Crypto Expert Gives Analysis Of Major Altcoins, Market Sees Slight Uptick

According to FxPro senior market analyst Alex Kuptsikevich, the crypto market has been relatively stagnant, showing a decline in market cap until today’s increase.

Ethereum (ETH) trades at $2,977.88, a 2.6% increase over the past 24 hours. Its market cap has grown by 2.64% to over $357 billion, staying the second-largest cryptocurrency.

Kuptsikevich highlighted Ethereum’s challenges, noting its ongoing consolidation near the lower end of its price range and a “death cross” under its 200-day average, suggesting potential longer-term declines. This contrast between the short-term increase and the analyst’s medium-term concerns shows the complexities of market predictions.

Similarly to Ethereum, Cardano (ADA) has seen a 2.43% rise in its price to $0.4461, with its market cap increasing by 2.42%. Positioned as one of the 10 largest cryptos, ADA’s trading near the lower end of its range suggests a cautious outlook despite the recent uptick, mirroring Ethereum’s consolidation trend.

Litecoin’s (LTC) price has increased by 1.81% to $80.98, and its market cap has risen by 1.82%. As the 19th largest cryptocurrency, LTC continues to test its 200-day average, indicating a potential ongoing struggle to regain stronger bullish momentum. According to Kuptsikevich, Litecoin could face a protracted period of bearish trends if it fails to reclaim higher levels soon.

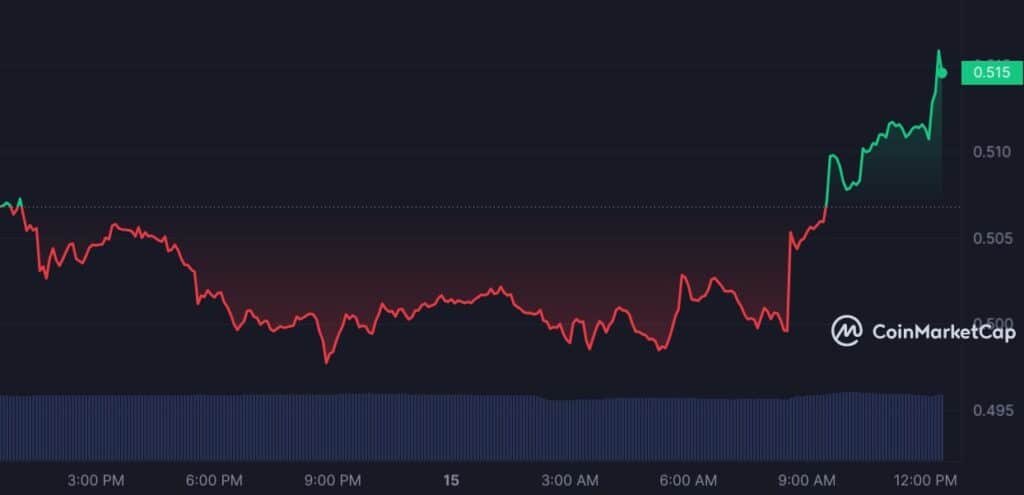

XRP is trading around a historically significant level of $0.50 after losing key support earlier in April.

“XRP broke below an upward support line, transforming it into resistance for subsequent peaks. This sets up a bearish scenario, potentially pulling back to long-term support at $0.25-30,” Kuptsikevich remarked, suggesting a cautious approach for investors.

XRP’s modest price increase of 1.57% to $0.5135 contrasts with a minor 0.56% increase in market cap. The 7th largest crypto, XRP’s break below key support levels earlier in the month points to a challenging road ahead despite some recovery, as indicated by the analyst.

In contrast, Solana (SOL) shows speculative potential, with predictions by Merkle Tree Capital suggesting a rise to $400 by November 2024, driven by meme coin popularity linked to the U.S. election campaign.

Since the Merkle Tree analysis, SOL has shown a notable surge. Its price has increased by 7.54% to $152.76, while its market cap has expanded by 7.53%, making it the fifth largest cryptocurrency.

While the short-term data from CoinMarketCap shows promising gains for these cryptocurrencies from U.S. inflation data, the medium-to-long-term analyses by Kuptsikevich paint a more nuanced picture that could be affected by other external economics.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more