Can BNB Price Hit $1,100 As Staking Yield Hits 12%?

Binance Coin price continued to consolidate at a key resistance level as its recent rally showed signs of losing momentum.

The Binance Coin (BNB), the native token for the BSC network, was trading at $655 on Nov. 29. It has risen by 223% from its lowest level in 2023 and by 9% in November, underperforming most major cryptocurrencies.

The BNB coin has strong fundamentals and technical indicators pointing to potential further gains in December. The BSC ecosystem has been performing well, with the total value locked in its DeFi ecosystem increasing by 18% to $5.53 billion over the past 30 days.

Similarly, the volume of cryptocurrencies traded on its DEX protocols, such as PancakeSwap (CAKE) and Uniswap, rose to over $34 billion in the same period, with PancakeSwap contributing nearly $30 billion.

Data also shows that the network continues to reduce coin circulation through burning. Over the last seven days, 652 coins worth $429,000 were burned. In total, the network has eliminated coins worth $160 million, aiming to reduce the total supply from 144 million to 100 million, a measure designed to curb inflation.

The ongoing burn, along with rising network revenue, has significantly boosted its staking yield, which stands at 12.5%. This means a $100,000 investment in BNB could yield approximately $12,500 annually.

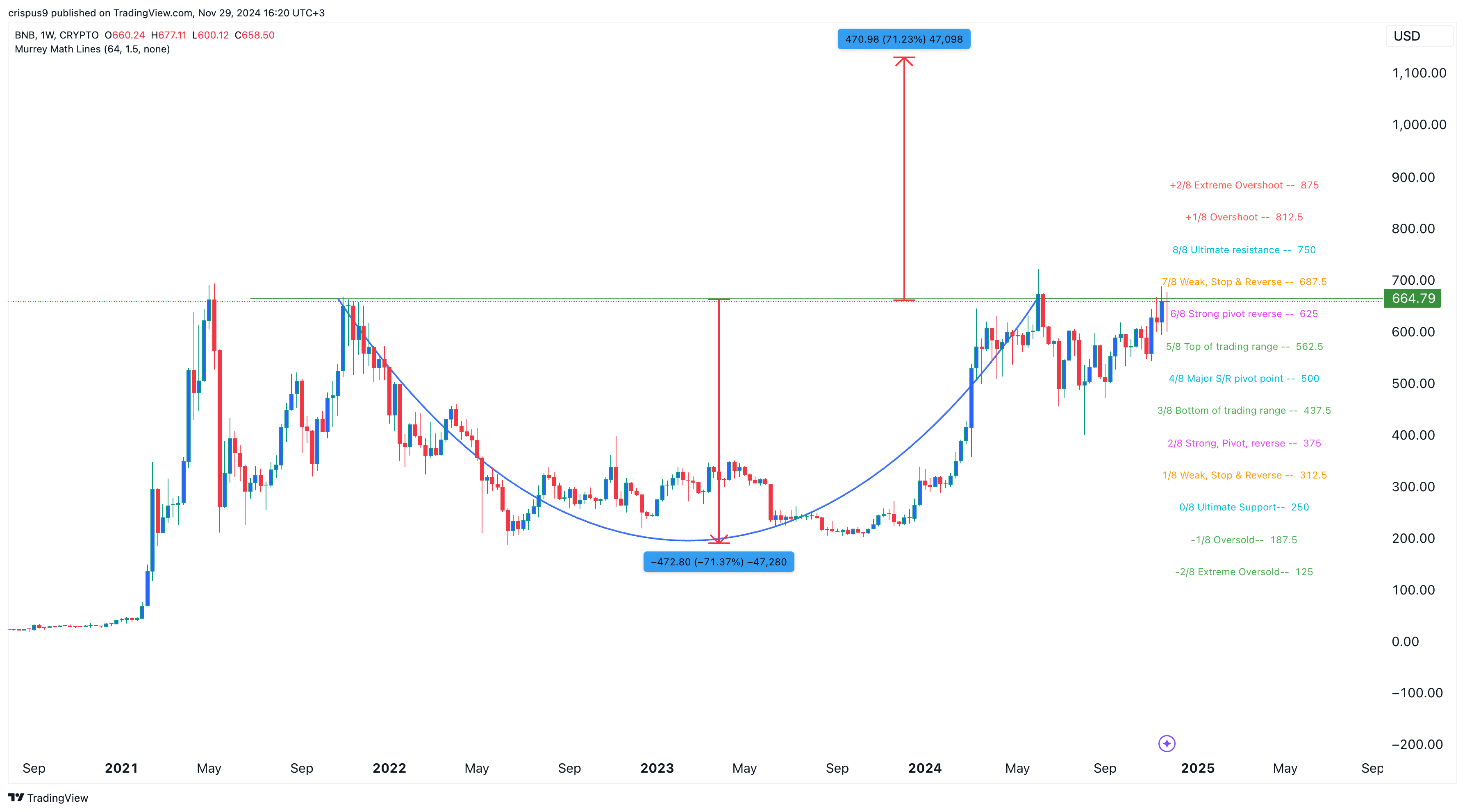

The weekly chart indicates that Binance Coin has potential for more upside in the coming weeks. It has formed a cup and handle pattern since October 2021, with resistance at $665. This bullish pattern includes a horizontal line, a rounded bottom, and consolidation or retracement.

The depth of the cup is around 70%. Applying the same measurement from the $665 level suggests the coin could rise to $1,130 upon a breakout. For this to happen, BNB must surpass critical levels at $875, the extreme overshoot of the Murrey Math Lines, and the psychological level at $1,000.

The invalidation point for this outlook is $437, which marks the bottom of the trading range based on the Murrey Math Lines tool.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more