Bitcoin And Altcoins Rise As US Jobs Report Hint At Large Rate Cut

Cryptocurrency prices rose slightly after the U.S. published another weak nonfarm payroll report.

Bitcoin (BTC) rose to $56,500 while Ethereum (ETH) jumped to $2,400 on Friday, Sept. 6.

In the latest report, the Bureau of Labor Statistics showed that the economy added 142k jobs in August, lower than the median estimate of 164k. The bureau also revised the July figure from 114k to 86k. On Sept. 5, a report by ADP showed that the private sector created just 99,000 jobs in August.

The unemployment rate slipped to 4.2% from the previous 4.3%, while average hourly earnings rose by 3.8%.

These figures indicate that the labor market is not performing well, as companies remain concerned about the economy. The manufacturing sector, in particular, is struggling, as reports from the Institute of Supply Management and S&P Global showed it remained in contraction mode in August. According to the BLS, 24,000 jobs were lost during the month.

As a result, the NFP data suggest that the Federal Reserve may cut interest rates at its meeting on Sept. 18. There is a likelihood it could deliver a substantial rate cut of 0.50%, which explains why government bond yields have retreated. The 10-year yield fell to 3.75%, while the 30-year dropped to 3.9%.

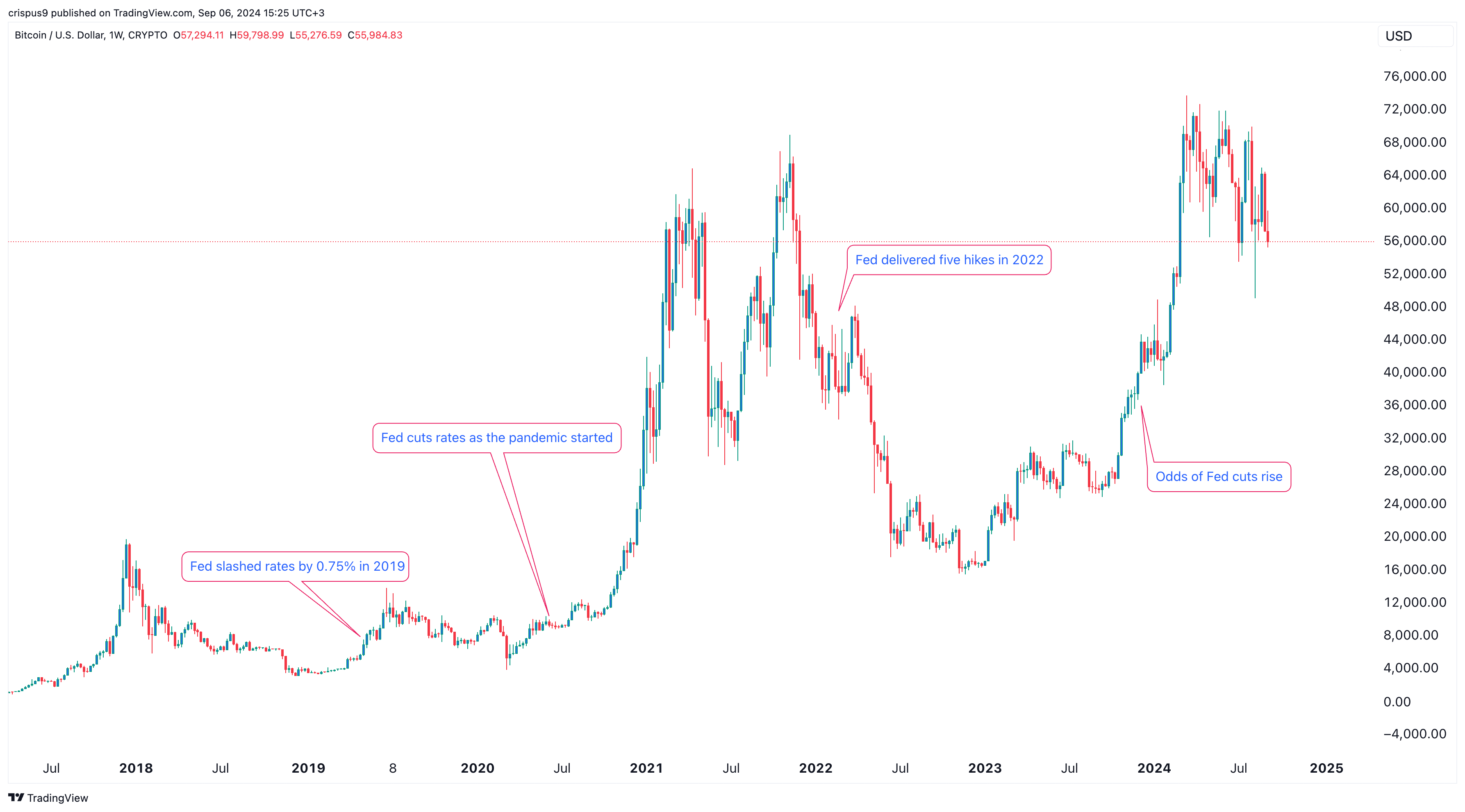

In theory, cryptocurrencies and other risky assets perform well when the Fed is cutting interest rates. A notable example occurred in 2018 when the Fed raised rates from 1.25% in March to 2.50% in December, causing Bitcoin to fall by over 84% between its highest and lowest levels.

Bitcoin then rebounded by over 350% in 2019 as the Fed slashed rates by 0.75%. A similar trend occurred in 2020 at the onset of the pandemic when the Fed cut rates to zero.

At that time, Bitcoin rose to a record high of $69,000 before plunging in 2022 as the bank hiked rates.

A likely reason for this trend is that investors tend to have a higher risk appetite in low-interest-rate environments. If the Fed cuts rates, there is a possibility that some of the trillions of dollars in money market funds will rotate to risk assets like stocks and crypto.

However, there is a risk that Bitcoin and other cryptocurrencies could retreat since the rate cut has already been priced in by market participants.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more