Bitcoin Perpetual Swaps Stabilize Amidst Year-end, Ethereum Options On Track For Short-term Volatility: Report

Bybit and Block Scholes’ latest report reveals that the Bitcoin options market maintained stability in the face of year-end expirations, while Ethereum options are poised for brief volatility.

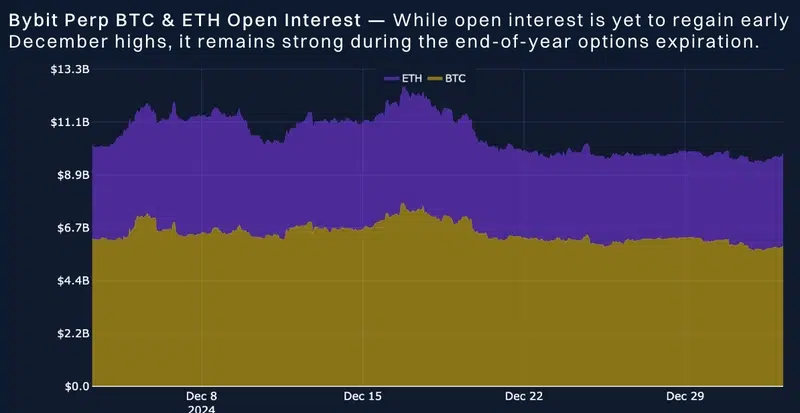

According to a report published by crypto exchange Bybit and analytics platform Block Scholes, open interest in Bitcoin (BTC) perpetual swaps remained stable throughout the year-end expirations. This stability came as a surprise, as options nearing their expiration date typically cause price swings.

The report suggests that traders are cautious but confident enough in their options’ stability that they did not overly rely on perpetual contracts to hedge the delta of expiring options. As a result, Bitcoin OI has stayed relatively stable, despite muted volatility and failing to recover to its higher December levels.

As previously reported by crypto.news, Bitcoin futures OI has dropped below the $60 billion threshold. The total BTC OI currently stands at around $56.6 billion, after plummeting at the start of January 2025. However, it hasn’t fallen as low as early November levels, when it dipped below $40 billion.

The report notes that the implied volatility term structure for BTC options remains steep, with implied volatility projected to stay at 57% over a one-week period for options trading five points lower.

Most of the expired open interest hasn’t been reinvested yet, resulting in a neutral call-put balance. This indicates that BTC’s options market shows limited leverage compared to its position at the beginning of December 2024.

Similarly, Ethereum (ETH) options remained stable through the end of December 2024. However, ETH’s spot price is showing lower volatility compared to its short-term implied volatility.

Over the past week, the implied volatility term structure for ETH options briefly plunged before flat-lining again. In contrast to BTC’s consistent downturn, ETH’s pattern suggests that its options market is preparing for potential short-term volatility in spot price movements.

Despite nearing expiration dates, ETH call options have gained momentum at the start of 2025. At the time of writing, Ethereum OI stands at $25.5 billion, returning to its mid-December levels.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more