CoinGecko: Meme Coin Narratives Gain 1,313% During Q1

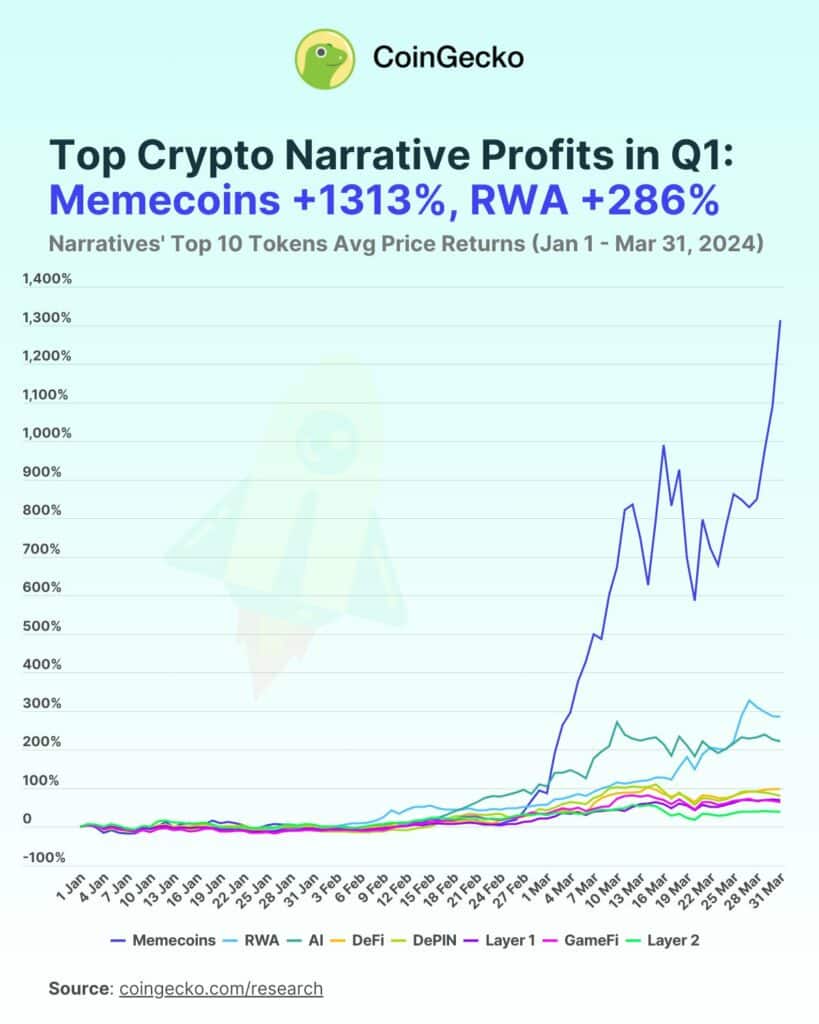

During the first quarter of 2024, the crypto market showcased a dynamic performance across various narratives, with meme coins, real-world assets, and AI tokens leading in profitability.

Narratives are specific sectors within the crypto industry that use a distinct coin and are broken down to show how crypto can be operated differently.

According to data from CoinGecko, meme coins saw an astonishing average return of 1,312% across the platform’s top tokens.

The performance was highlighted by the remarkable success of new entrants such as Brett (BRETT), BOOK OF MEME (BOME), and cat in a dogs world (MEW), which launched around March 2024. Brett led the pack with a staggering 7,727% return by the quarter’s end compared to its launch price. Another notable performer was dogwifhat (WIF), which gained 2,721% after going viral, fueling the ongoing meme coin frenzy.

The RWA (Real World Asset) narrative, focusing on tokens tied to physical assets or real-world utilities, came in second with a 285% return. Early in February, RWA briefly held the top spot before being overtaken by meme coin and AI narratives but regained its position above AI by late March. MANTRA (OM) and TokenFi (TOKEN) were among the leading RWA tokens, with gains of 1,074% and 419% respectively.

The AI narrative also performed well, with an average return of 222%. This sector saw significant interest, with all large-cap AI tokens posting gains. AIOZ Network (AIOZ) and Fetch.ai (FET) led with 480% and 378% gains, respectively.

The decentralized finance (defi) and Decentralized Physical Infrastructure Networks (DePIN) narratives experienced moderate gains. Defi saw a boost late in the quarter, ending with 98.9% returns, influenced by the Uniswap (UNI) fee switch proposal. Ribbon Finance (RBN) was the most profitable defi token, gaining 430% after pivoting to Aevo. DePIN, despite initial losses, ended the quarter with 81% returns, led by Arweave (AR), Livepeer (LPT), and Theta Network (THETA).

The Layer 1 (L1), GameFi, and Layer 2 (L2) narratives lagged in profitability. L1 narratives saw 70% returns, with Solana (SOL) gaining popularity but being outperformed by Toncoin (TON) and Bitcoin Cash (BCH). GameFi and L2 narratives posted 64.4% and 39.5% returns, respectively, with established Ethereum L2s like Arbitrum (ARB), Polygon (MATIC), and Optimism (OP) underperforming.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more