Crypto Liquidations Cross $210m With Longs Accounting For 85%

The cryptocurrency market has witnessed over $210 million worth of liquidations across the board, with long positions accounting for 85% of this bloodbath amid the latest market turmoil.

Data from crypto analytics resource Coinglass confirms that market participants have suffered a blow from the recent turbulence, which has triggered a 4% drop in the price of Bitcoin (BTC) in the last 24 hours. Specifically, 92,298 traders have witnessed liquidations worth $210.26 million in long and short positions.

The bulk of these liquidations, totaling $178.2 million, are linked to long positions, while short positions have seen liquidations amounting to $32.05 million. With long positions comprising 84.7% of the liquidated trades, sentiment has swiftly transitioned from bullish to bearish, as the market flips red.

Moreover, the current market instability stems from Bitcoin’s retreat from its recent high of $67,183 on April 23. Following this peak, BTC experienced a notable correction, culminating in a 3.2% decline by the end of yesterday’s trading session.

This bearish momentum has persisted, leading Bitcoin to relinquish the psychologically significant $64,000 threshold earlier today. The global cryptocurrency market capitalization has declined by 3.87% over the past 24 hours, now standing at $2.47 trillion, as altcoins venture into bearish territory.

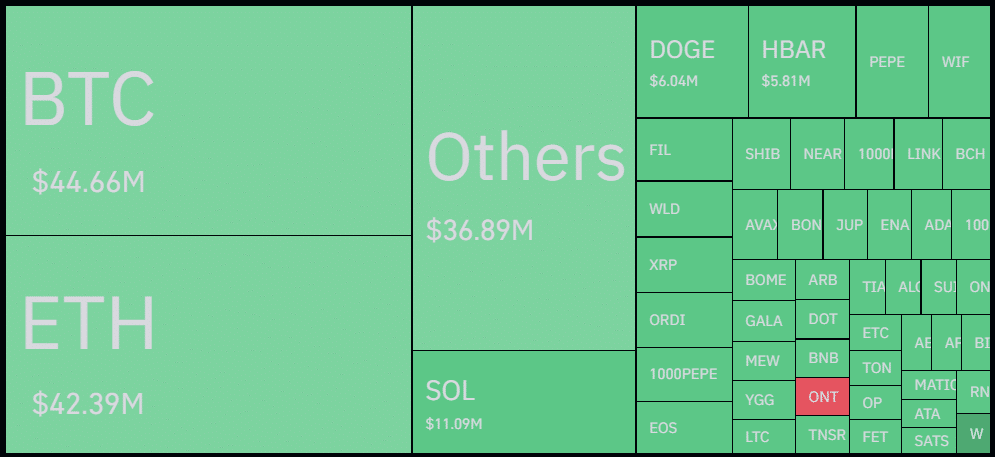

Being the premier cryptocurrency, Bitcoin has witnessed the largest liquidated positions among all crypto assets, totaling $44.6 million within 24 hours.

The liquidation trend was noticeable across the market on April 18 before the most recent Bitcoin halving, resulting in a loss of $247 million. The Bitcoin halving, taking place on April 20, sparked renewed optimism after this downturn, prompting a resurgence of long positions amid the market’s recovery.

Despite the recent increase in liquidations, the derivatives market has witnessed a surge in volume, with trade volume jumping by 30% in the last 24 hours to reach $159 billion at the reporting time. This is due to an increase in short positions, with the long/short ratio now sitting at 0.7832.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more