Crypto Liquidations Reach $292m, Global Market Cap Falls 3.6%

Cryptocurrency liquidations have witnessed a massive increase as the global crypto market cap plunged below the $2.5 trillion mark.

According to data provided by Coinglass, total crypto liquidations surged by 92.5% in the past 24 hours, reaching $292.22 million. Due to the market-wide downturn, almost 89% of the total amount, worth $259.7 million, belongs to long positions.

The remaining $32.5 million has been liquidated from short-position holders.

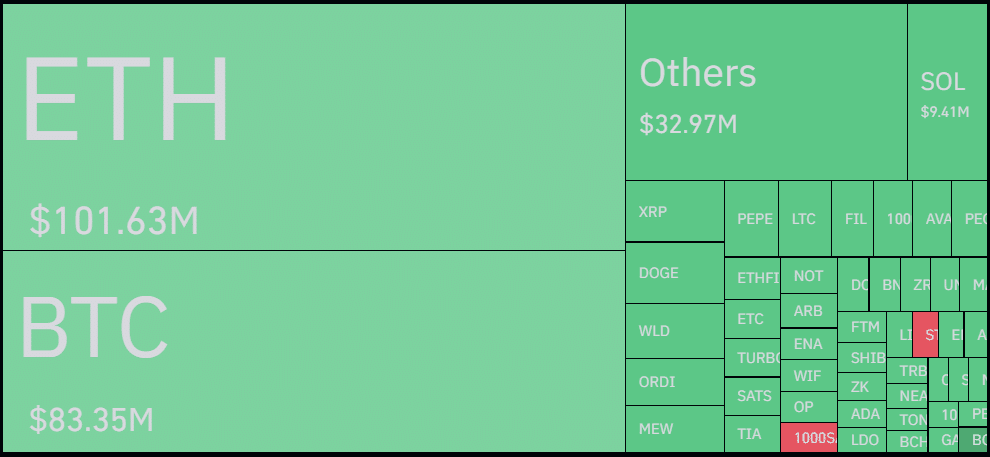

Per Coinglass, Ethereum (ETH) has the largest allocation, worth $101.6 million in liquidations — $97.5 million in longs and $4.1 million in shorts. Bitcoin (BTC) secured the second spot with $83.3 million in liquidations over the past day — $71.5 million in long positions and $11.7 million in shorts.

Data from Coinglass shows that the largest liquidation happened on Binance, the largest crypto exchange by trading volume, worth $11.78 million in the BTC/USDT trading pair.

According to data from CoinGecko, the increased amount of liquidations comes as the global cryptocurrency market capitalization declined by 3.6% over the past 24 hours — falling from the $2.5 trillion mark to $2.42 trillion. Notably, the total crypto market cap briefly touched a local high of $2.55 trillion at 15:00 UTC on July 24.

Moreover, Bitcoin reached an intraday high of $67,110 on Wednesday, July 24, before plunging close to $64,100. Ethereum is currently among the top losers in the past 24 hours with an 8.1% price drop. ETH is trading at $3,160 at the time of writing.

Ethereum’s decline came after the spot ETH ETFs in the U.S. recorded a net outflow of $133.3 million on their second trading day, July 24.

Following the increased liquidations, the total open interest in the cryptocurrency market decreased by 4% and is currently hovering around $63.6 billion, according to Coinglass. At this point, lower market-wide volatility would be expected with a lower amount of incoming liquidations.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more