Grayscales Bitcoin ETF Continues Pre-halving Bleed

All-time spot Bitcoin ETF trading volumes exceeded $200 billion on April 8 despite outflows from Grayscale’s GBTC and a shift in market share.

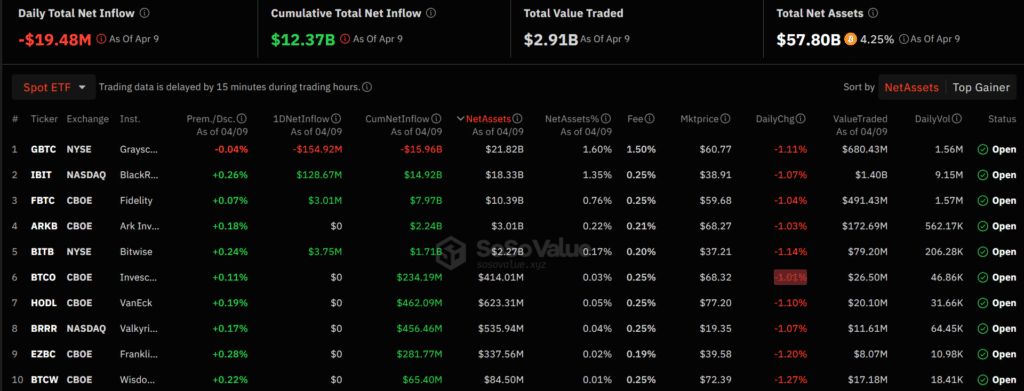

Grayscale’s converted Bitcoin (BTC) ETF shed $154.9 million, contributing to $19.4 million in cumulative outflows from all 10 U.S. spot BTC investment products, per SoSoValue. The data tracker ranked BlackRock’s IBIT fund as the largest intaker of investor demand with $128.6 million in inflows.

Bitwise’s $3.7 million followed BlackRock as the second-biggest inflow of the day, as Fidelity came in third with $3 million. Six spot BTC ETF issuers did not mark daily net inflows as products experienced volatile interest ahead of Bitcoin’s halving.

Nevertheless, cumulative trading volumes have doubled since last month, when numbers first hit $100 billion following listing approval from the U.S. SEC. in January.

Grayscale CEO: Bitcoin ETF outflows reaching equilibrium

According to Reuters, Grayscale CEO Michael Sonneshein remarked that exits from the crypto asset manager have likely reached equilibrium, due to conclusive proceedings in bankruptcy cases like Sam Bankman-Fried’s FTX.

FTX’s estate previously liquidated over $2 billion in GBTC shares, crypto.news reported. Sonnesnshein also believes a subsequent decrease in Grayscale’s fees will incentivize demand for its Bitcoin ETF as an incumbent issuer and market leader.

BlackRock seizes spot Bitcoin ETF market share

While Grayscale strategizes a pivot from fielding the industry’s highest spot Bitcoin ETF fees, the company has lost ground to new issuers. Sonnenshein’s firm commanded over 50% of the market share at the start of the year but dropped below 25% at press time.

Wall Street stalwart BlackRock has upstaged Grayscale as the Bitcoin ETF leader and now boasts around 52%, up from a 22% market share. The shift places Grayscale in second, and Fidelity’s 16.9% share in third.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more