Deepfake Frauds In Crypto Spiked By 245% Globally, Bitget Says

Bitget’s latest report reveals that deepfake-related crypto fraud has resulted in losses exceeding $79.1 billion since 2022, with a 245% increase in 2024 alone.

The surge in artificial intelligence (AI) popularity has drastically transformed the landscape, with deepfakes emerging as a new threat resulting in nearly $80 billion in losses since 2022.

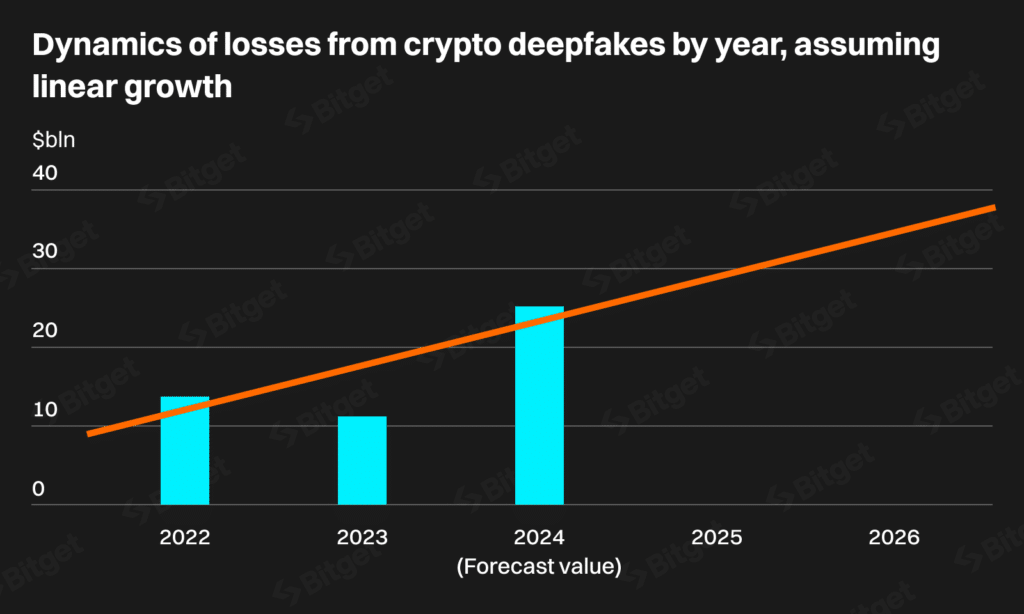

According to Bitget Research’s latest report, the number of cases involving malicious deepfakes soared by 245% around the globe in 2024 compared to the previous year. Despite various efforts on the international level, quarterly losses from deepfake use could reach “around $10 billion by 2025,” the exchange says, adding that 2024 will likely end with $25.13 billion in such crimes.

Bitget chief executive Gracy Chen noted that deepfakes are moving into the crypto sector “in force,” adding that “there is little we can do to stop them without proper education and awareness.”

“The vigilance of the users and their ability to discern scams and fraud from real offerings is still the most effective line of defense against such crimes, until a comprehensive legal and cybersecurity framework is in place on a global scale.”

Gracy Chen

Bitget also detailed that social engineering and bot fraud accounted for 14.21% of deepfake crimes in Q1 2024, resulting in $2.03 billion in losses.

The report also projects a 70% surge in crypto deepfake crimes by early 2026. Bitget’s analysts suggest that “without regulatory intervention” financial losses from deepfakes “are likely to continue increasing,” eventually becoming a big threat for both the cryptocurrency sector and the broader financial industry.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more