Bitcoin Dumps As Biden Supports Israel Hitting Iran Oil Facilities

Bitcoin and altcoins continued their downward trend while crude oil prices jumped as the odds of a wider crisis in the Middle East rose.

Bitcoin (BTC) retreated below $60,000 for the first time since Sep. 16 after Joe Biden hinted that he would support Israel hitting Iranian oil facilities, per Barrons. Other altcoins, like Ethena (ENA), Conflux (CFX), and Beam (BEAM), tumbled by over 15%, making them the worst performers in the top 100.

Meanwhile, crude oil bounced back, with Brent and West Texas Intermediate surging by over 4% to $76.5 and $73, respectively. American indices like the Dow Jones and Nasdaq 100 reversed earlier gains and dropped by over 50 bps.

Biden’s statement raises the stakes for a wider conflict in the Middle East. A report by the New York Times cited senior Israeli officials who said that the country was prepared to go to war with Iran. Polymarket traders see a 63% chance that Israel will attack Iranian oil this month.

A prolonged war in the Middle East would have a major impact across all asset classes, including cryptocurrencies.

It would increase oil and gas prices because Iran exports over 1.3 million barrels a day. Also, because of the Red Sea’s importance in the shipping industry, it would lead to supply chain interruptions.

Higher inflation would then impact the ongoing interest rate cycle by the Federal Reserve and other central banks.

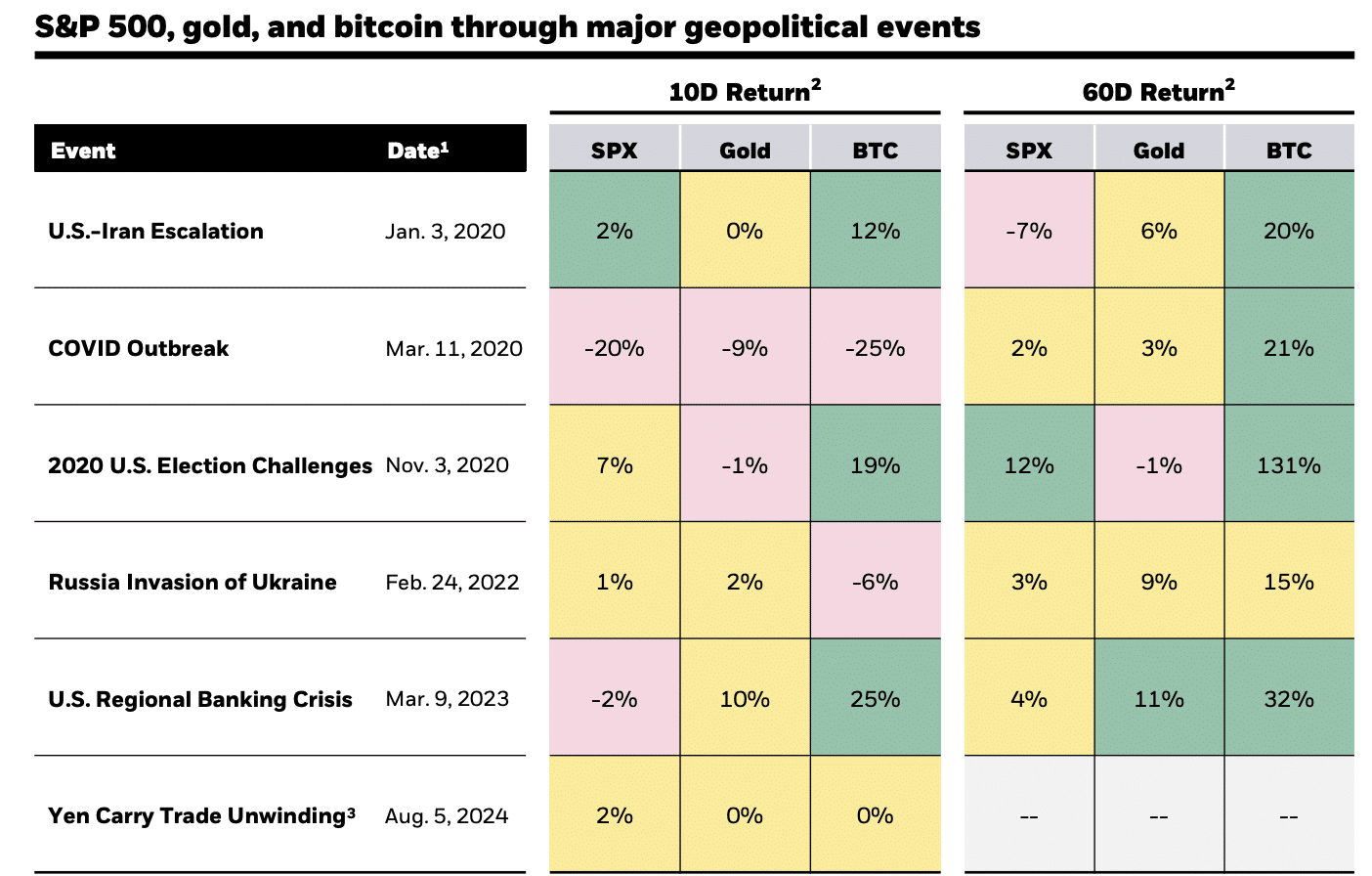

In a recent note, three Blackrock analysts wrote that Bitcoin holds better than other assets in periods of geopolitical issues.

They cited six major events, including the US and Iran escalation, the COVID outbreak, 2020 US election challenge, Russia’s invasion of Ukraine, US banking crisis, and the yen carry trade unwinding. In all these events, Bitcoin did better than the S&P 500 index and gold in a 60-day period.

Blackrock also noted that Bitcoin had more potential catalysts that could push it higher in the long term. The most notable ones were the US debt dynamics, its long track record of outperformance, its uncorrelated asset status, and its 21 million supply cap.

Other analysts, including Michael Saylor, have noted that Bitcoin will ultimately become a hedge against inflation.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more