Crypto Trading Volumes Fall For Third Consecutive Month: CCData

Trading volumes on centralized cryptocurrency exchanges saw a nearly 20% drop in June, marking the third consecutive month of decline amid a stagnant market.

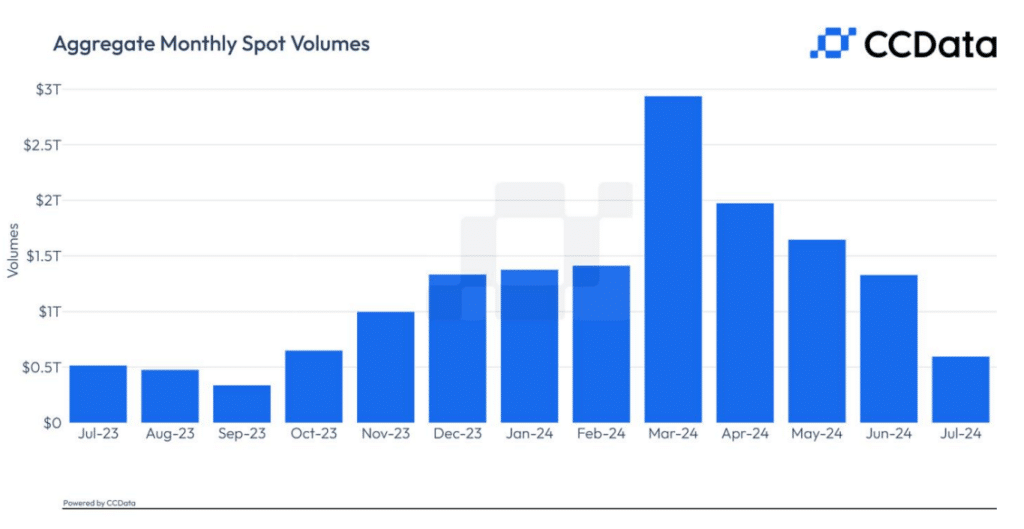

Spot trading on cryptocurrency exchanges continued to fall in June, as prices struggled to break the downtrend, leaving traders largely unfazed. Data from CCData reveals that total spot trading volume fell by 19.3% in June to $1.3 trillion, significantly down from March’s peak of nearly $3 trillion.

Open interest on derivatives exchanges also dropped in June by nearly 10% to $47.1 billion, largely due to a wave of liquidations triggered by a substantial drop in crypto prices. CCData says Coinbase saw a significant decline in its open interest of more than 52% to over $18.2 million, while Binance “maintained the biggest position” among trading platforms by its $19.4 billion in open interest which dropped by only 10%.

“This decline was exacerbated by fears of selling pressure from Mt. Gox, with the defunct exchange announcing repayment for its users in July. Additionally, the German government contributed to the pressure by selling a major portion of its BTC positions.”

CCData

Despite the negative landscape, analysts at CCData point out that spot prices in the first half of 2024 have increased compared to the second half of 2023, with trading volumes recording a 148% increase, with a total volume of $10.7 trillion.

As crypto.news reported earlier, South Korean crypto exchanges, including Upbit, Bitfinex, and KuCoin, recorded significant reductions in trading volumes, with declines of 45%, 38%, and 32%, respectively as capital exited the digital asset market and investor sentiment turned bearish.

In contrast to the overall trading decline, stablecoin transfers have shown steady growth, indicating widespread adoption. Data from Token Terminal shows that stablecoin transfers have increased over 16-fold in the past four years, reaching a record high of $1.68 trillion in Q2.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more