3 Catalysts That Could Push Ethereum Price To $5,000

Ethereum price has underperformed Bitcoin and other popular coins like Ripple and Solana this year.

Ethereum (ETH) was trading at $3,400, down by nearly 20% from its highest level in December last year. This decline coincided with controversies surrounding the Ethereum Foundation and its token sales.

ETH has also dropped as balances on exchanges have continued to rise, while the popular buy-sell ratio on Binance has remained bearish. Still, Ethereum has several catalysts that may push it to $5,000.

Ethereum Pectra upgrade

The first major catalyst for Ethereum’s price is the upcoming Pectra upgrade, which is expected to occur in March. This will be one of the biggest upgrades in Ethereum’s history, introducing several crucial features.

The first feature will bring features like transaction bundling and gas sponsorship. It will also introduce the maximum effective balance, meaning that staking rewards will be added to a validator no matter their size.

Additionally, the Pectra upgrade will increase blob throughput, adjust calldata costs, and enable execution layer triggerable exits. Historically, cryptocurrencies often see price increases ahead of major updates.

https://twitter.com/sassal0x/status/1882774555095425371

ETH’s open interest is rising

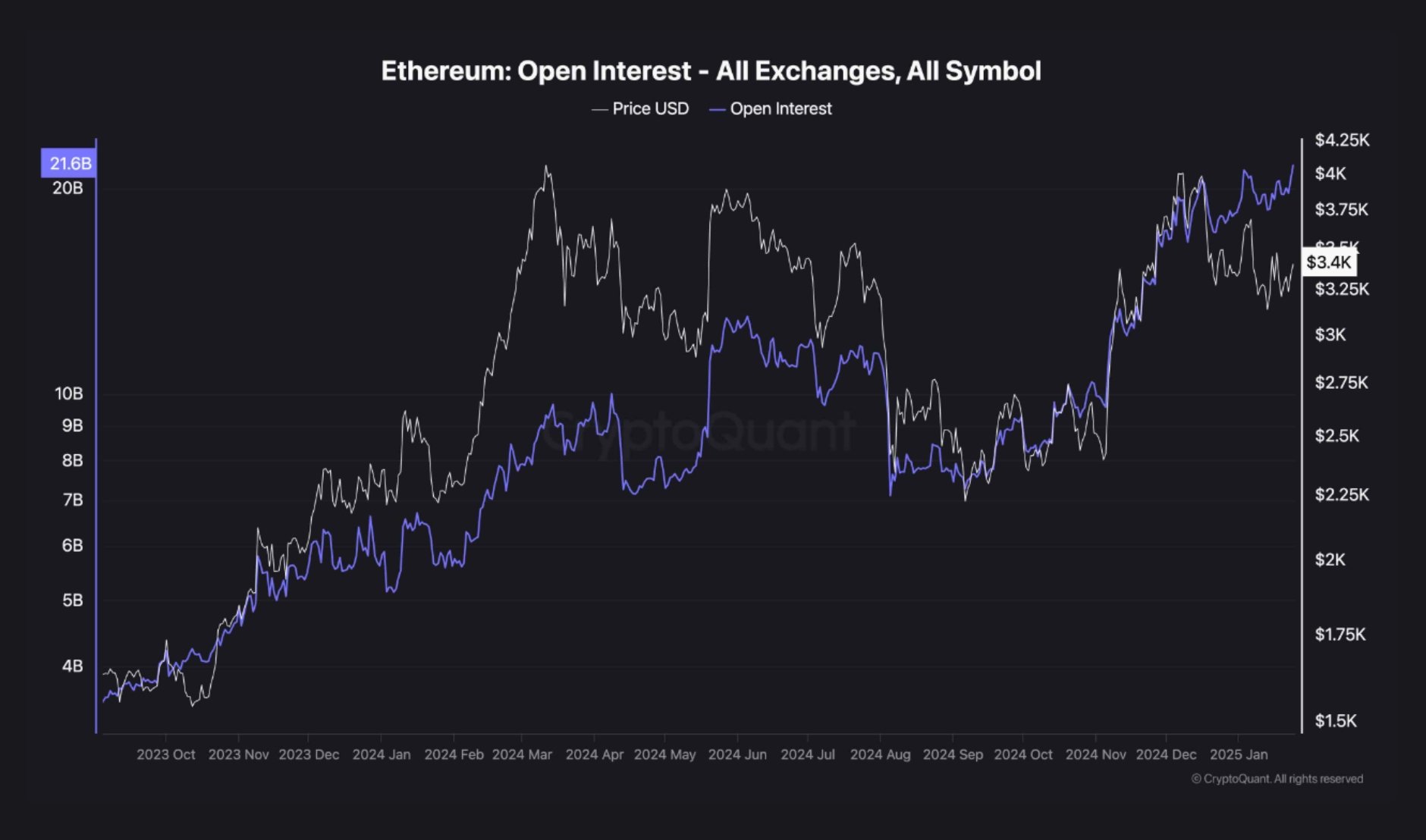

Meanwhile, Ethereum’s open interest in the futures market has been rising, suggesting a potential price surge in the coming weeks. The chart below shows a divergence between Ethereum’s price and its open interest. While Ether has dropped nearly 20% from its highest level in November, open interest has continued to climb.

Ethereum price has strong technicals

The daily chart shows that Ethereum’s price has strong technical indicators, which could push it significantly higher in the longer term. ETH has formed a falling wedge chart pattern, composed of two descending and converging lines, which is widely considered a bullish signal.

Ethereum has also formed an inverse head-and-shoulders pattern, with its neckline at $4,082. The left and right shoulders are around the $3,000 level. This pattern frequently precedes substantial price gains.

Furthermore, the recent retreat aligns with the fourth phase of the Elliott Wave pattern. This phase is typically followed by a bullish fifth wave.

As a result, Ethereum is likely to experience a bullish breakout, with the initial key level to watch at $4,082. A break above this level could lead to further gains, potentially testing the key resistance at $4,800, its all-time high. Beyond this, ETH could surge toward $5,000.

Crypto Firms Push Into US Banking

America’s cryptocurrency companies are scrambling to secure a foothold in the country’s traditional banking system, ... Read more

Ether Surges 16% Amid Speculation Of US ETF Approval

New York, USA – Ether, the second-largest cryptocurrency by market capitalization, experienced a significant surge of ... Read more

BlackRock And The Institutional Embrace Of Bitcoin

BlackRock’s strategic shift towards becoming the world’s largest Bitcoin fund marks a pivotal moment in the financia... Read more

Robinhood Faces Regulatory Scrutiny: SEC Threatens Lawsuit Over Crypto Business

Robinhood, the prominent retail brokerage platform, finds itself in the regulatory spotlight as the Securities and Excha... Read more

Ethereum Price Holds Five-year Range As Breakdown Risk Points To $950

The current Ethereum price is within a long-term five-year range and positioned below key volume levels, increasing the ... Read more

400 Million Coins Left: BlockDAGs $0.0005 Entry Price Is About To Vanish Forever

BlockDAG is entering its final presale hours at a fixed price of $0.0005, with only 400 million coins remaining before p... Read more