Expert Explains Why Ethereum Price Suffered A Harsh Reversal

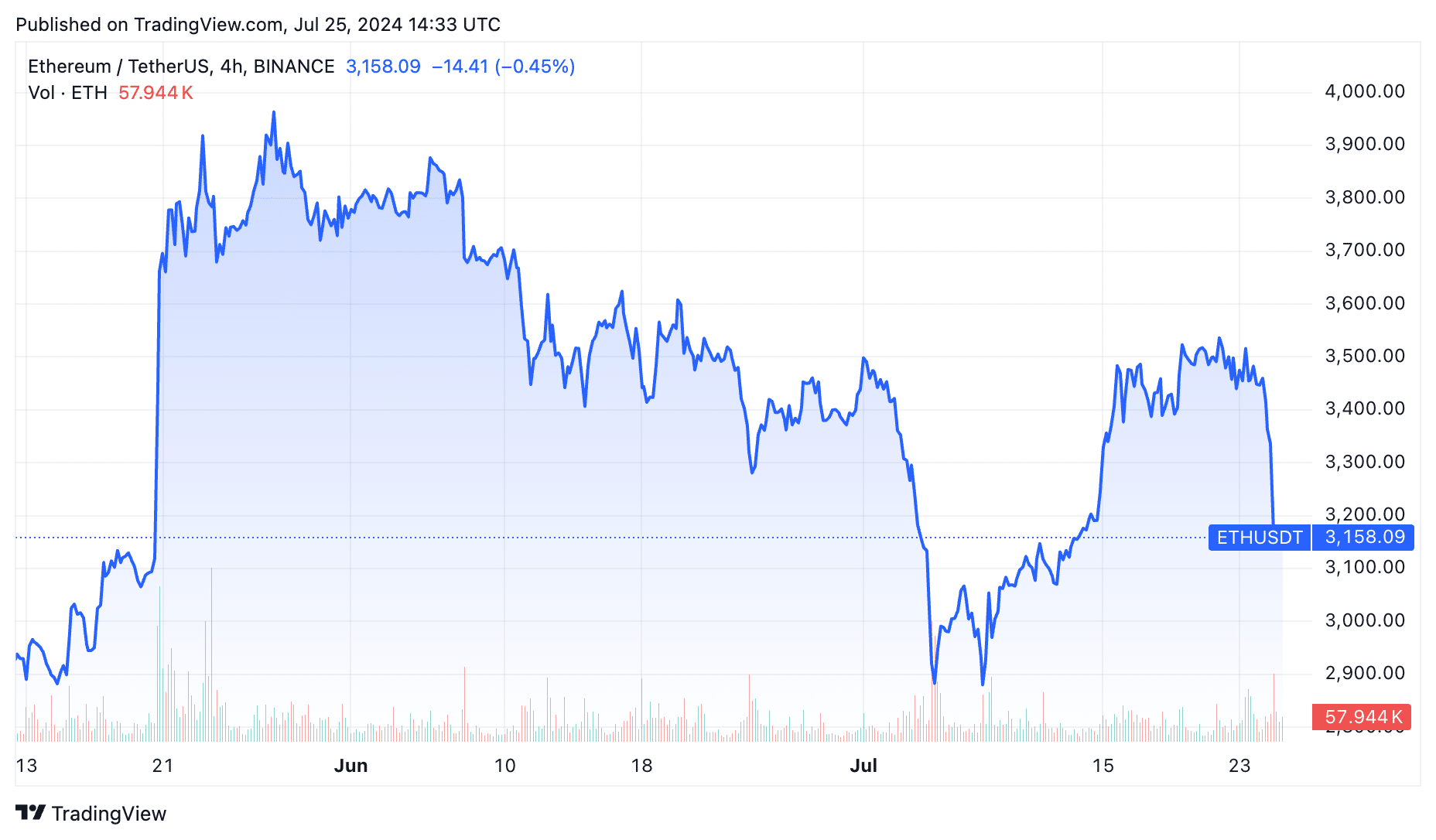

Ethereum price has dropped for two consecutive days, erasing most gains in the last three weeks.

The price of Ethereum (ETH) retreated to $3,145 on Thursday, its lowest level since July 13 and 11% below its highest point this week.

Why Ethereum price is falling

This pullback happened despite the Securities and Exchange Commission’s recent approval of spot Ethereum ETFs and their strong performance.

On Wednesday, these ETFs traded about $852 million compared to Bitcoin’s $1.1 billion, meaning that there is strong demand among investors. Data by Blackrock shows that ETHA has over $269 million in assets, while the Bitwise Ethereum ETF (ETHW) has $230 million in assets.

Ethereum has dropped for three reasons. In a note, Michael van de Poppe, a popular crypto analyst, pointed to the ongoing liquidations from the Grayscale Ethereum Trust (ETHE), a fund with an expense ratio of 2.50%.

As it happened with the Grayscale Bitcoin ETF, many investors have sold their holdings and moved them to cheaper funds. For example, an ETHE investor with $100,000 in assets will pay a fee of $2,500, while one in Grayscale’s Mini Ethereum ETF (ETH) will pay just $150.

Therefore, Michael believes that Ethereum price could retreat some more soon and then bounce back when outflows from ETHE ease. He expects that the coin could jump to a record high when these outflows end.

Buy the rumor, sell the news

Second, Ethereum price is falling as investors sell the news since the token rallied ahead of the approval. In most cases, assets rise ahead of a major event and then retreat when it happens. This happened after the recent Bitcoin halving, the approval of Bitcoin ETFs in January, and the judgment of the Ripple vs. SEC case.

Finally, the decline aligns with the ongoing Bitcoin (BTC) price action. BTC, the biggest crypto in the industry, has dropped for four straight days, triggering a deep sell-off among other altcoins like Avalanche (AVAX) and Jasmy.

Despite the ongoing decline, a bullish case can be made for Ethereum. It is the second-biggest cryptocurrency in the world, has a long history of outperforming Bitcoin, and has strong utility, as Jay Jacobs of BlackRock said.

Ethereum is still the most active blockchain network. It handles the most stablecoin transactions, has the most assets in the decentralized finance industry, and makes the most money. Data by TokenTerminal shows that it has made over $1.7 billion in fees this year, double what Tron (TRX) and Bitcoin have made combined.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more