Bitcoin Miner Riot Platforms Acquires 12% Stake In Bitfarms

Colorado-headquartered crypto mining company Riot Platforms has acquired ownership of a 12% stake in rival Bitfarms despite shorting pressure from Kerrisdale Capital.

Bitcoin mining company Riot Platforms said in a press release on Jun. 5 it acquired 1,460,278 common shares of Bitfarms, becoming the beneficial owner of approximately 12%. The company said the latest purchase, at $2.45 per share, cost Riot over $3.5 million in total.

Following the acquisition, Riot stated its intention to call a special meeting of Bitfarms’ shareholders. At this meeting, Riot plans to nominate “several well-qualified and independent directors” to the Bitfarms board, citing “serious concerns regarding the board’s track record of poor corporate governance.”

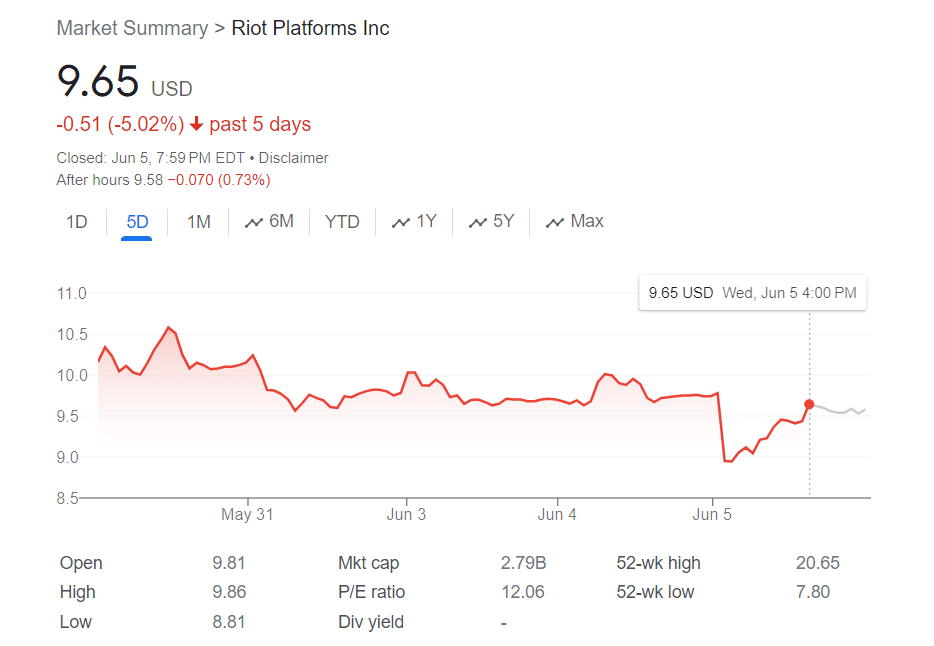

This move comes amid shorting pressure from Kerrisdale Capital, which recently disclosed a short position in Riot, citing issues with Riot’s equipment sourced from China and operational concerns, and causing Riot’s shares to drop by as much as 9% to $8.84. However, Riot’s share price rebounded to $9.65 following the announcement of its additional Bitfarms share purchase, according to Google Finance data.

In late May, Riot announced a $950 million acquisition bid for Bitfarms, alleging that Bitfarms’ founders weren’t acting in the best interests of all shareholders. Riot claims its proposal, initially submitted privately in late April, was rejected by the Bitfarms board without substantive engagement.

Bitfarms responded by stating that Riot’s offer “significantly undervalues” its growth prospects. The company added that a special committee had requested “customary confidentiality and non-solicitation protections” to which Riot didn’t respond.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more