Bitcoin May Suffer A Harsh Reversal Unless It Clears Key Hurdle

Bitcoin price rose to a key resistance level as investors embraced a risk-on sentiment after the dovish interest rate decision.

Bullish catalysts for Bitcoin

Bitcoin (BTC) jumped to the important point at $64,000 for the first time since Aug. 9. It has moved into a technical bull run after soaring by over 20% from its lowest point this month.

This price action is mostly because of Wednesday’s Fed decision in which it slashed rates by 50 basis points and hinted that it may deliver more cuts later this year.

It accelerated after the Bank of Japan left interest rates unchanged even as the country’s inflation rate remained at an elevated rate. A BoJ rate cut would have led to fears of a Japanese yen carry trade unwind, which pushed most assets downwards in August.

Meanwhile, institutional investors and countries have continued buying Bitcoin and ETFs. The net Bitcoin ETFs in the last five trading days stood at over $567 million.

MicroStrategy has continued buying coins, bringing its total holdings to over 252,000. Its Bitcoin holdings have made it an unrealized profit of over $5.95 billion.

El Salvador’s government currently holds 5,800 coins and continued accumulating this week while Bhutan has coins worth over $800 million, a substantial amount for a country with a GDP of $3 billion.

Bitcoin also rose as the fear and greed index moved from the fear zone to the neutral area of 46. Cryptocurrencies often do well when the index is rising.

Bitcoin hits a key resistance

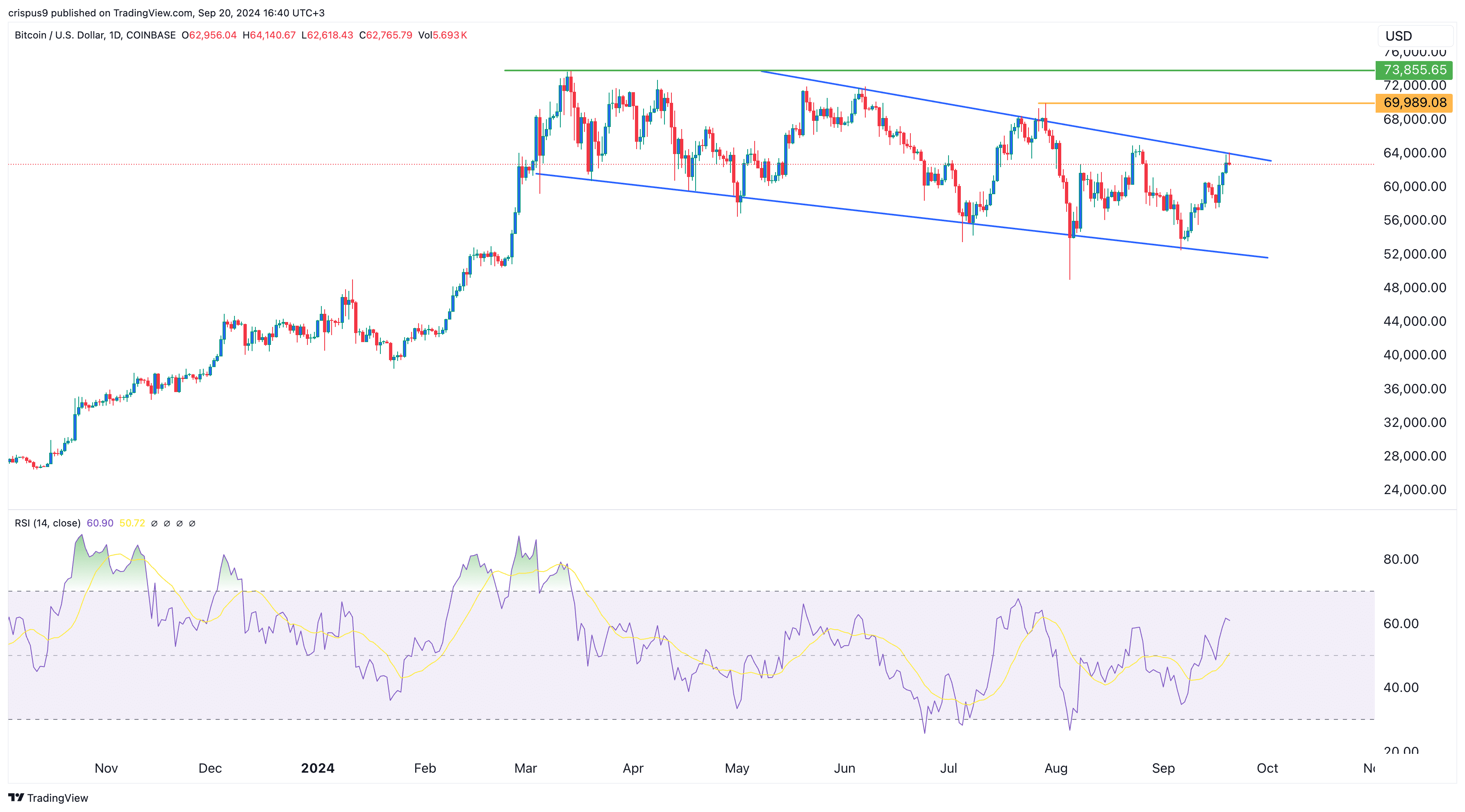

On the daily chart, Bitcoin has risen to an important resistance level at $64,000. This price coincided with the descending trendline that connects the highest swings since June 7. It found substantial resistance in its past attempts to cross that level in July and August.

Therefore, there is a risk that the coin will suffer a sharp reversal if bulls don’t push it above that level. A likely catalyst for the pullback will be the Triple Witching event in Wall Street that will see options worth over $5.1 trillion expire on Sep. 20. Historically, stocks often drop in the week following this witching event. A strong pullback in the stock market will likely lead to a similar price action in Bitcoin.

On the flip side, a strong rebound above this resistance will raise the possibility of Bitcoin rising to $70,000, a psychological level and its highest point in July. A complete bullish breakout will only be confirmed if it pushes above its all-time high.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more