EU Securities Watchdog: 10 Exchanges Dominate 90% Crypto Trades

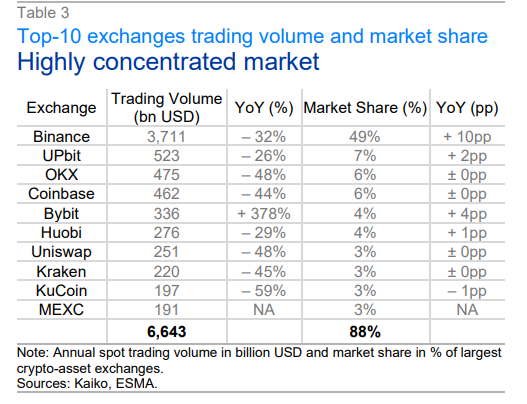

The crypto market appears to be highly concentrated, as only 10 exchanges process around 90% of all trades, according to a recent study done by the European securities regulator.

A recent study conducted by the European Securities and Markets Authority (ESMA) has unveiled a significant concentration within the crypto trading landscape, raising concerns about its potential implications for market stability. According to the study titled “Crypto assets: Market structures and EU relevance,” only 10 crypto exchanges handle approximately 90% of all trades, with Binance accounting “for almost half of global trading volumes.”

Collectively, Binance, UPbit, and OKX control over 60% of the market share, with Bybit experiencing a 380% increase in trading volume year-over-year, while Coinbase saw a 44% decline for the same period, the study shows. ESMA warns that such concentration carries potential risks, expressing significant concerns about the potential fallout of a major asset or exchange failure on the broader crypto ecosystem.

“Moreover, we find that market liquidity can vary widely and tends to be higher in the largest exchanges.” ESMA

The European securities regulator also pointed out that contrary to popular belief, cryptocurrencies do not consistently serve as a safe haven during periods of market stress, saying cryptocurrencies “are strongly interconnected” with equities and “no stable relationship with gold” has been found.

Despite regulatory efforts such as the EU Virtual Asset Service Provider (VASP) license, the study suggests that a substantial portion of transactions executed on EU-licensed exchanges likely occur outside the EU, underscoring the need for continued monitoring and regulation of the crypto market.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more