Crypto Exchange Bluefin Announces Plans For Native Token

Decentralized crypto exchange Bluefin has unveiled plans to launch its own native token BLUE on the Sui blockchain.

Bluefin, an orderbook-based derivatives exchange backed by Polychain Capital, plans to introduce its own governance token, BLUE, to enable the community to guide the development of its Sui-based protocol. In a Thursday blog post, Bluefin stated that token holders will be able to “propose and vote on key protocol decisions.” Those interested in submitting a proposal would have to put at least 10,000,000 BLUE in voting power.

“Voting power will be determined based on the number of tokens you decide to lock into a proposal. The voting process starts with a forum discussion and is then followed by an on-chain vote on the Bluefin Governance portal,” the Bluefin team explained.

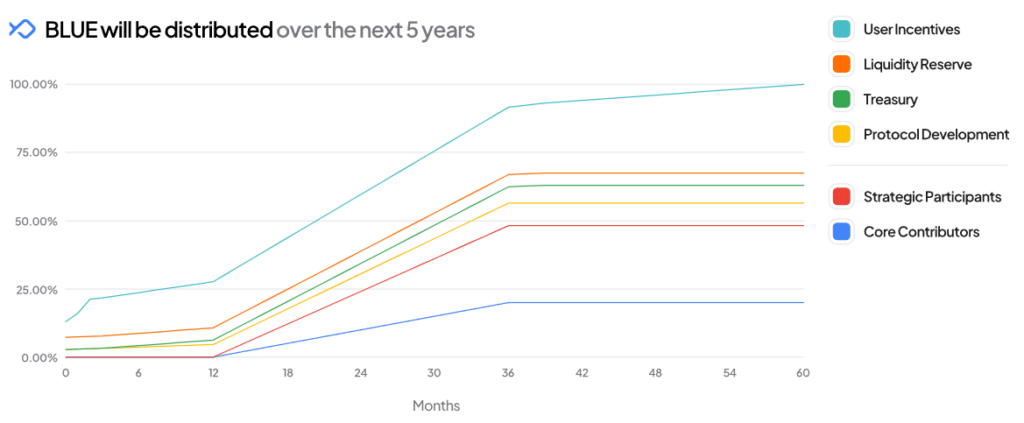

Token distribution details reveal that 52% of BLUE will be allocated for “ecosystem growth,” fully unlocking after five years. This includes 32.5% for user incentives, 8.5% for protocol development, 6.5% for the treasury, and 4.5% for liquidity reserve.

Another 28% is designated for “strategic participants,” to be distributed among investors via private sales and advisors, with a three-year vesting period. The remaining 20% is allocated for “core distribution,” also with a three-year vesting period. The tokenomics documents also reads that BLUE will have a maximum supply of 1 billion, with an initial circulating supply of 116 million tokens.

Bluefin says all smart contracts related to the Blue token have been audited by TrailOfBits, reassuring investors that “there has been no security breach on Bluefin since the launch of the protocol.”

Founded in 2020 by Rabeel Jawaid, Ahmad Jawaid, Nikodem Grzesiak, and Zabi Mohebzada, Bluefin has raised approximately $30 million thus far, according to PitchBook data, with support from investors including Polychain Capital, Brevan Howard Digital, Wintermute, Alliance DAO, and Bixin Ventures among others.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more