BNB Price Unfazed As Binance Burns 1.7M Tokens

Binance has burned over 1.7 million BNB tokens as a part of its quarterly burning initiative.

On Nov. 1, Binance, the world’s largest cryptocurrency exchange in terms of trading volume, announced its 29th quarterly BNB token burn, where it removed a total of 1772712.363 BNB from circulation.

https://twitter.com/BNBCHAIN/status/1852260130361901319

The total burn included two parts. First, 1,710,142.733 BNB was removed through Binance’s regular Auto-Burn process, a mechanism Binance uses quarterly to reduce the total BNB supply.

Second, an additional 62,569.63 BNB was burned specifically to address an issue with BTokens, which are tokens created when assets are bridged onto the Binance Smart Chain. Some users accidentally sent these BTokens to inactive addresses, essentially locking them up.

To compensate for these lost tokens, Binance reimbursed users through its Pioneer Burn Program and included the unburned portion in this quarter’s burn.

The total accounted for 1.22% of the altcoin’s total supply with the transaction valued close to $1.07 billion at current prices.

Prior to this, Binance had removed over 1.64 million BNB tokens in July, valued at approximately $971 million.

The token burn failed to play out in favor of BNB which was down 1% at the time of writing, trading at $576.98, while its market cap had dropped by 2.1% to $83.27 billion.

BNB rallied to a three-month high of $615.50 on Sept. 28 after former Binance CEO Changpeng Zhao was released from prison after serving a four-month sentence for failing to implement proper anti-money laundering and sanctions regulations at Binance.

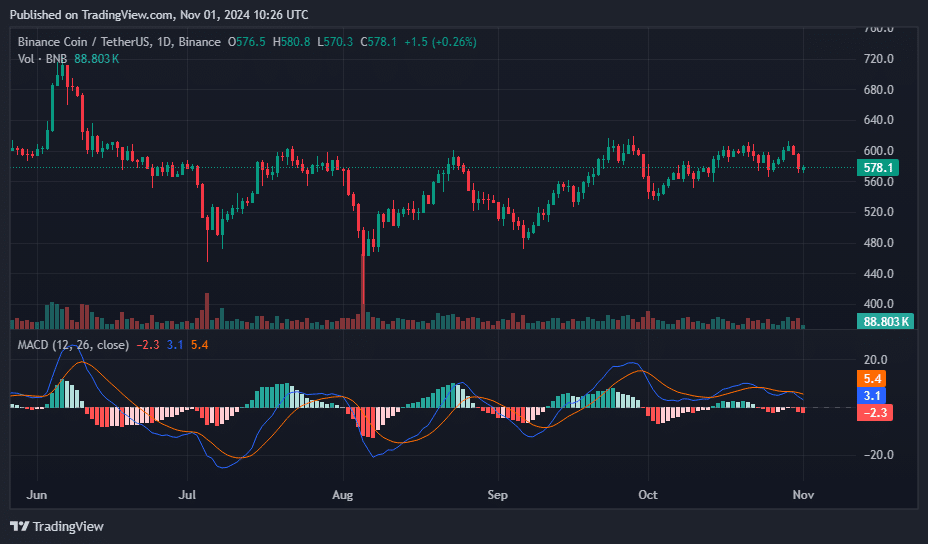

Since then the altcoin has tried to reclaim those levels but has been rejected twice at the resistance level near $610. Technical indicators suggest that BNB’s price is currently consolidating.

On the 1-day BNB/USDT price chart BNB’s Relative Strength Index stood at 47 while the Average Direction Index showed a reading of 11 indicating that the current trend is weak and the altcoin could continue to trade range-bound.

Meanwhile, the bearish crossover on the Moving Average Convergence Divergence histogram, with the MACD line below the signal line, hints at potential downside pressure. However, without stronger trend signals, notable movements in either direction are unlikely.

The uncertainty around BNB’s next move was also highlighted by pseudonymous trader Crypto Yapper, who pointed out that BNB’s price is “compressed into an apex,” which is the point where support and resistance lines converge as the price range narrows.

While this often signals that a major breakout is coming, the analyst added that the price could be heading toward “either the topside or the downside.”

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more