Bitcoin Price To Dip Below $60k In August, According To Polymarket

Bitcoin price has dropped by over 7% from its highest level this week and could fall below $60,000 this month, according to Polymarket.

Bitcoin (BTC) dipped to a low of $63,504 on Thursday even after the Federal Reserve hinted a potential rate cut in September is on the table. What should be seen as a bullish indicator isn’t the sentiment shared among the Polymarket community.

In a Polymarket poll with $57,000 in funding, most participants believe the coin will drop below $60,000 before September. About 24% expect it to fall below $55,000, while 15% see it moving below $50,000.

It’s unclear why Bitcoin sold off on Thursday. One possible reason is the rising geopolitical risks in the Middle East, which could cause inflation and push the Fed to delay its rate cuts. Oil prices have risen, with Brent and West Texas Intermediate hitting $82 and $79, respectively.

Another key macro catalyst for Bitcoin and other risk assets will be Friday’s non-farm payroll data. Jerome Powell stated on Wednesday that the Fed would watch these jobs to determine whether a rate cut is necessary in September.

The other potential reason to explain Bitcoin’s weakness has to do with the U.S. election and the possibility that Donald Trump won’t emerge victorious. According to Polymarket, while Trump still maintains a 55% lead, current Vice President and presidential candidate Kamala Harris has notably narrowed the gap.

Another poll by PredictIt has Harris leading with 53% followed by Trump’s 49%. More polls have shown that Harris has wiped out Trump’s lead across key battleground states in the past few days.

Trump is seen as the more crypto-friendly presidential candidate. In his speech at a crypto conference, he vowed to support the industry and to ensure that the government will not sell its Bitcoin holdings. Data shows that the government holds 213,246 coins, mostly from Silk Road.

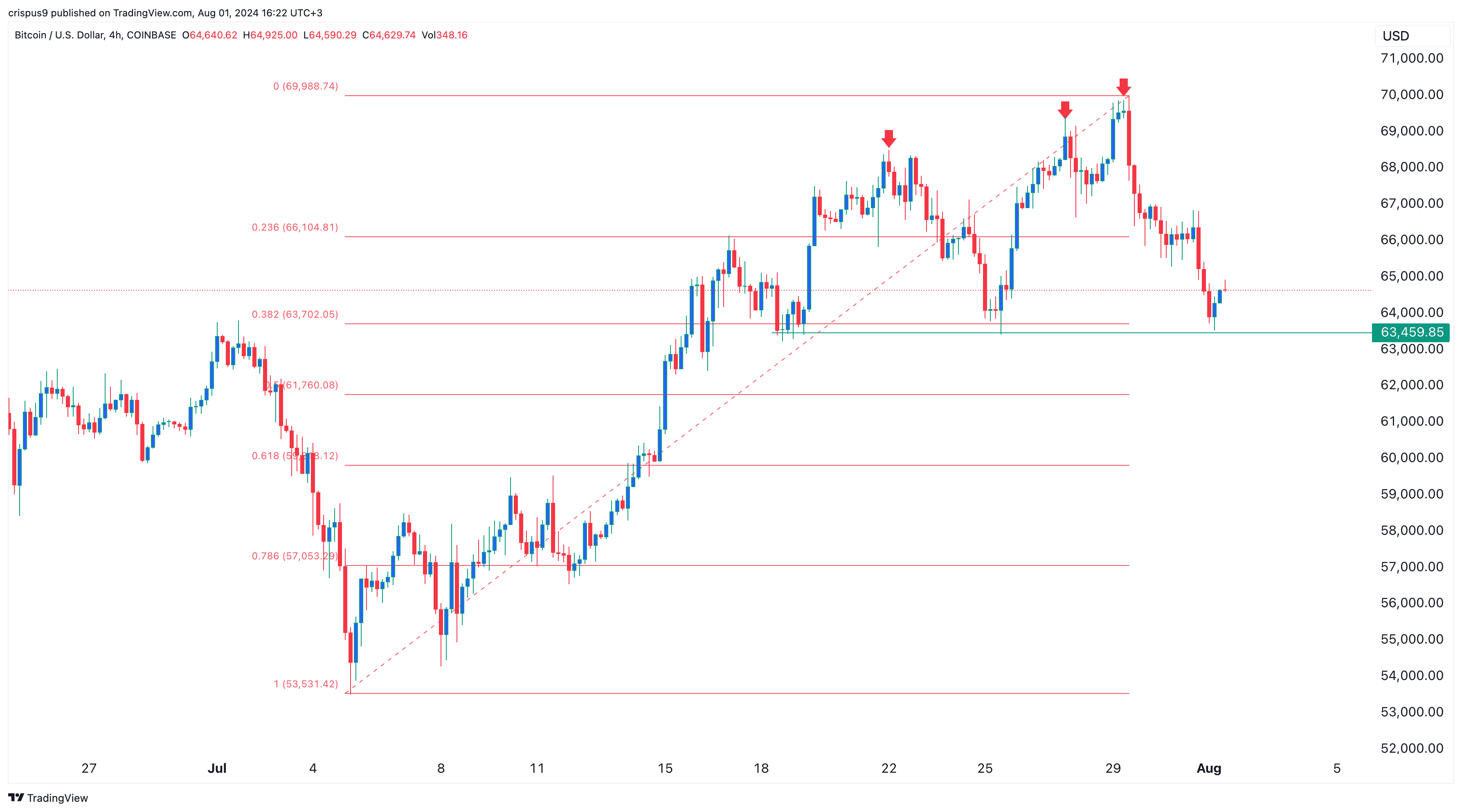

For Polymarket’s Bitcoin forecast to play out, sellers will need to push the price below the key support at $63,460, its lowest swing on Thursday. This level is significant as BTC failed to drop below it on July 18, 19, and 25.

It is also the neckline of the triple-top pattern formed in July and the 38.2% Fibonacci Retracement point. Breaking this support would signal that bears have prevailed and increase the likelihood of BTC dropping to $60,000.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more