Ethereum Price Could Slip By 40%, Peter Brandt Argues

Ethereum price has remained under pressure as exchange reserves rise, ETF inflows stall, and its market share in decentralized finance declines.

Ethereum (ETH) was trading at $2,550 on Friday, Nov. 1, down by 37% from its highest level this year. In contrast, Bitcoin (BTC) is just 4.7% below its all-time high.

Ether faces several challenges. Data from CryptoQuant shows that the volume of tokens in exchanges has been increasing in recent months, suggesting that some holders have started selling. Among those reportedly selling are the Ethereum Foundation and Vitalik Buterin.

Second, spot Ethereum ETFs are seeing sluggish demand from investors. According to Sosovalue, cumulative outflows stand at $480 million, while Bitcoin ETFs have seen over $24 billion in inflows.

Ethereum has also lost market share in the decentralized exchange sector to Solana (SOL). Data shows that Solana DEX platforms like Raydium and Orca handled $51 billion in volume in October, surpassing Ethereum’s $42 billion.

Ethereum’s market share could face further pressure when Uniswap launches Unichain, its layer-2 blockchain.

Additionally, Ethereum’s control over the stablecoin market has slipped to about 48%, followed by Tron, BNB Smart Chain, Arbitrum, and Base. A year ago, its share was over 60%.

Stablecoins have become a significant part of the crypto industry. For example, Tether made a net profit of $2.2 billion in the third quarter, bringing the nine-month profit to $9 billion.

Also, data shows that stablecoins are booming in South Korea, where they have become pivotal in cross-border payments. Highly sanctioned countries like Iran, North Korea, and Russia have also embraced these tokens.

There is a high probability that Ethereum’s price will decline in the coming weeks, according to analyst Peter Brandt. He predicts a drop to $1,551, implying a 40% decrease from current levels.

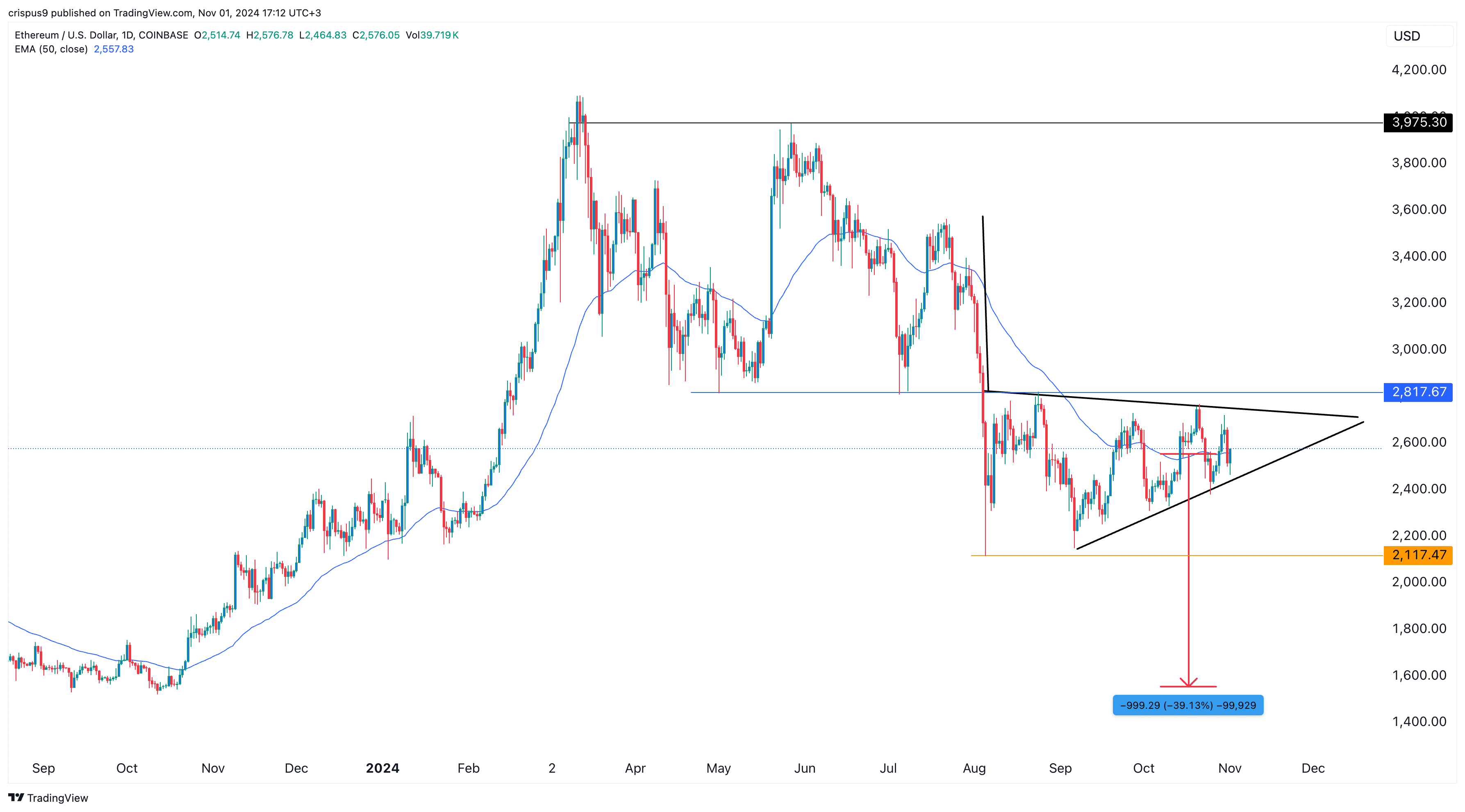

The daily chart shows that Ethereum remains below the 50-day moving average, and the key support at $2,817, the neckline of the double-top pattern at $3,975.

Ethereum has also formed a bearish pennant pattern, with the triangle pattern nearing its confluence point. This suggests a potential bearish breakout in the coming weeks. If this occurs, the initial level to watch will be $2,117, its lowest point on August 5.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more