reshuffle

The move has had an impact on both the MKR and EIGEN prices.

MKR has fallen by 0.75% today, while EIGEN has gained 1.2%.

Lookonchain reported BlockTower Capital’s transaction on Thursday, revealing that the firm sent 1,815 MKR to GalaxyDigital and received 653K EIGNEN from Wintermute 20 hours later.

Glancing at Etherscan data, this is the first time the BlockTower Capital wallet has invested in EigenLayer. The firm’s holdings currently total $2.42 million.

Despite the recent rotation, the wallet still holds 1,364 MKR tokens, which are worth $10.45 million at press time.

In addition, the wallet controls $3.56 million worth of Maple Token, which is another DeFi crypto. It also holds $849K worth of Lido DAO, $142K worth of Blur, and $69K worth of FOAM Token.

BlockTower Capital’s recent reallocation into EigenLayer reflects a growing risk appetite among market participants.

Maker has been around since 2018, while EigenLayer token launched less than two weeks ago.

Clearly, this makes EigenLayer a riskier bet. BlockTower Capital’s move illustrates the market’s swelling risk appetite as traders look toward a more bullish performance through Q4 and into 2025.

The growing risk appetite has positively impacted DeFi token prices, with the likes of Aave and Maker up over 100% from their yearly lows.

However, one category always outperforms in a risk-on environment – and its meme coins. Tokens like Dogwifhat and Pepe are each up over 1,000% this year. And many newer projects are up even more.

Crypto All-Stars is a crypto that connects these two sectors, offering the first “MemeVault” that lets users stake their joke tokens.

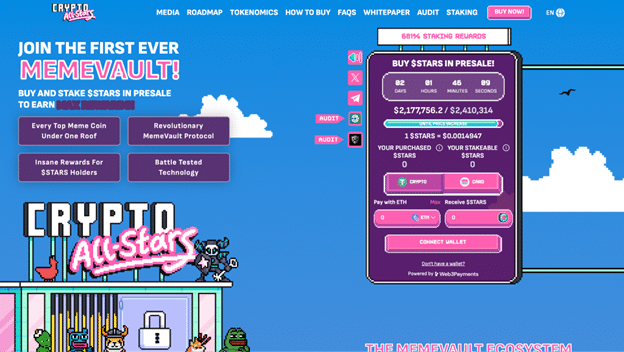

MemeFi project Crypto All-Stars raises $2.1M in ongoing presale

The project also aligns with BlockTower Captial’s recent move to rotate from legacy DeFi into a next-generation token.

Crypto All-Stars is a project that accommodates value-seeking investors who want exposure to crypto’s hottest and most counterintuitive trend: meme coins.

The project lets users stake tokens such as Dogecoin, Shiba Inu, Pepe, Mog Coin, and more, and they’ll receive STARS token rewards in return.

STARS plays a significant role in the Crypto All-Stars app. Users must hold it to acces the platform, and their rewards depend on how much they hold.

Moreover, users can stake their STARS tokens for more rewards.

Currently, the project is undergoing a presale, and it has raised $2.1 million so far.

Traders have high hopes for Crypto All-Stars. Recently, Jacob Bury said it will 10x in price, rivalling the gains produced by Dogwifhat and Pepe this year.

However, the difference between Crypto All-Stars and Dogwifhat or Pepe is that $STARS is backed by real utility and embraces the DeFi formula, which has helped projects like Maker and Aave stand the test of time.

The Crypto All-Stars price will increase throughout the ICO, so prospective buyers should act quickly to secure the most value for money.

For more information, visit the Crypto All-Stars presale website.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more