Bitget Research: ETFs Not The Only Factor Behind Bitcoins Run

Ryan Lee, the chief analyst at Bitget Research, observed that while Bitcoin exchange-traded funds play a major role in driving demand, multiple factors are contributing to Bitcoin’s momentum.

Since January 2024, when spot Bitcoin (BTC) ETFs began trading in the U.S., the market has witnessed massive inflows. These investment products have accumulated over $24 billion in net flows—with $5.4 billion in net inflows in October alone.

However, Lee told crypto.news that ETFs are not solely responsible for Bitcoin’s bullish trend, as the asset retested the $73,000 mark amid an impressive rebound.

Political and technical factors fueling bullish sentiment

Lee pointed to the upcoming U.S. presidential election as another catalyst in Bitcoin’s upward movement. Notably, both major candidates Donald Trump and Kamala Harris have voiced support for clearer regulatory frameworks for digital assets.

While Trump has been more forward with his approach, Lee expects a more supportive stance toward the industry, regardless of the election’s outcome. This has further boosted market confidence in Bitcoin.

“With the election drawing near, the market is anticipating that the future administration, whether led by Trump or Harris, might adopt a friendlier stance toward the cryptocurrency sector.”

Lee added.

Bitget Research’s chief analyst further called attention to technical factors. He highlighted a recent golden cross pattern, in which Bitcoin’s 50-day moving average rose above its 200-day moving average on Oct. 27. This cross signals a bullish trend.

Upcoming economic indicators to impact the market

Looking forward, Lee argued that several upcoming economic events could affect Bitcoin’s performance through November.

He stressed that the Federal Reserve’s interest rate decision on Nov. 7 could lead to a 25-basis-point cut, potentially increasing market liquidity and benefiting crypto assets.

“Currently, the U.S. Dollar Index and Treasury yields are on the rise, but a rate cut would improve overall macroeconomic liquidity, potentially boosting crypto assets.”

Lee says.

Other important metrics, such as CME’s BTC open interest, recently reached an all-time high, signaling substantial interest in Bitcoin from the futures market. He also noted that sustained inflows into Bitcoin ETFs could continue to provide support.

Lastly, a potential BTC acquisition by Microsoft remains on the horizon. Lee expects that if Microsoft’s board approves the purchase, it would mark a landmark event in Bitcoin’s adoption and add substantial institutional interest.

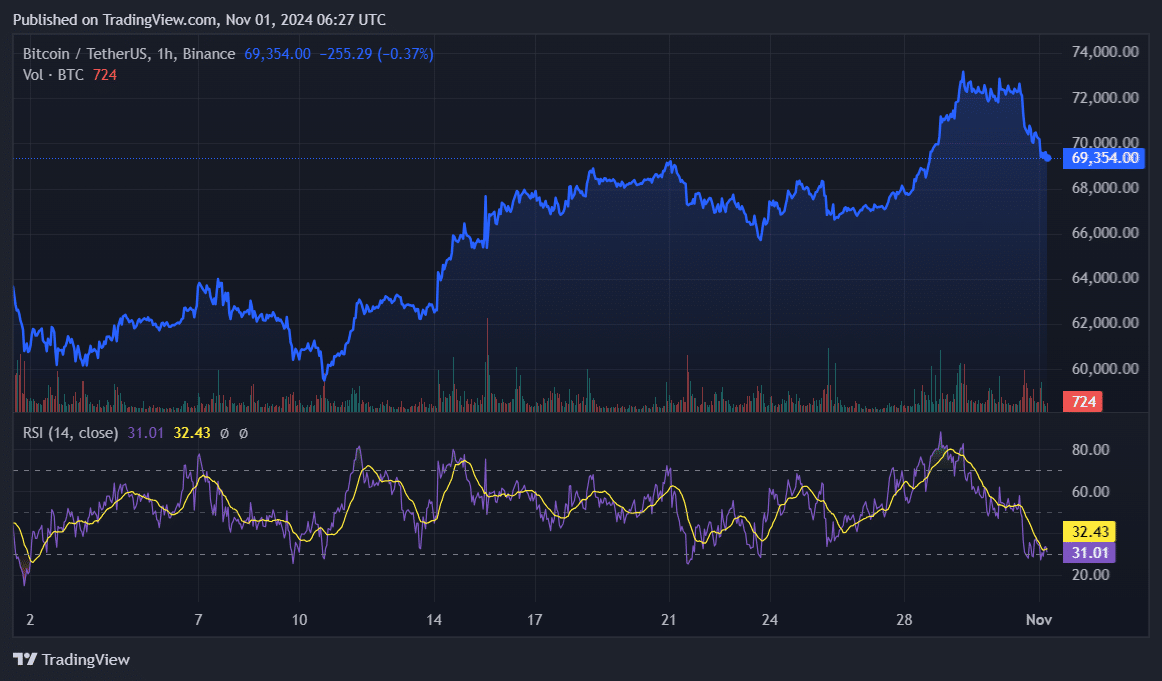

With these varied factors at play, Lee predicts Bitcoin’s price will likely fluctuate between $66,000 and $75,000 in November, although market volatility is expected to remain high.

Bitcoin declined 4% in the past 24 hours and is trading at $69,350 at the time of writing. Its market cap plunged below the $1.4 trillion mark with a daily trading volume of $45 billion.

One of the main reasons behind the BTC price correction could be the consecutive gains over the past week, pushing Bitcoin to the overbought zone. Currently, the BTC Relative Strength Index is hovering at 32, already suggesting that the flagship cryptocurrency is near the oversold zone.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more