96% Of PEPE Holders In Profit After Month Long Rally

Thanks to the impressive price rally over the past month, Pepe (PEPE) is now the most profitable token among the leading meme coins.

According to data provided by IntoTheBlock, more than 96% of PEPE holders are currently in profit thanks to the asset’s 91% price rally over the past month. The meme coin hit an all-time high (ATH) of $0.00001718 on May 27 as the market wandered in the bullish zone.

IntoTheBlock’s data comes while PEPE recorded a 12% decline in the past 24 hours. The meme coin is trading at $0.00001333 at the time of writing. Pepe’s market cap is currently sitting at $5.6 billion, making it the 21st-largest digital currency.

FLOKI is still the second most profitable meme coin with roughly 89% of its holders enjoying their returns, per IntoTheBlock’s chart.

PEPE is down by 21.5% from its ATH, which is a much lower percentage compared to Dogecoin (DOGE) and Shiba Inu (SHIB), with 78.5% and 70.5% plunges from their ATHs, respectively.

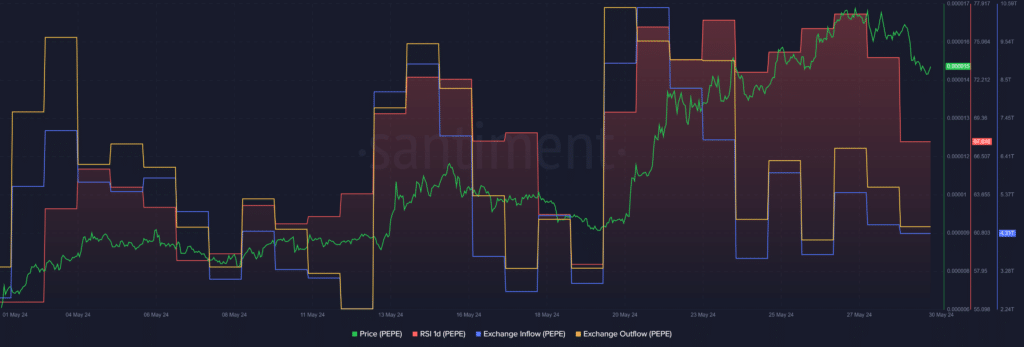

According to data provided by Santiment, the PEPE exchange inflow and outflow have been constantly declining over the past three days. Roughly 4.31 trillion PEPE tokens have entered the exchanges while 4 trillion coins have left the platforms — showing an exchange net inflow of around 310 billion Pepe tokens.

This behavior might show that some holders are wandering in FUD (fear, uncertainty and doubt) due to the market-wide bearish momentum.

Moreover, the PEPE Relative Strength Index (RSI) declined from 77 to 67 in the past three days, per Santiment data. The movement shows that the meme coin is still overbought while moving toward its consolidation zone.

An RSI of lower than 50 would mean that Pepe could potentially face a steady price hike.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more