BTC, ETH, XRP, Altcoin Prices At Risk: Nasdaq 100 Loses Key Support

Cryptocurrency prices resumed their downward trend after President Donald Trump hosted top executives for the White House industry summit.

Bitcoin (BTC) price retreated from this week’s high of $93,000 to $86,000, while altcoins like Ethereum (ETH), Solana (SOL), and Ripple (XRP) fell by over 1%. This crash was in line with crypto.news’ pre-summit prediction.

Nasdaq 100 index crashes below 200-day moving average

Bitcoin and other altcoins may continue falling as the U.S. stock market finds itself on the downtrend. The Nasdaq 100 index, which tracks the biggest technology companies, is about to enter a technical correction, where an asset drops by 10% from a local peak.

It has formed a double-top pattern at $22,137 and moved below the neckline at $20,565. A double top is one of the most bearish chart patterns in technical analysis.

The Nasdaq 100 index has also crashed below the 200-day moving average, pointing to a downtrend in the next few weeks. Also, the spread between the 200- and 50-day moving averages is narrowing, risking the formation of a death cross.

The other large U.S. stock indices, like the S&P 500 and the Dow Jones, have also dropped in the past few weeks. The S&P 500 index has dropped by 6.3% from its highest point this year.

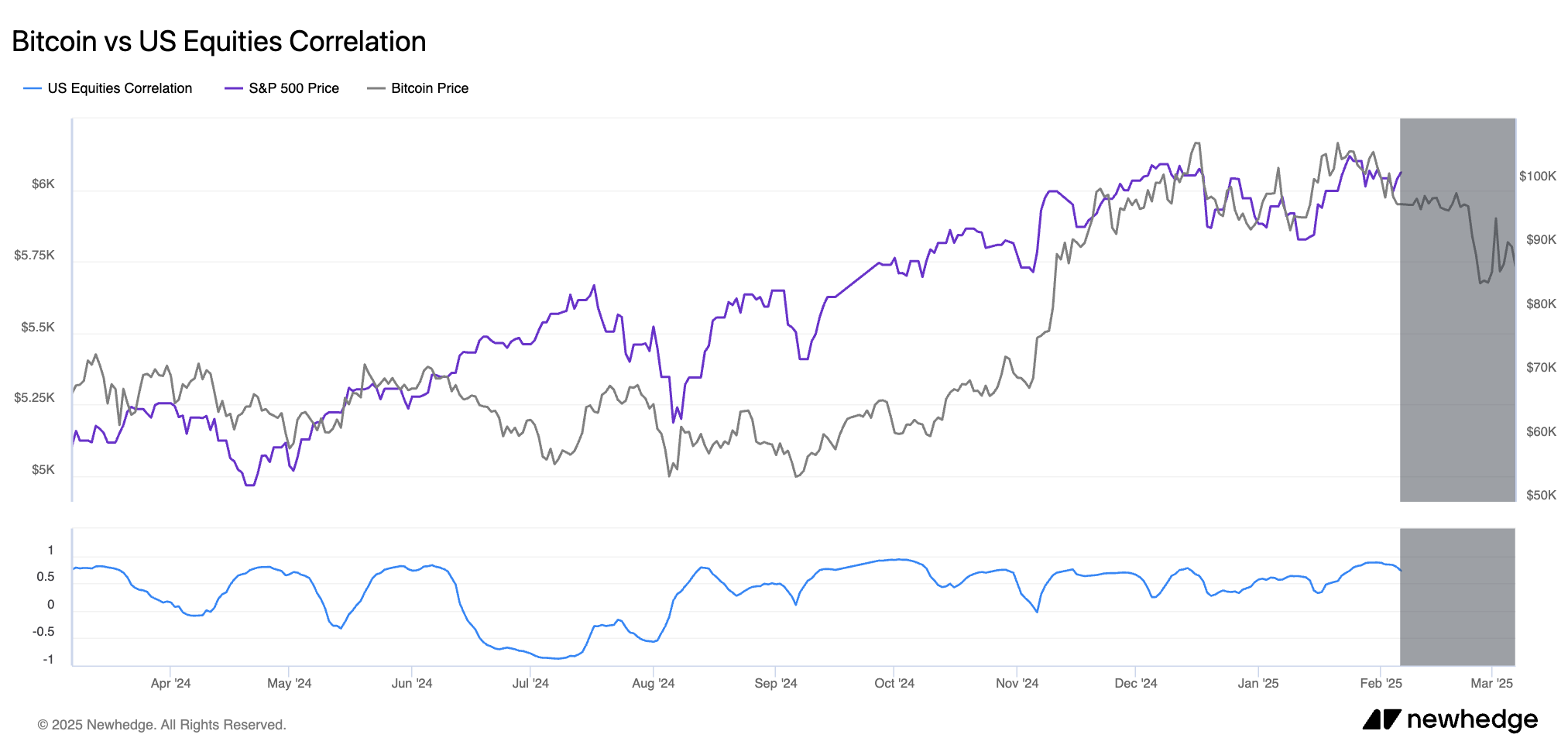

U.S. equities and cryptocurrencies often have a close correlation because they are characterized as risk assets. As shown below, Bitcoin and the S&P 500 index are highly correlated.

Cryptocurrency and stock prices have retreated in the past few weeks because of concerns about stagflation in the U.S.

Flash economic data show that the US may be moving towards negative growth this quarter because of Trump tariff uncertainties. At the same time, inflation, which is already high, could jump as companies boost prices to offset the tariff impact.

Impact on Bitcoin, Ethereum, and XRP

Bitcoin, Ethereum, and XRP prices may continue falling if the US stock market keeps falling, as technicals show.

XRP price has already formed a head and shoulders pattern and could have a strong bearish breakdown unless it moves above the right shoulder at $3.

Bitcoin is also at risk of further downside after forming a double-top pattern at $108,400. It has moved slightly below the neckline at $89,165 and is about to lose the 200-day moving average again. As such, there is a risk that it will drop to the key support at $73,550, the highest point in 2024.

Ethereum price is hovering above the key support level at $2,000, the neckline of the triple-top pattern at $3,000. As we wrote before, this pattern points to a potential ETH price crash to $1,500 and below.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more