Alpaca Crypto Rallies Post-listings, But Becomes Severely Overbought

Alpaca Finance token experienced a significant surge this week, reaching a high of $0.227, the highest level since April 8.

ALPACA (ALPACA) rose by over 252% from its lowest point this year, making it one of the top-performing coins of the week. Its market cap climbed to over $37 million, while its 24-hour trading volume spiked to $142 million.

The token’s surge followed the listing of its perpetual futures on Binance, the largest centralized exchange in the industry. This listing potentially exposed the token to over 216 million users on the platform.

In addition to Binance, WhiteBit, a partner of FC Barcelona, also listed Alpaca Finance’s perpetual futures. According to WhiteBit’s website, it recorded a 24-hour trading volume of over $6.5 million.

Alpaca Finance is one of the top Decentralized Finance dApps in the BNB Smart Chain ecosystem with over $55 million in funds deployed across its V1 and V2 networks. It is an alternative to AAVE (AAVE) that lets people borrow and earn rewards.

It is common for altcoins to see substantial gains following their listing on major exchanges like Binance and Coinbase.

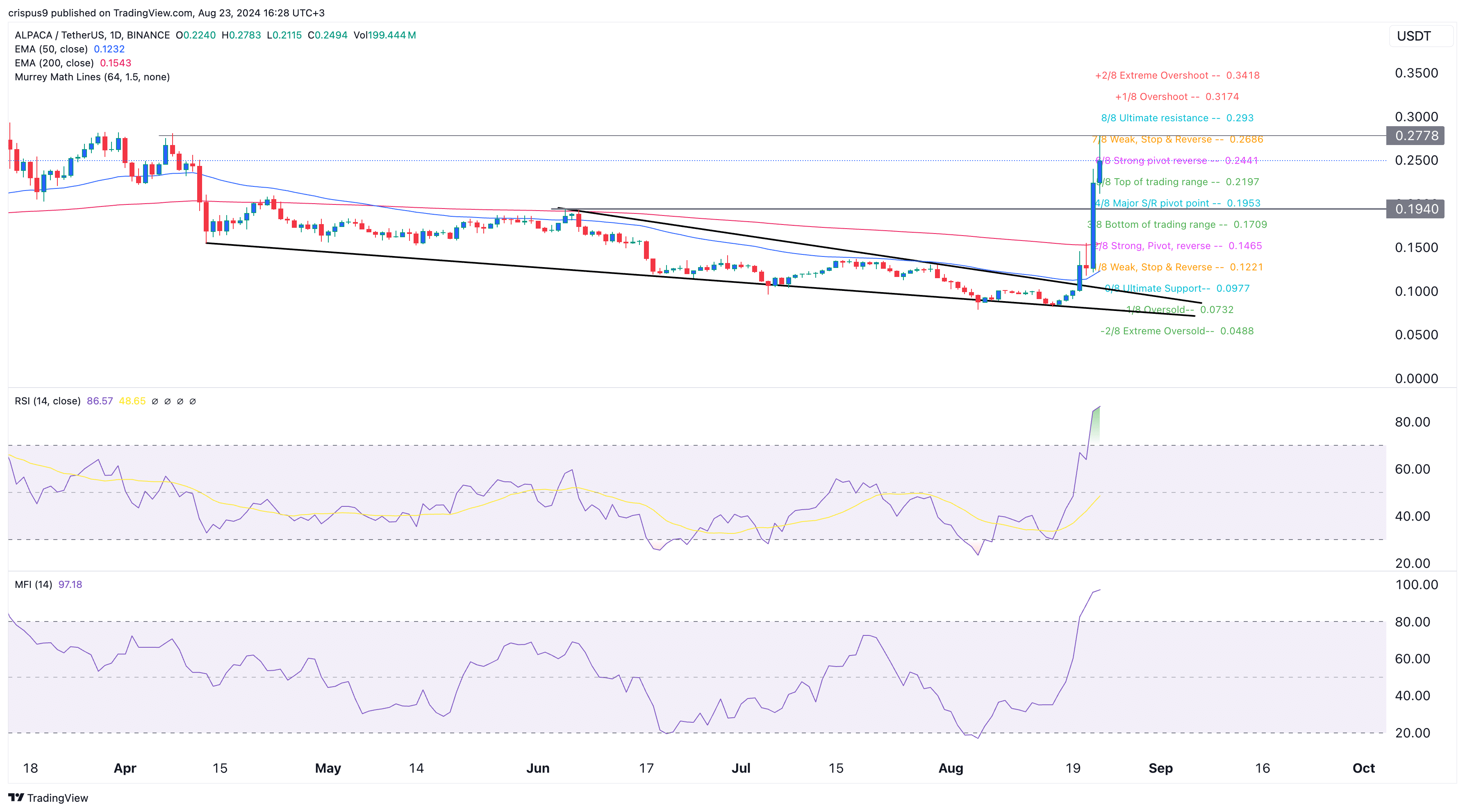

Alpaca’s price surge coincided with the convergence of two lines forming a falling wedge pattern, a technical setup that typically signals further upside potential.

The token broke above the key resistance level at $0.1940, the highest point on June 5, and surpassed both the 200-day and 50-day moving averages. This move indicates that bullish momentum is currently strong.

Alpaca reached a high of $0.2778, aligning with the weak, stop & reverse level of the Murrey Math Lines tool.

However, there are signs that it has gotten highly overbought. The Relative Strength Index rose to the extremely overbought point at 86 while the Money Flow Index indicator moved to 97.

While these overbought conditions reflect strong bullish momentum, they also suggest that a sharp reversal could occur as the initial excitement from the exchange listings fades. If a pullback happens, the key reference level to monitor would be $0.1940, which aligns with the major support/resistance pivot point of the Murrey Math Lines.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more