Cryptocurrency Liquidations Reach $160m Amid Marketwide Turbulence

The cryptocurrency ecosystem witnesses increased liquidations as the market weathers correction.

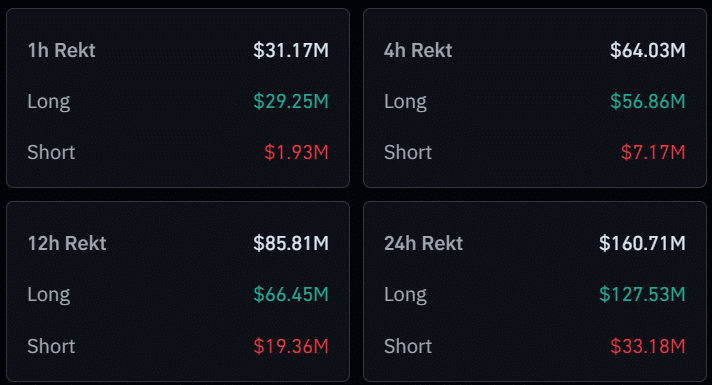

According to data provided by Coinglass, the total crypto liquidations have reached $160.71 million in the past 24 hours. The majority of the liquidations are long positions, worth roughly $127.53 million, as the market takes a U-turn.

Data shows that only $33.18 million worth of diverse cryptocurrencies have been purged from short positions.

Per Coinglass, the global crypto open interest decreased by 2.95% in the past 24 hours — sitting at $69.3 billion at the time of writing.

Binance, the largest crypto exchange by trading volume, is on top of the list with roughly $75.79 million in liquidations over the past day. OKX, Bybit and Huobi are following Binance with $53.91 million, $14.23 million and $11.32 million in liquidations, respectively.

Moreover, the amount of Ethereum (ETH) liquidations reached $27.81 million, surpassing Bitcoin’s (BTC) $20.36 million.

According to a crypto.news report on May 23, the ETH to BTC trader exposure ratio has increased due to the approval of spot Ethereum ETFs in the U.S. Notably, before the approval of these investment products, permanent ETH holders accumulated over 100,000 ETH tokens on May 20.

Notcoin (NOT) gained the third spot with $6.2 million in liquidations in the past 24 hours, per Coinglass data. However, the amount of short NOT positions purged reaches $3.77 million while roughly $2.43 million worth of long positions have been liquidated. This is due to the 29% price rally of the asset.

The increased liquidations come as the global crypto market capitalization declined by 2% in the past 24 hours, falling from $2.7 trillion to $2.66 trillion, according to data from CoinGecko. The total daily trading volume plunged by 8%, currently hovering at $86 billion.

At this point, lower price volatility would be expected, at least for large cryptocurrencies, due to the declining trading volume and open interest.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more